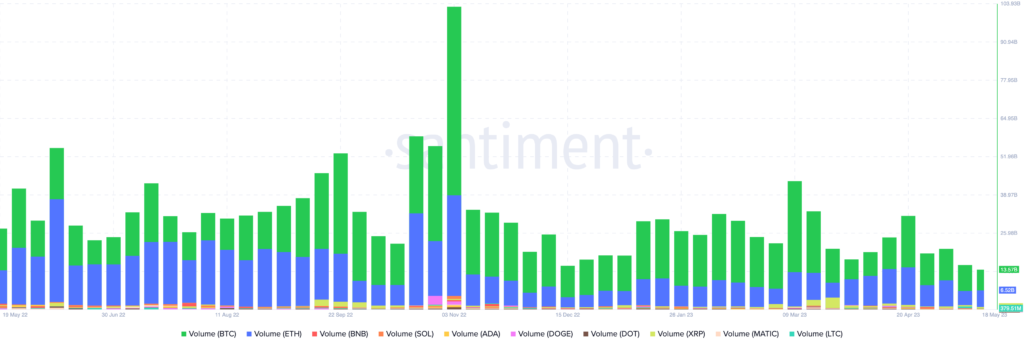

Top digital assets like XRP, BTC, or Cardano (ADA) are seeing their lowest total trading volume in more than a year, according to a research by intelligence portal Santiment. The cryptocurrencies, whose trading volume has significantly decreased, stand out in particular in this fall in trading activity.

The research notes that even when solely taking into account Bitcoin and Ethereum (ETH) trade volumes, the numbers are the second-lowest since September 2019. The declining trade volumes show a lack of investor interest and engagement in the market.

“Sell in April”

The research highlights several noteworthy trends, including the decline in trading volume that has occurred since the start of the price increase in March. During this time, the price of cryptocurrencies rose sharply, but trading volumes lagged behind, which worried market players. The traditional saying, “sell in May and go away,” seems to have been anticipated by the market as early as April.

The bitcoin ecosystem may be affected in a number of ways by the drop in trade volume. Low trading volumes imply less liquidity and more volatile prices, which makes it difficult for traders to initiate and exit positions with ease. Furthermore, if investors aren’t actively investing in the market, it can be a sign that they lack confidence.