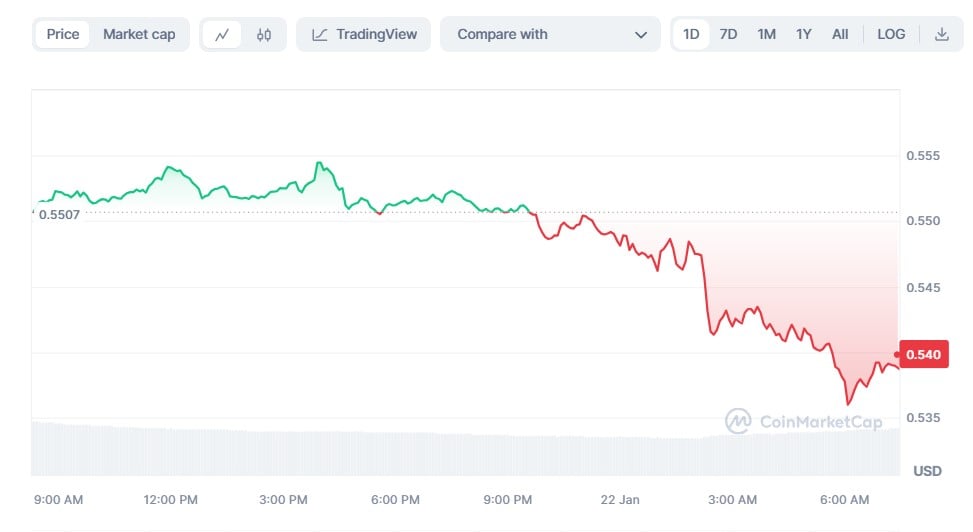

Because market bears outnumbered bulls and drove the price down over the weekend, XRP was unable to overcome the $0.57 barrier level as support. As of this writing, XRP is trading at $0.5398, a decrease of 2.21% over the previous day. The decline has been more severe over the last seven days, with XRP losing 6.8% of its market value in a broad, negative sell-off.

XRP has spent the most of this year in corrective mode. Despite a severe sell-off, the digital currency has held into the $0.5 support zone, demonstrating its remarkable resilience. It is now the bulls’ responsibility to change things, and three important catalysts can aid in accomplishing these objectives.

The coin’s price forecast is headed into positive territory in large part due to the involvement of Ripple Labs and the degree to which it is focusing on XRP use cases. Long-term demand for XRP may shift if Ripple leverages its network and partners to increase the coin’s acceptability, even while XRP is still an essential component of its cross-border settlement solution.

XRP Ledger and whale factor

In addition to Ripple Labs’ effect, XRP Ledger developments might have a more significant short-term impact on XRP’s prospects.

New use cases that potentially increase the demand for the underlying currency are emerging as a result of the introduction of new protocols like Xahau and Evernode (EVR), which bodes well for the price.

Last but not least, XRP whales play a critical role in improving the outlook for digital currency. Whales’ steady XRP accumulation can send out signals throughout the community about how appealing the coin is, which might temporarily improve mood.