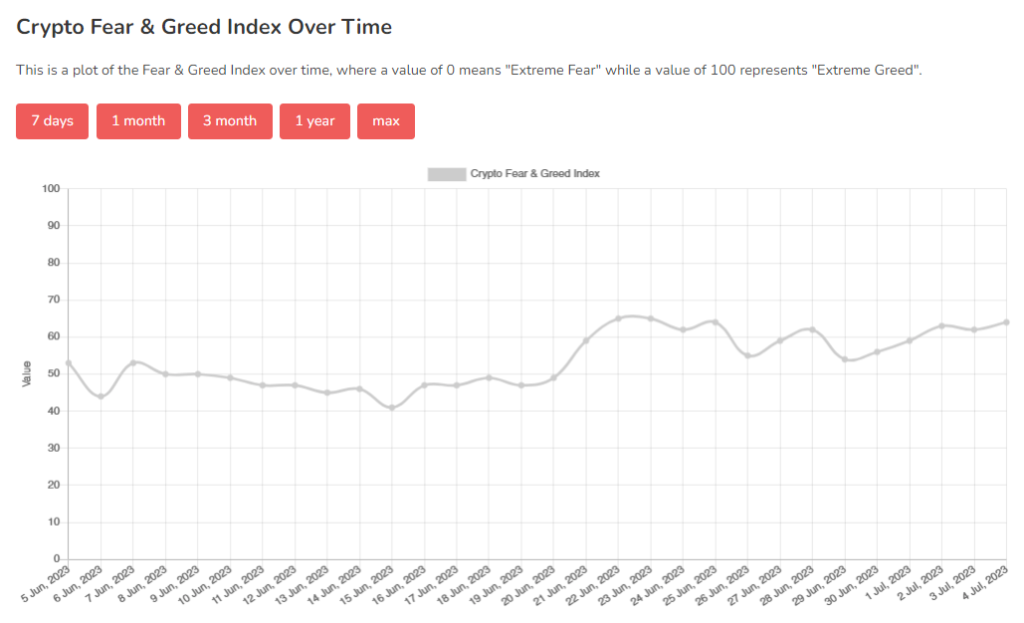

The price movement in the bitcoin market is significantly influenced by market sentiment. The Crypto Fear and Greed Index is one widely used method to gauge this emotion. It looks like “Greed” has returned to the cryptocurrency market following a recent upgrade. But what exactly does this imply for investors?

By examining variables including volatility, market momentum, social media trends, and the dominance of Bitcoin, the Fear and Greed Index is intended to evaluate the feelings and mood influencing the market. An index rating of 0 indicates “Extreme Fear,” whereas a reading of 100 indicates “Extreme Greed.”

Market corrections may occur when investors become overly greedy. On the other hand, when fear overrides reason, it could create a purchasing opportunity since prices might be discounted. The current reading of “Greed” indicates that investors may be growing more confident, which frequently results in a positive view for the market.

The Fear and Greed Index is one such attitude gauge, although they are not perfect. They are one of the investor’s numerous tools, but they shouldn’t be the only factor considered when making judgements about their investments. Short-term market swings may be influenced by emotions, but fundamentals and larger market dynamics frequently determine longer-term trends.

It is important to remember that large market corrections can occasionally be preceded by “Greed” periods. In the past, when the cryptocurrency market gets too bullish, it frequently leads to abrupt reversals brought on by profit-taking or market manipulation.

Investors should exercise caution when the Fear and Greed Index begins to lean towards the “Greed” category. While it could suggest a bullish period, it also serves as a cautionary tale about potential over-enthusiasm in the market. Therefore, it is suggested that investors use a balanced approach to investing during these times, along with careful research and risk management.