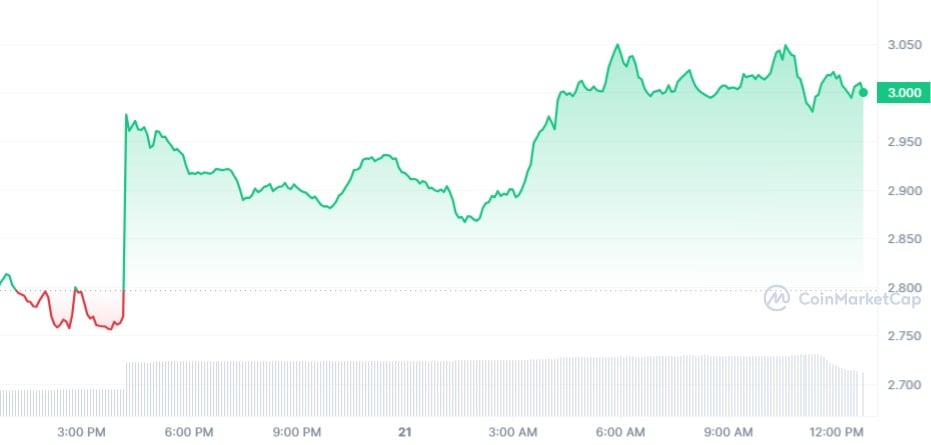

One of the cryptocurrencies driving the bullish trend on the market today is Synthetix (SNX), which has increased by a staggering 10% in the last day to reach $3. Synthetix has already increased by more than 16% in the week-to-date (WTD) period based on the current performance expectation.

In the ecosystem of decentralised finance (DeFi), Synthetix fills a specific niche. The protocol is intended to serve as a decentralised method of providing locked liquidity to any organisation that needs it for a variety of uses. Some of the most well-known protocols in the market, including as the combo of Optimism and Ethereum, use Synthetix as a backend due to its vast liquidity and low costs.

Over the past several months, Synthetix has demonstrated its strength as a procedure and is poised to retest its prior highs. Prior to the protracted crypto winter, the all-time high (ATH) for SNX was $28.77. The cryptocurrency is currently down up to 89.5%, which is a negative indication that suggests a potential impending significant rise.

The coin is being snatched up by retail investors among others, as seen by the bullish trade volume’s increase of more than 77.56% during the last 24 hours.

Consistency is the Synthetix mantra

This year has seen a number of obstacles in the larger digital currency ecosystem, with the United States Securities and Exchange Commission’s (SEC) regulatory crackdown on exchanges taking centre stage. Through some of the CEX rivals Synthetix is bootstrapping, this crackdown on centralised exchanges has opened doors for it.

As commonly stated by U.Today, Synthetix has maintained consistency in its growth spurt despite the uncertainty. The SNX coin is ready to revisit its 52-week high of $4.39 after recently surpassing significant DeFi milestones.