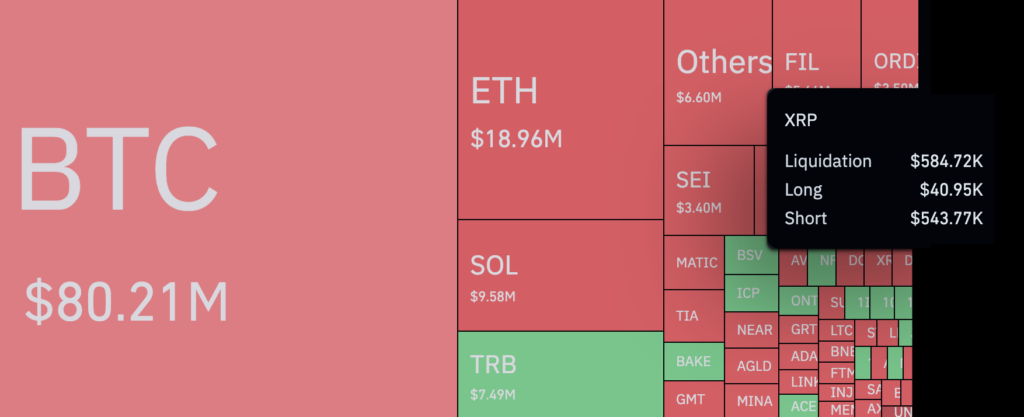

In addition to being a new year, the first few days of 2024 brought with it a traditional roller coaster ride on the cryptocurrency market, with XRP taking centre stage due to its ability to withstand unfavourable emotions. CoinGlass reports that the cryptocurrency market liquidated holdings worth a whopping $161 million in the last day, with 81.8% of those positions being short bets.

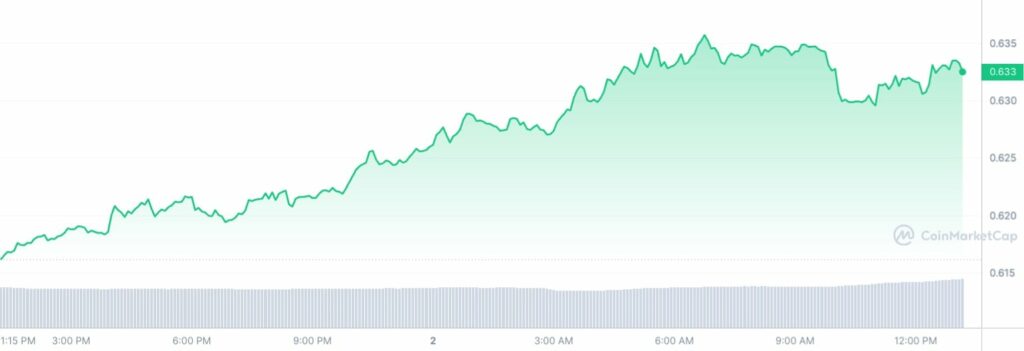

A remarkable 13.57 times more short bets than long ones, totaling over half a million dollars, were liquidated in XRP, which turned out to be a star performer. The price of XRP managed to rise by a small 2.14% despite the constant adverse pressure. It is presently trading at $0.634 per token and remains inside the range that was set in early November.

The vast majority of market players have a pessimistic attitude towards XRP, and trading tactics clearly reflect this tendency.

The true conundrum, though, is figuring out whether the selling of short positions or the actual price movement is the main force behind it. It seems that high levels of debt together with poor risk management are causing large-scale liquidations that are sparked by little increases in value.

What comes first?

A crucial issue is raised by the way the market is acting right now: is the rise in XRP a result of or the cause of bearish traders giving up? According to certain commentators, the short seller’s liquidation may be driving up the price of XRP, benefiting the bulls.

For investors and traders negotiating the erratic waves of the cryptocurrency market, the war between bulls and bears in the XRP arena is still fierce.