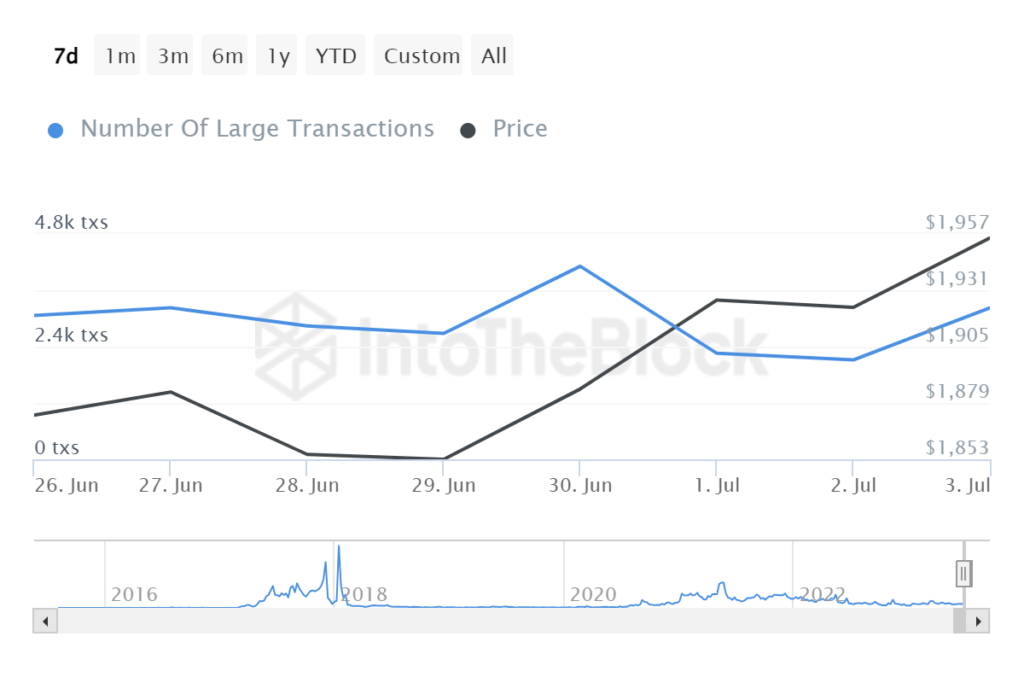

Recent weeks have seen a number of articles regarding the small performance improvements of Ethereum (ETH). The whale transactions in the second-largest cryptocurrency have increased significantly, despite its relatively modest growth. Data from the cryptocurrency analytics company IntoTheBlock (ITB) shows that $2.81 billion worth of major Ethereum transactions increased by 54.35%.

In particular, there were 3,230 significant transactions as of the time of writing compared to 2,120 on July 2.

According to ITB’s definition, big transactions are those involving more than $100,000 worth of Ethereum tokens per unit of time. While it is still apparent that retail investors dominate Ethereum, the most recent ITB data insights show a wide range of major spenders that continuously use Ethereum for on-chain value transfer.

The Ethereum protocol has recently produced some mildly positive results, which is presently being affected by these whale transactions. The spot price of the Ether currency is $1958.65 at the time of writing, up 0.11% over the previous 24 hours. Ethereum has made modest weekly progress, growing by 4.10%.

Broad Ethereum milestones

A number of favourable elements have come together to push Ethereum closer to breaking over the psychologically significant barrier of $2,000. Since the Shanghai Upgrade went live earlier this year, the protocol has also experienced a notable increase in its staking deposits, as previously reported by U.Today.

Now that Ethereum is a full-fledged proof-of-stake (PoS) technology, people are more interested in yield farming and staking. Staked Ethereums are frozen until a long-defined date prior to the Shanghai Upgrade. Staked assets can now be redeemed upon request thanks to the modifications, which have increased investor activity all around.

Large transactions and rising staking liquidity have worked together to keep Ethereum afloat in the face of general market concern.