The previous 24 hours have seen hundreds of millions and even billions of dollars’ worth of transactions in the cryptocurrency market, creating a whirlwind that is akin to an extremely fast roller coaster. According to CoinGlass data, traders of all stripes went into a frenzy that resulted in an astounding $177.86 million in liquidated holdings, with a majority 71.88% being long positions – a strong indicator of overbullish attitude among investors.

On the other hand, XRP—the sixth-largest cryptocurrency by capitalization—came under intense scrutiny. The liquidation data for XRP showed a startling 2,000% increase in bullish investors’ losses relative to bearish holdings, which was an unexpected turn of events. It was a huge $2.14 million liquidation for bulls and a little over $100,000 loss for bears.

So, what’s the price of XRP?

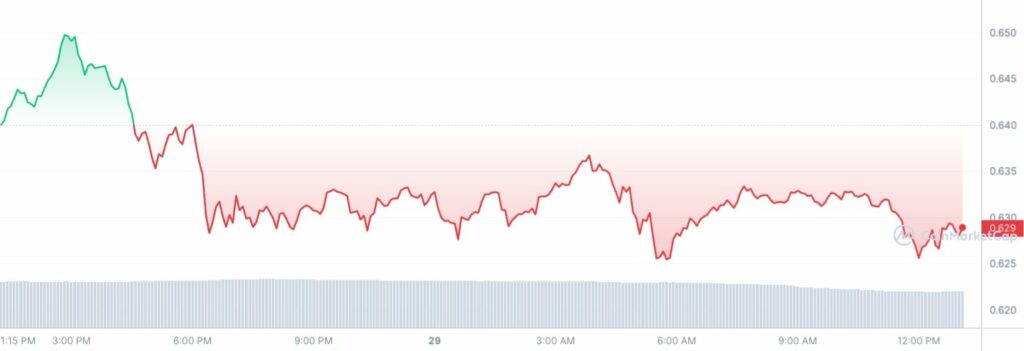

Surprisingly, the price of XRP showed comparatively low volatility over this time, rising by 2.11% and then falling by almost 3%. There are concerns over the general perception of XRP and the cryptocurrency sector as a whole given the sharp discrepancy between price activity and liquidation data.

There have been a lot of green candles in the last several weeks, which has made optimistic traders feel festive. But it appears that caution was overlooked, as XRP unexpectedly rose to prominence on the CoinGlass liquidation map.

Two days remain till 2024, and uncertainty surrounds the cryptocurrency market. Will the liquidation pendulum swing in the other direction with an equal amount of force?

The sharp rise and subsequent collapse highlight the volatility that lies ahead and pose fascinating questions about the next climate in the cryptocurrency market. With bated breath, investors welcome the new year with the hope of clarity on a market that keeps them constantly on edge.