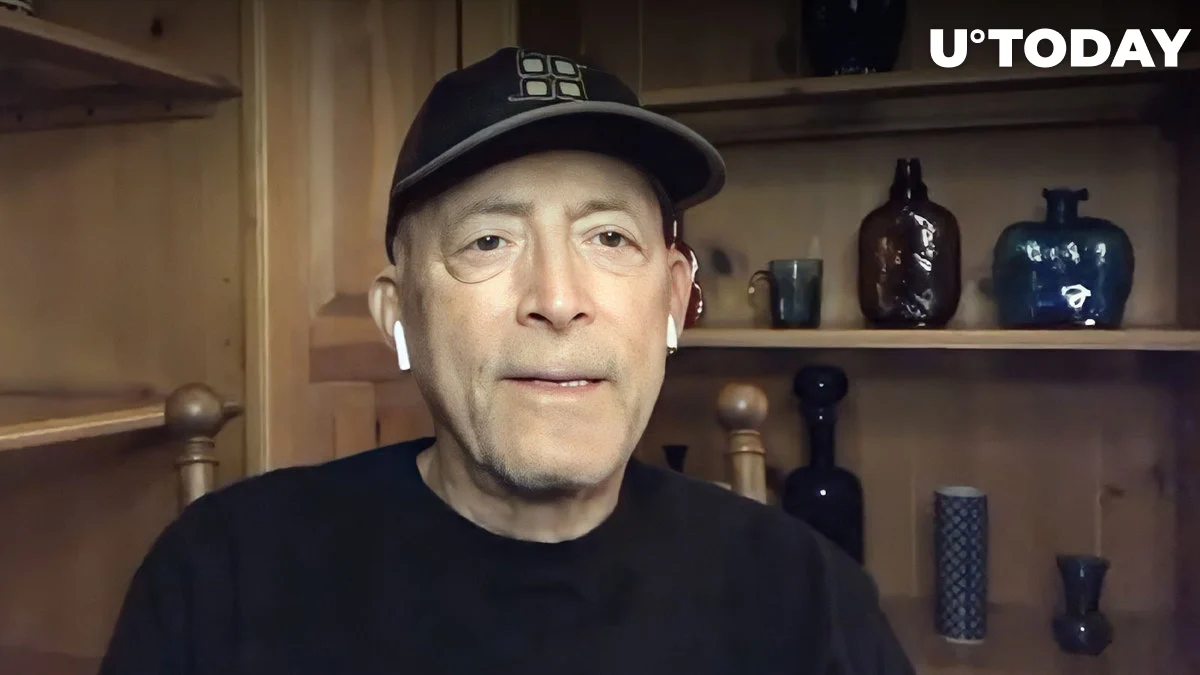

The market capitalization of the whole ecosystem of digital currencies has decreased, falling as much as 0.59% to $1.17 trillion. Legendary trader Peter Brandt noticed this pattern and shared his opinions on it on his official Twitter account, suggesting that it may indicate the bubble is already breaking.

Brandt’s tweet is even more damning of the positioning and choices made by cryptocurrency traders. He emphasised that the majority of the investors that debase the US dollar also own assets in USDT, which he feels runs counter to their underlying beliefs. Changpeng “CZ” Zhao was another target of Brandt’s criticism; he was referred to as the “scam of the decade.”

On Twitter, Brandt has a sizable following with more than 697,000 followers. His insight is highly valued as a crypto and stock market analyst, and he has made a name for himself in the field over the years.

According to many observers, the growth rates of the majority of digital currencies reveal a bubble that is typically not representative of their actual prices and value propositions. As a result, every price decline may be viewed as an expected pattern that alerts customers to exercise cautious.

Current crypto performance

The values of many cryptocurrencies available today have fallen, with Bitcoin (BTC) down by 0.32% to $30,160.23. Tron (TRX) has emerged as the greatest loser among the top 10 tokens now trading, while Ethereum (ETH) has also fallen by 0.17% to $1,862.23. To $0.07683, TRX is down by 4.01%.

Although the market outlook is still negative, the volatility seems to be decreasing. Many of the digital currencies that were mentioned earlier today had a more severe price decline; however, this trend seems to be ebbing gradually now. If the market prints a rebound in the near future, the opposition to Brandt’s assertion that the market is in a bubble will become more entrenched, according to several observers.