What is Haven Protocol?

Haven Protocol is a fork of Monero that supports the creation of private coins representing both stable and volatile assets. Virtually any asset can be created on Haven Protocol including currencies and commodities. All of these are private by default. The intention is to make it possible to create your very own digital offshore bank that is out of reach to governments and regulators.

What is Haven Protocol?

Haven Protocol is a fork of Monero that supports the creation of private coins representing both stable and volatile assets. Virtually any asset can be created on Haven Protocol including currencies and commodities. All of these are private by default. The intention is to make it possible to create your very own digital offshore bank that is out of reach to governments and regulators.

Unlike many cryptocurrencies we see today, Haven Protocol had no premine, did not hold an initial coin offering, and did not receive any seed funding. Instead, 5% of all block rewards are automatically allocated to the development team.

Haven Protocol’s two core developers go by the pseudonyms Dweab and Neac. Dweab is a mathematician and Neac is a cryptographer. Both are also software developers and have 20+ years of experience in their respective fields.

How does Haven Protocol work?

Although Haven Protocol is described as a fork of Monero, it is more accurate to call it a clone of Monero. Haven Protocol has the same transactions per second (1700 – theoretically unlimited due to adaptive block sizes), the same base transaction fees (less than 1 cent), the same block time (2 minutes), and the same mining algorithm (proof of work – RandomX).

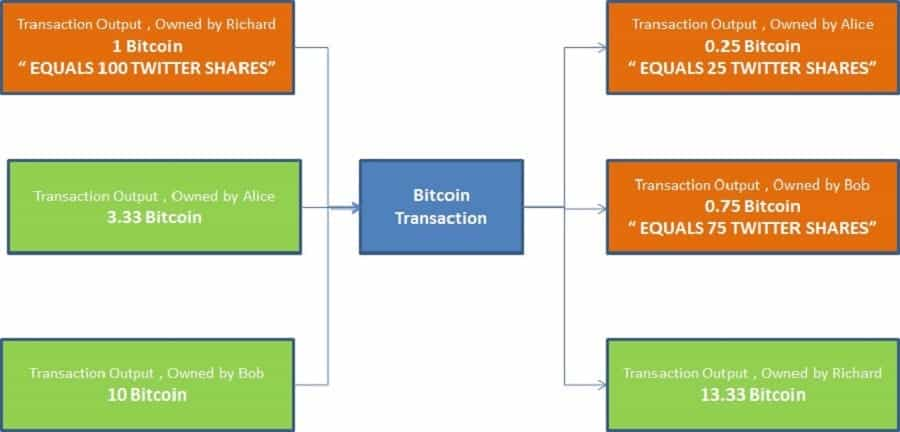

The primary difference (and perhaps the only difference) is that Haven Protocol has implemented something called Colored Coins. Colored Coins is a technology that was originally designed for Bitcoin in 2013 and allows you to assign a specific attribute to a Bitcoin (or fraction of a Bitcoin). This would make it possible for a Bitcoin to represent an asset like Tesla stock or even a single US dollar.

Haven Protocol XHV Mining

Like Monero, Haven Protocol uses a proof of work mining algorithm called RandomX. Unlike other proof of work mining algorithms, RandomX is designed to be resistant to specialized mining equipment (ASIC miners). As such, all you need to mine Haven Protocol’s native currency XHV, is a regular computer, though preferably a newer one.

XHV is one of the most profitable cryptocurrencies to mine right now. The return on mining works out to about 1$ per day and this can be 2-3x higher if you have cheap electricity. If you are interested in mining XHV, you can do so by joining one of the five Haven Protocol mining pools. You can learn how to set up your Haven Protocol node by contacting the team via Discord or Telegram.

Haven Protocol Privacy

Haven Protocol has the same privacy features as Monero. Though the technology behind these is also outside the scope of this article, there are three you should know about.

The first is Ring Signatures which hide the identity of the wallet sending a transaction. In a Ring Signature transaction, any wallet belonging to the same group of wallets can sign for that outgoing transaction. This makes it impossible to tell which wallet the transaction actually came from.

