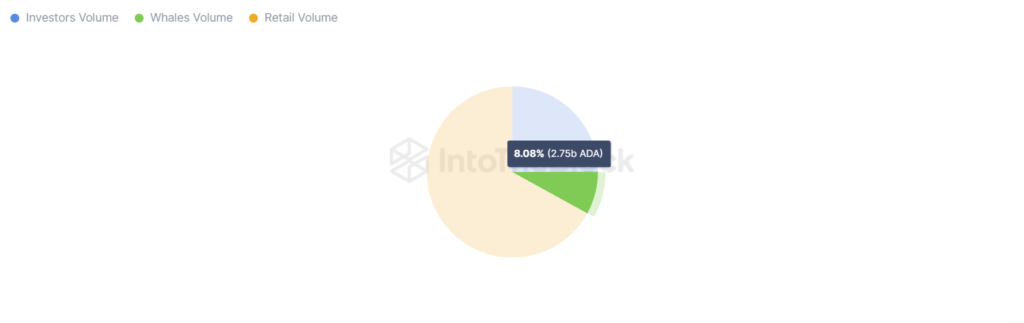

Whale grip over the supply of Cardano (ADA) has significantly weakened, reaching only 8% of the overall supply. This number is much lower when compared to competing cryptocurrencies, making ADA one of the top 10 most decentralised digital assets on the market (excluding stablecoins). Cardano confronts market hurdles and is working to reclaim its previous rise despite these encouraging advancements in decentralisation and the usage of cutting-edge technology.

The allocation of the asset among holders has changed, reflecting a decline in whale-controlled ADA supply, leading to a more decentralised network. The cryptocurrency is anticipated to grow increasingly resistant to manipulation as its distribution spreads out and sustain a thriving, diversified ecosystem of stakeholders.

Sadly, Cardano’s advancements in decentralisation and cutting-edge technologies have not resulted in a pronounced competitive advantage. Following many weeks of an ascent, ADA is presently having trouble regaining momentum. An indication of a prospective reversal may have been seen in the volume profile’s downturn.

The recent volatility of the larger cryptocurrency market might be one cause for ADA’s market difficulties. It is hardly unexpected that Cardano’s market performance has been impacted given the corrections and swings that many digital assets have seen. Moreover, some investors could still be unsure about Cardano’s technology’s long-term sustainability, mostly because of the project’s academic approach to putting novel solutions into practise.

It is crucial to remember that while Cardano’s present market difficulties could worry some investors, the project’s fundamental values of decentralisation and innovation continue to hold true. Cardano’s commitment to building a more equitable financial system may eventually turn out to be a useful asset as the cryptocurrency industry develops and grows.