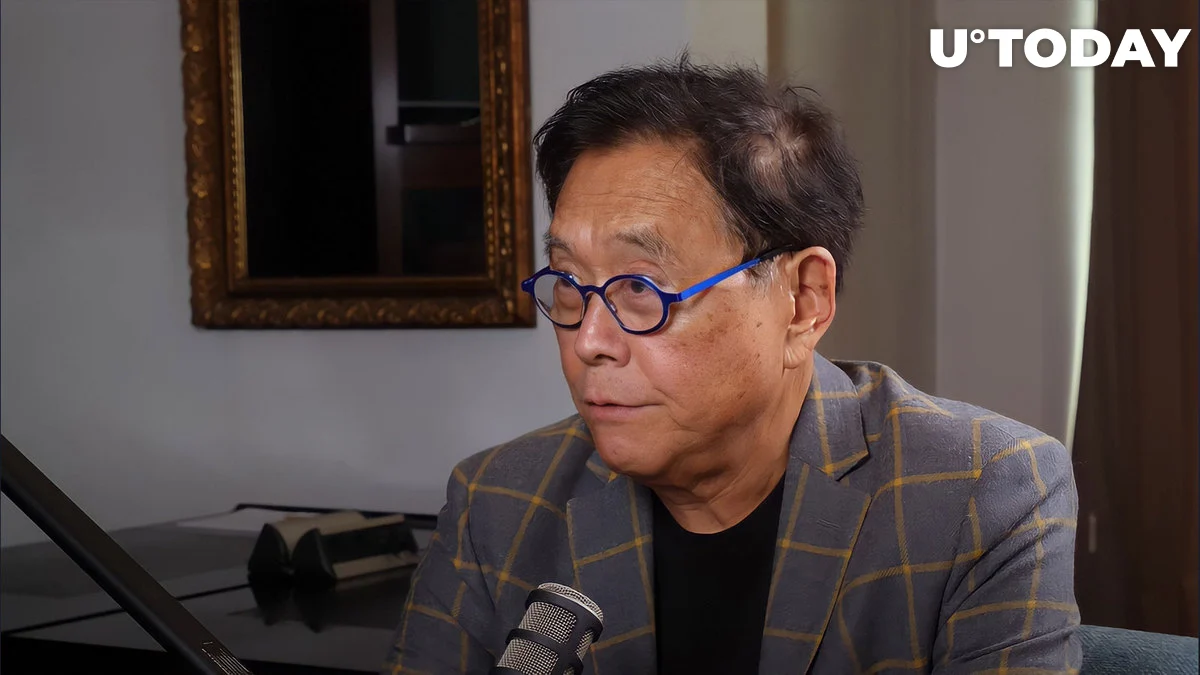

Robert Kiyosaki, a financial expert, investor, and author of nonfiction known for his book on financial literacy “Rich Dad Poor Dad,” has been a staunch advocate of Bitcoin for the past several years.

Bitcoin, gold, and silver, in his opinion, are all potent risk-hedging investments. Kiyosaki doubled down on his BTC wager in a recent tweet and advised his followers to persevere with it.

“Stick with Bitcoin, gold, silver”

Kiyosaki tweeted that Treasury Bills (T-Bills), which are regarded as “the best collateral in the world,” have increased by 100 basis points. The guru wondered if such indicated that a significant collapse of the global banking system is imminent.

He asserted that Treasury notes no longer function and that the best course of action right now is to “stick with gold, silver, Bitcoin, and home defence.”

As previously reported by U.Today, Kiyosaki referenced fund manager Steve Van Meter’s forecast that the price of gold will most certainly fall to $1,000. The author replied that he would just purchase more of it in such situation. He previously stated that he would purchase the dip in the event that Bitcoin fell.

Kiyosaki expects Bitcoin to hit $100,000

Robert Kiyosaki made numerous bullish predictions about Bitcoin earlier this year. He forecast that Bitcoin will reach a staggering $500,000 by the year 2025 in February. He mentioned the US Treasury and Federal Reserve as his justifications for this practise of massive dollar production.

In 2020, when the virus expanded globally and economies began to suffer from quarantines, these QE programmes got underway.

Later, he said that the same reason—along with the collapse of many regional American banks that started in March, including Silvergate Bank, Silicon Valley Bank, Signature Bank, and others—is why Bitcoin is on track to reach $100,000. First Republic Bank is the most recent bank to do so. According to reports, the enormous financial powerhouse JP Morgan will buy the banks’ assets.