The second is RingCT which obscures the amount of coins being sent in any transaction. Instead, only the sum of inputs and outputs is accounted for. If you could not tell, this is the privacy feature that makes it so hard to implement Colored Coins on Monero.

Haven Protocol xUSD

xUSD is privacy preserving stablecoin. It also functions as the cornerstone xAsset on Haven Protocol that is used to mint other types of xAssets.

xUSD is a synthetic stabelcoin. This means that there is technically nothing backing it. Instead, it simply mirrors the price of the asset it is supposed to represent. xUSD falls into this category, and Haven Protocol uses Chainlink and Band Protocol to check the price of XHV, xUSD and other xAssets. This means that unlike the other three types of stablecoins, xUSD cannot lose its peg to 1$USD.

If there is nothing backing xUSD, then where does it get its value from? This is where Haven Protocol’s minting and burning mechanism comes in. To mint xUSD, you must burn an equivalent USD amount of XHV. So, for example, if 1 XHV is worth 1$, minting 100 xUSD would require 100 XHV.

Haven Protocol xAssets

xAssets are synthetic representations of real-world assets on Haven Protocol. There are quite literally no limitations as to which assets can be represented, nor is there a limit on the liquidity of that asset (i.e. you can buy as many synthetic shares of Tesla as you want). This is because like xUSD, there is technically nothing backing any xAssets. They just reflect the prices provided by the oracles.

To mint another xAsset, you must burn xUSD. It is not possible to go directly from XHV to any xAsset other than xUSD. This is primarily for simplicity on the developer side, and is also justified by the fact that most commodities (e.g. oil, precious metals) are universally valued in USD.

That said, you can mint other synthetic currencies such as xEUR or xGBP using xUSD. xAssets have not been implemented at the time of writing, and the first set of xAssets to be supported is detailed in the Roadmap section of this article. Oh and of course, all xAssets are completely private like XHV and xUSD.

Haven Protocol Transactions

In addition to the privacy features mentioned earlier, Haven Protocol has added a few additional features to its transactions to ensure the mint and burn mechanism for xUSD remains stable. The first is something called ‘notes’.

You can think of notes as being equivalent to physical banknotes (cash). Transactions on Haven Protocol are designed so that any ‘change’ associated with a given note cannot be spent or moved until the transaction has completed.

For example, suppose you bought 100 XHV on an exchange and sent it to your wallet. Unless you manually split that amount in your wallet, it will be treated as one note. This means that if you want to send 50 XHV to one person and the other 50 XHV to another, you have to wait until the first 50 XHV transaction completes before sending the second one.

XHV Cryptocurrency Analysis

XHV has a current supply of roughly 14.25 million. Since XHV has the same emission schedule as Monero, this means that 2 XHV will be mined every block (every 2 minutes) until May 2021, when the block reward is reduced to 1 XHV per block.

After May 2022, Haven Protocol will enter something called tail emission, wherein the block reward will be 0.6 XHV indefinitely into the future. That said, Monero (and by extension Haven Protocol) could change their mining algorithm and block reward if a new one is found to increase privacy and decentralization (resistance to ASIC miners).

Haven Protocol XHV ICO

As noted earlier, Haven Protocol had no ICO, no premine, and no seed funding from any venture capital firms. That said, the aforementioned Haven Foundation received a 1 million dollar donation from an anonymous entity in late September, not long after they became officially incorporated in Cayman Islands.

Final Word

Haven Protocol may just be one of the most valuable projects in the cryptocurrency space. The crypto markets have become incredibly reliant on stablecoins issued from centralized parties, namely Tether (USDT). With rumors circulating that regulators could go after these stablecoin issuers, it is high time to explore crypto-based alternatives.

Overcollateralized and algorithmic stablecoins are arguably not developed enough to fill the void centralized stablecoins would leave. Consider the fact that a substantial amount of the cryptocurrency that backs the DAI stablecoin is actually USDC! Though there are likely to be improvements in those camps, neither of the two can adequately preserve privacy.