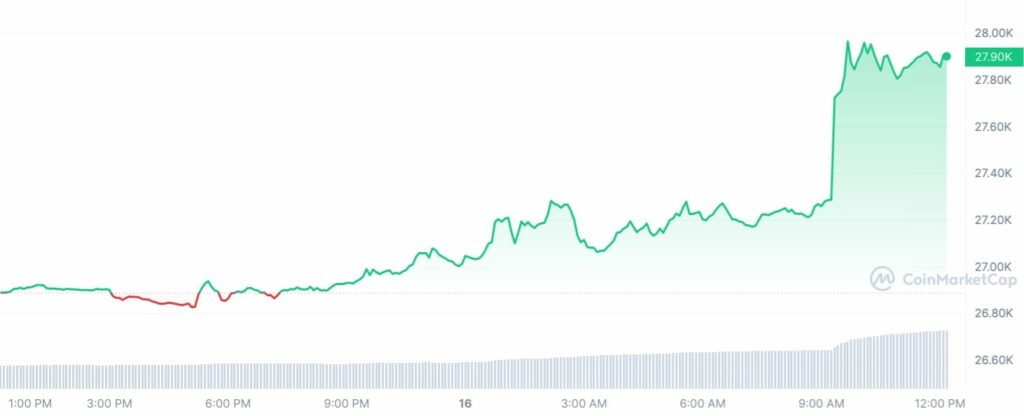

Astonishing market participants with an explosive increase of 3.8%, Bitcoin (BTC) surged back to life at the start of this week in a shocking turn of events. The sudden increase sent shockwaves across the cryptocurrency market, and as a result, there have been a stunning 75.23 million dollars worth of liquidations in the previous 24 hours alone.

As $36.89 million, or a staggering 94% of all liquidations, related to short positions, bears who had staked a lot on a downward trend found themselves on the short end of things.

The booming pump that sent Bitcoin’s price to an astounding $27,980 per BTC marked the peak of this tumultuous trip. Surprisingly, this spike not only erased the losses from the prior week but also set off an unheard-of avalanche of liquidations.

The world’s largest cryptocurrency exchange, Binance, served as the focal point of this market-shaking event, with the price of Bitcoin futures surging to an astounding $28,168 and scattering negative market participants in its wake.

Bearish pump?

The massive short squeeze has traders in awe and questioning if Bitcoin is prepared for a sustainable rising trajectory or getting ready to continue its downward trajectory after collecting liquidity from tardy and overly ambitious bearish.

The million-dollar issue now is whether Bitcoin will capitalise on this renewed energy to keep growing or if this is just a temporary reprieve before another decline.

The potential of Bitcoin to surprise and enthral is unrivalled, demonstrating once again that in the world of digital currencies, the only constant is unpredictability. As the crypto sector waits for what comes next, one thing is clear.