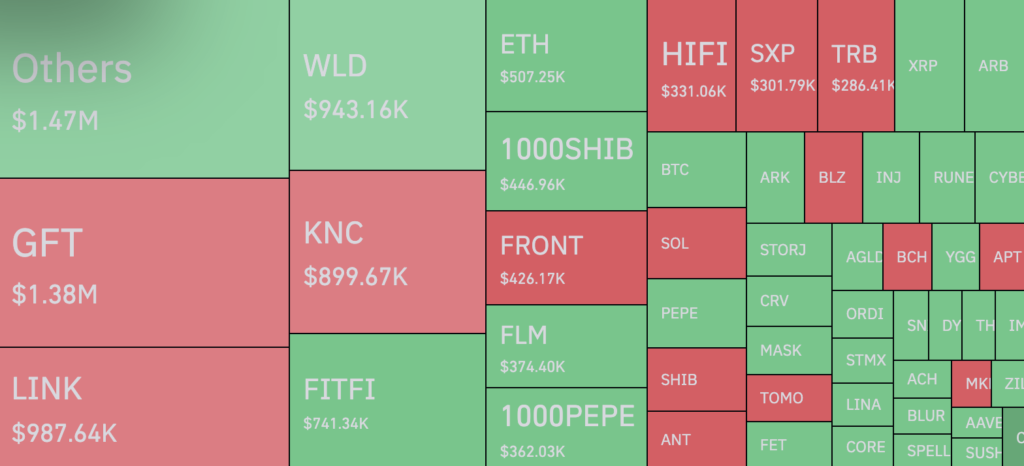

The past 24 hours have witnessed a rush of activity in the quick-paced world of cryptocurrencies, with a staggering $13.62 million in transactions liquidated, leaving traders reeling from the implications. Regarding two crypto heavyweights Shiba Inu (SHIB) and XRP, who absorbed the lion’s share of the blow, the liquidation map from Coinglass offers some fascinating information.

Out of the total amount liquidated, long positions, which indicate purchasers, contributed $7.79 million, while short positions, which represent sellers, contributed $5.83 million. This shows that market participants’ sentiments were quite split.

SHIB aficionados, prepare yourself, as deals worth $624,080 in SHIBs were liquidated during this turbulent time. What’s remarkable is that bullish bets accounted for over 60% of these liquidations. Further investigation reveals that the longs outnumbered the shorts on the instrument 1000SHIB, a futures contract that multiplies the price of SHIB by 1,000, by a startling 2.83 to 1 ratio. The ratio, which was 1 to 3.3 for the normal SHIB instrument, however, favoured shorts.

Turning back to XRP, it seems that XRP bulls have recently encountered a fair number of difficulties. A whopping $259,860 in XRP trades were liquidated in the same 24-hour period, with a stunning 94.55% of these liquidations being associated with long holdings. The chances have not been favourable for XRP bulls.

It is uncertain how these assets will perform in the upcoming days given the erratic nature of the cryptocurrency market. It will always remain a high-stakes game where fortunes may be made or lost in a split second, that much is clear.