The biggest cryptocurrency by market capitalization, Bitcoin (BTC), has increased 12.2% over the last day on expectations that a spot ETF may be approved. Bears that had survived one of the most agonising sessions in the previous year succumbed in a ruthless manner as a result of this unanticipated increase.

BTC price run to $35K erases $400 million in short and long positions

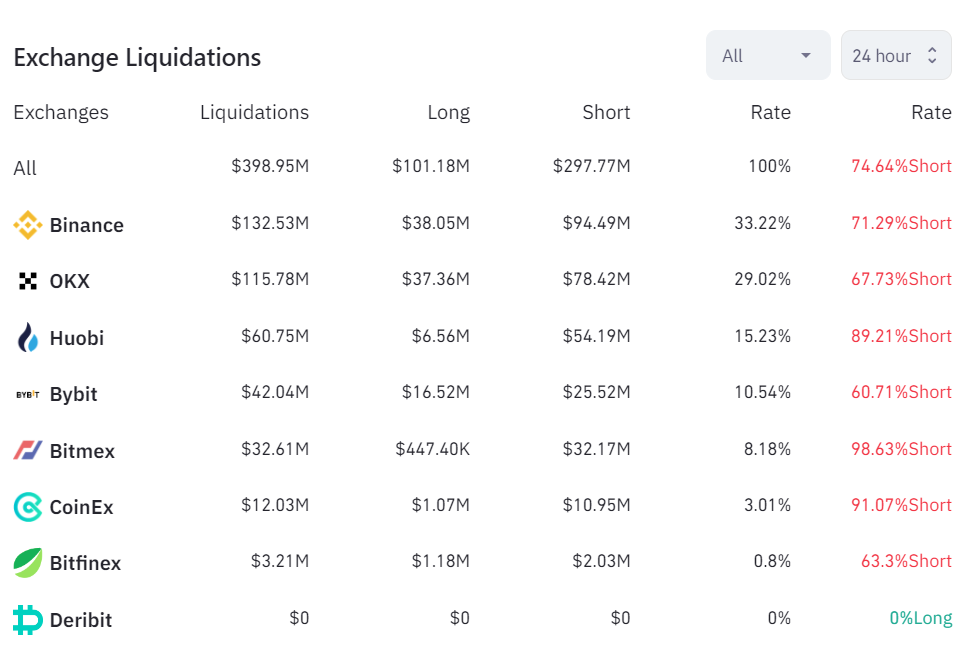

75% of the over $399 million in liquidated crypto derivatives contracts over the last day were short bets. The highest short position liquidation for Bitcoin (BTC) bears occurred during the past 24 hours, wiping off $298 million worth of short holdings. According to Coinglass statistics, the biggest single liquidation reached $10 million in short BTC/USDT holdings on Binance (BNB).

Bears are in charge of 99% of liquidations on BitMEX. In the previous day, dealers of Bitcoin (BTC) lost $224 million, while owners of Ethereum (ETH) suffered losses of $60 million.

When a trader fails to fulfil margin requirements or does not have sufficient funds to keep their positions open, the exchange will liquidate their leveraged position for them.

The experts mostly attribute these liquidations to the excitement around the Bitcoin (BTC) spot ETFs that are awaiting clearance from the U.S. SEC. The legal dispute was resolved last night when the court issued a directive for the Grayscale/SEC procedure. Grayscale can consider this outcome a victory, although its application for a spot ETF has not yet been approved.

In addition, BitMEX creator Arthur Hayes emphasises that this run can be a harbinger of the beginning of a bullish trend, as reported by U.Today.

Bitcoiners have never been so greedy since mid-April

Hayes further stated that Bitcoin (BTC) is once more being utilised as a safe haven in the midst of the continually rising inflation of the major foreign currencies.

The crypto community experienced extreme joy following BTC’s rise to $35,000. The “Greed” zone of Alternative’s Fear and Greed Index soared to 66/100.

According to statistics, this indicator is at its most “overheated” level since April 17, 2023. The index increased by almost 25% during the previous seven days.