On May 8, when investors considered worries both inside and outside the sector, Shiba Inu (SHIB) dropped along with the rest of the market.

SHIB hit intraday lows of $0.0000087 and was down 4.32% in the last 24 hours to $0.000009 at the time of writing.

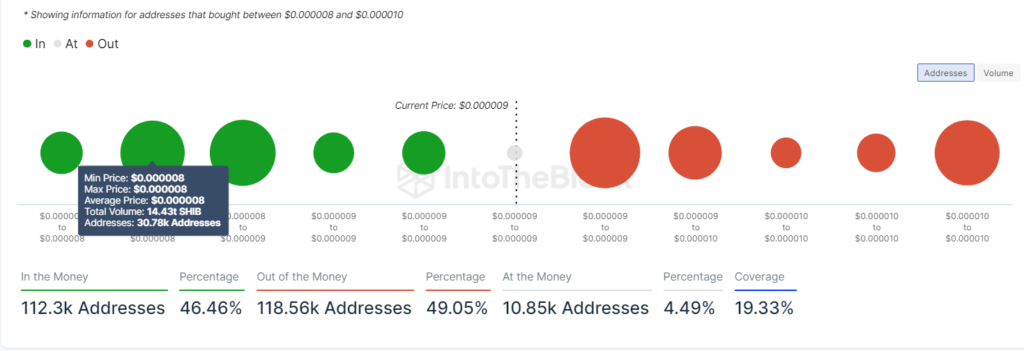

Shiba Inu is going through a big demand area, according data from IntoTheBlock. Shiba Inu confronted the next crucial support at $0.000008, as 30,780 addresses purchased 14.43 trillion SHIB, after the SHIB price momentarily dropped below the $0.000009 threshold on May 8.

This might mean that if the price falls below $0.000008, 30,780 Shiba Inu addresses could be in danger of losing their positions in excess of 14 trillion SHIB.

Bulls appear to be making an effort to retake the greatest of the support clusters, the $0.000008 to $0.00009 level, though.

According to statistics from IntoTheBlock, more Shiba Inu owners made purchases in this category, with 31,760 SHIB addresses doing so at the highest price of $0.000009.

SHIB approaching oversold levels

After peaking at $0.0000159 on February 4, Shiba Inu prices rapidly dropped. At the $0.000011 high set on April 16, the bulls’ effort to resume the uptrend ran into resistance.

The daily RSI, which has dropped below the 30 mark, suggests that Shiba Inu may soon reach oversold levels. An RSI reading of 30 or lower frequently indicates an oversold or undervalued state.

Shiba Inu is now trading below its daily MA 50 and 200 moving averages, which act as a key upward movement hurdle at $0.0000106.

The Shiba Inu daily moving averages are projected to cross in the next days or weeks, so traders may want to keep an eye on them in the interim.