The debut of Paw Chain Aggregator was announced on the company’s official Twitter account. Through the use of current liquidity pools, it secures cross-chain swaps. According to the tweet, PAW will be purchased through this mechanism and then burnt using the transaction fees from each transfer.

Currently, CertiK, which has been auditing the PAW staking portal and will start doing the same for the Paw Chain Aggregator, is receiving the aggregator code from the Paw Chain developer team. The team anticipates that CertiK will complete the second audit more quickly than it did the first, which was deemed to be compliant by CertiK.

Over 200 trillion PAW staked via new portal

according to U.A mainnet gateway for PAW staking was previously introduced by Paw Chain today. A staggering 190 trillion PAW tokens were staked for 13 weeks in less than 24 hours.

The amount staked has now reached 200 trillion. The first significant Paw Chain product to be made public was the staking mainnet. PAW is the PawSwap multi-chain DEX’s native coin.

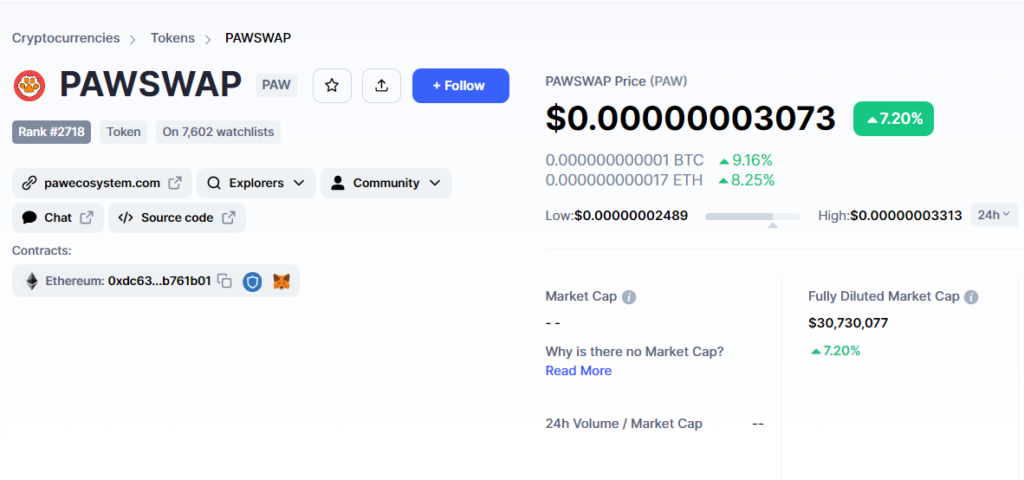

PAW price prints rise

The price of the PAW token has increased by 7.20% in the last 24 hours, according to information provided by CoinMarketCap. The increase occurred at the same time when Paw Chain Aggregator’s news began to circulate.

Despite the news that 190 trillion PAW were being staked on Monday, the price fell 12%.

@Dezaxe, a PawSwap advocate and validator who goes by the pseudonym, explained the price drop. He said that the staking webpage was launched at a time when the value of the two most important cryptocurrencies, Bitcoin and Ethereum, was falling. The Twitter user said that the decline in the price of BTC and ETH had a detrimental effect on the whole cryptocurrency industry.

He emphasised that the Paw environment in no way contributed to the price turning red. The latter, according to @Dezaxe, is solid and won’t be impacted in the near future.