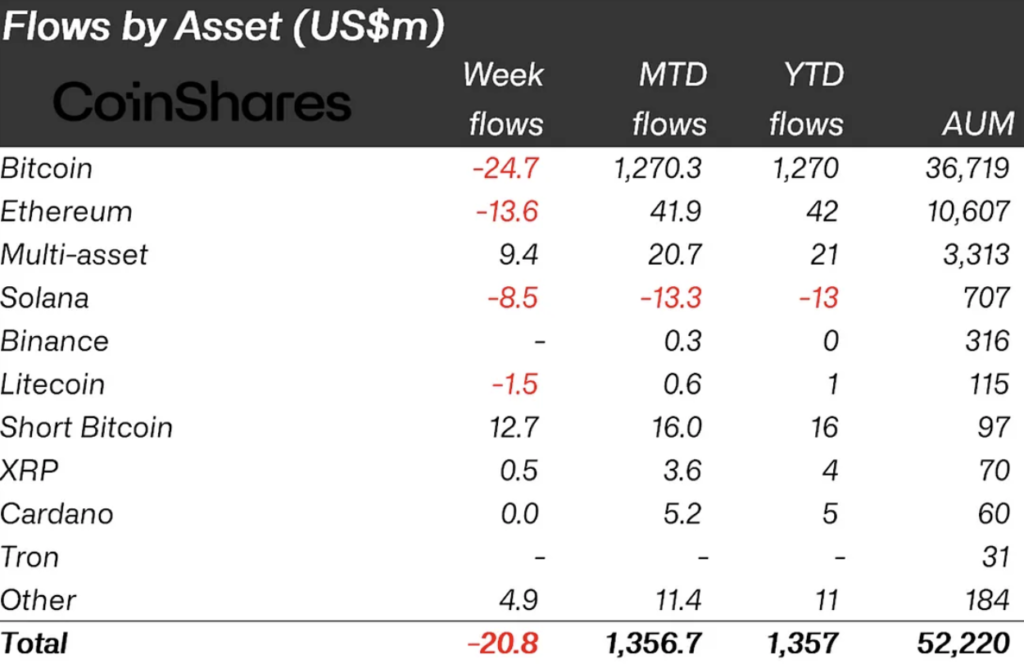

XRP stands out as the only ray of hope during a difficult week for digital asset investment products, demonstrating durability in the erratic market. A setback with slight outflows of $21 million across digital assets is revealed in Coinshares’ most recent weekly report, which mostly affects higher-cost issuers in the United States.

Notably, incumbent players experienced a major hit with $2.9 billion in outflows since the debut of spot-based ETFs on January 11, 2024.

Despite the dire circumstances, the report offers a bright spot. The information shows a significant inflow of more than half a million dollars into investment products, especially those that centre on the well-known cryptocurrency XRP. With a remarkable $4 million in capital flow since the start of the year, the digital asset is the only alternative to Bitcoin that has seen positive growth.

The hit

Grayscale’s move to sell its Bitcoin assets from the GBTC trust was a big blow to the market and contributed to the total loss. The $4.13 billion in inflows that new ETFs have received since their inception have not, however, been enough to offset the losses incurred by existing ETPs with higher fees.

Investors profited from short-Bitcoin investment products by taking advantage of the current price dip; $25 million was somewhat out of pocket for Bitcoin itself.

XRP’s durability and good capital flow highlight its attraction to investors as the digital asset sector navigates through difficulties.