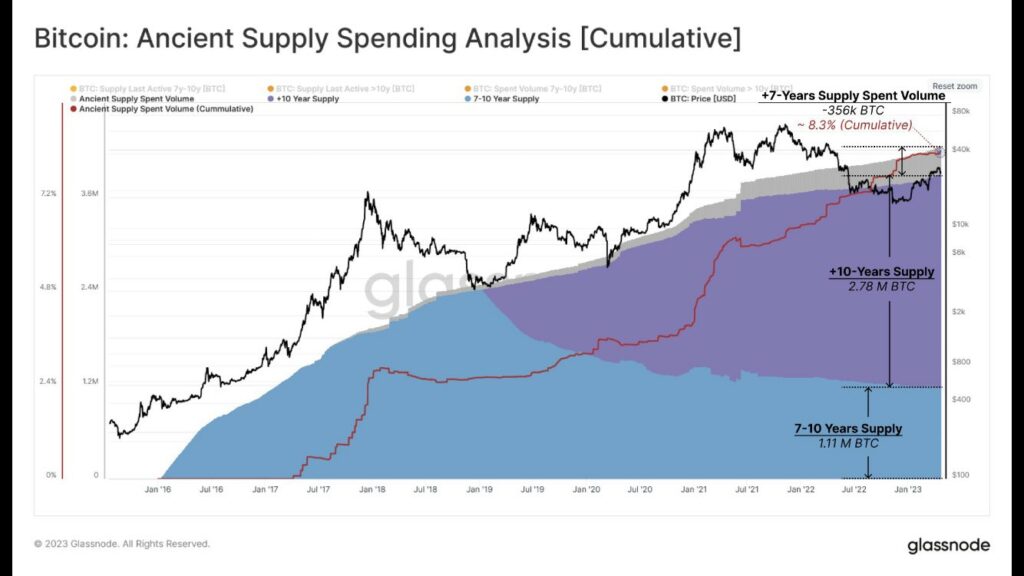

Long-dormant Bitcoin whales have recently shown a remarkable uptick in activity. 3,200 BTC of Ancient Supply, which had been dormant for more than seven years, were awakened last week, of which 1,1K were from before 2013. Only 4.25 million coins have ever attained the status of Ancient Supply, and only 356K of those have ever been spent, to put this into perspective.

The state of the market at the moment may be one reason for this rise in activity. Some long-term investors may view the current price of Bitcoin, which is circling about $30,000, as an ideal opportunity to sell and collect gains. The current market situation may have provided these elderly whales with the ideal chance to reenter the market, which they may have been waiting for.

The possible impact of institutional investors entering the crypto market is another thing to think about. It’s also likely that some of these long-term investors are moving their holdings to fresh exchanges or wallets in order to manage their portfolios more effectively in light of the shifting market conditions.

The reawakening of these venerable Bitcoin whales might potentially be a fortuitous occurrence. Given the enormous number of Bitcoin addresses, it is entirely conceivable that a small proportion of long-inactive wallets are reactivating naturally or that a single entity is transferring assets among several addresses.

Regardless of the causes for this unexpected activity, it is critical for investors to understand the possible market effects of these old Bitcoin whales. Large-scale transfers of digital assets may result in more volatility and, in certain situations, may even have an impact on the direction of the market as a whole.