The burn volume of Shiba Inu (SHIB) has increased astronomically by 19,000%. The cryptocurrency community has put it under close scrutiny due to its startling rise.

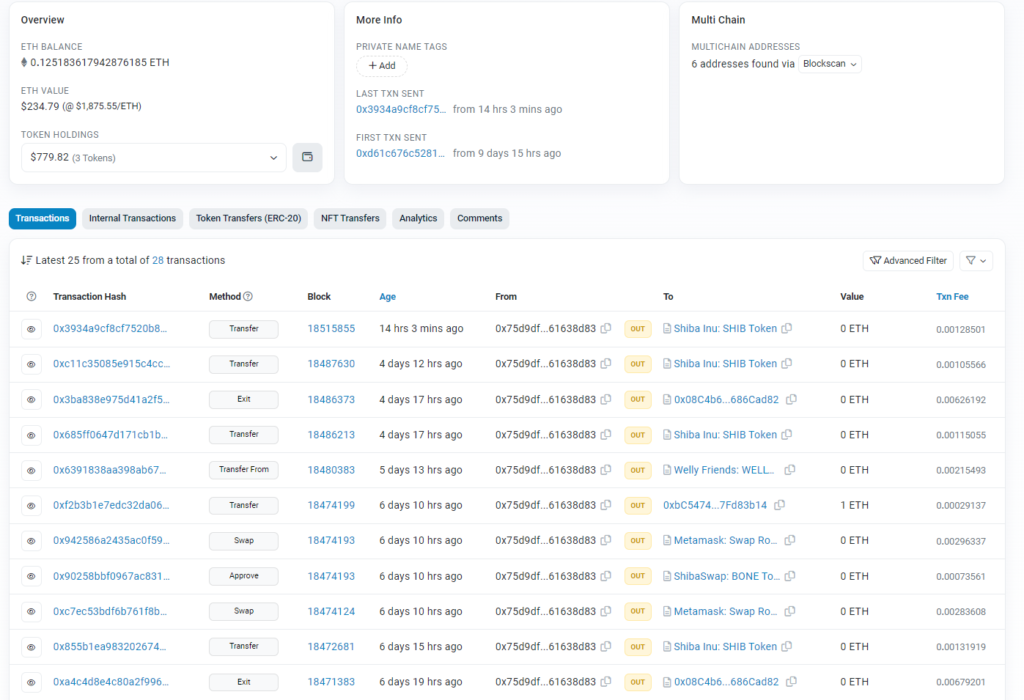

Upon deeper inspection, burner addresses have shown some interesting transactional behaviour from wallets that have burned SHIB tokens. With the wallet identity “0x75d,” one such OpenSea user has demonstrated a great deal of activity in this area. A blockchain analytics platform’s profile screenshot provides details about their most recent transactions. One example of how this person has been regularly transferring large amounts of SHIB to a burn address is the transfer of 1 billion SHIB, which, at the current value shown in the picture, amounts to $842.08.

The user’s exchange usage pie chart suggests that they engage on many exchanges, such as Coinbase and Crypto.com, and have a diverse portfolio. This action shows a methodical approach to managing the user’s SHIB assets, even if it may not be sufficient proof of the user’s identity or long-term plan on its own.

The situation gets less obvious when we go on to the second noteworthy wallet, the Coinbase #10 hot wallet. It has been suggested that the transfer of money from this wallet to a burn address may have happened by mistake.

Given the size of Coinbase’s user base and the frequency with which withdrawal transactions occur, it would be difficult to ascertain the specifics without more comprehensive transaction data. The fact that money has been transferred to a burn address is noteworthy, even if it doesn’t say anything about the user’s identity or intentions.

These actions point to a growing tendency among SHIB holders to manipulate the token’s scarcity and value through token burning. The goal of stimulating demand through decreased supply appears to be in line, regardless of whether large-scale investors or small-scale investors are organising these burning.