In an unexpected turn of events, XRP saw a staggering 700% increase in fund inflows, making it the unchallenged leader among investment products focusing on cryptocurrencies last week. The most recent data from CoinShares claims that a startling $700,000 was invested in XRP-related items in only the last week. This increase not only solidifies the token’s supremacy but also represents a sevenfold increase in weekly inflows into XRP ETPs.

This surge’s association with increased XRP influx activity on the Bitstamp platform is particularly fascinating. Such activity often denotes a sell-off, but in this instance, it can mean something quite different. Therefore, an increase in XRP inflows on Bitstamp may be related to Ripple Payments’ expanding user base (formerly known as On-Demand Liquidity).

It’s important to remember that major cryptocurrency company Ripple has a stake in Bitstamp and actively uses XRP for its payment services. The increase in XRP-focused investments may be due to the synergy between Ripple and Bitstamp.

https://x.com/whale_alert/status/1706046412725600416?s=20

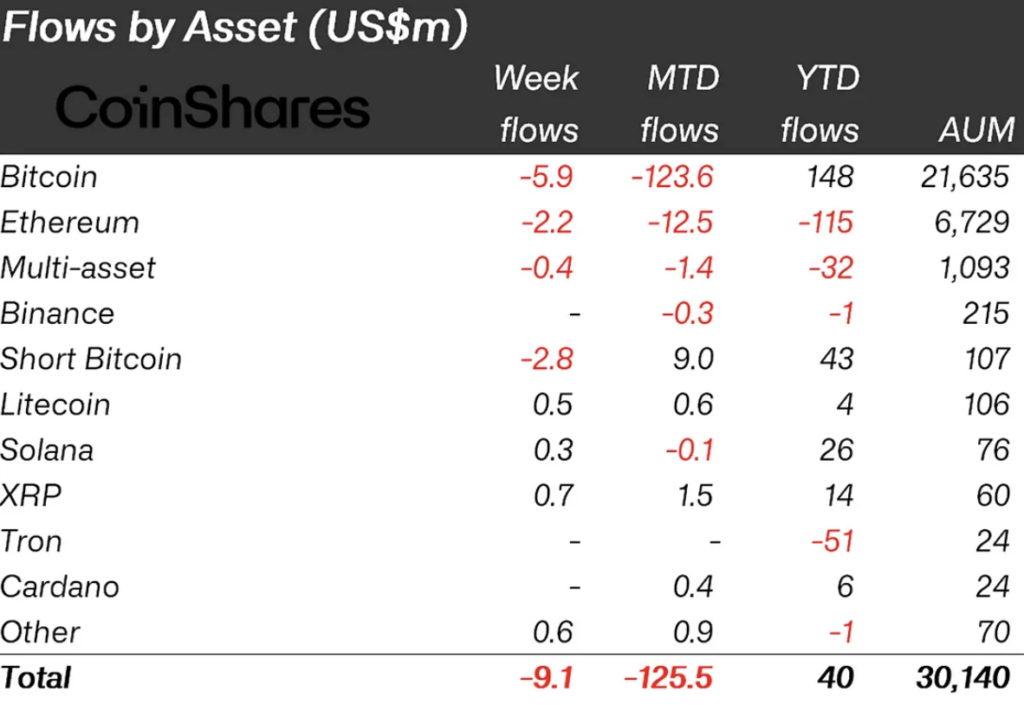

While XRP has taken centre stage, other cryptocurrencies aren’t completely in the background. Over the past week, there have also been notable inflows into the ETPs for Solana (SOL) and Litecoin (LTC).

The larger market for cryptocurrency investment products, though, paints a different picture. It was the sixth week in a row that the market lost money, with a total of $9.1 million leaving the market. The outflow total since the beginning of the year is a substantial $125.5 million. The Bitcoin (BTC) ETPs, which had withdrawals of $5.9 million last week, were among the victims of this trend.