BYDFI is an exchange that was established in 2019 and is based in Singapore. They are registered as Bityard Blockchain Foundation limited and have addresses at Paya Lebar Square Singapore.

The main products offered by the exchange are leveraged trading instruments on numerous different cryptocurrencies. The main differentiators of this is exchange is the low entry levels as well as well as their unique contract offerings. They are trying to be more simplistic than the likes of BitMEX or Prime XBT.

They are also one of the few leveraged cryptocurrency exchanges that have regulatory licences. These include licences in the USA, Australia, Estonia and Singapore.

Since they launched last year they have expanded their offering to over 150 countries around the world. They have translated their website into 8 different languages in order to cater to this expanded client base.

Something else that immediately differentiates them from some of the other exchanges that we have reviewed is that they do not have any restricted regions. Anyone in the world can create an account there and start trading.

Is BYDFI Safe?

This is one of the most important questions that any trader can ask. The safety of your funds and the security that the exchange provides is of paramount importance.

So, how does BYDFI stack up?

Well, there are a number of things that we like to individually look into when assessing this. These include the exchange security, licences, risk management and user side security.

Regulations

The first thing that you should note is that BYDFI has licences from 4 different country regulators. These include the likes of the United States, Estonia, Singapore and Australia.

You can see the full licences on their website. These regulations are important as they show that BYDFI has the authority to operate in these regions as a money service business. So, you can be sure that they will not be running away with your funds.

Exchange Security

Given that you are sending cryptocurrency to the exchange, you will want to make sure that they are protecting your coins. This is why BYDFI uses multiple wallets stored offline in cold environments.

“Cold storage” is perhaps the best way to protect the funds from a hacker as it cannot be accessed from the internet. BYDFI keeps the majority of the funds in cold storage with only a smaller portion in “hot wallets” that are used to pay withdrawals / take deposits.

When it comes to market risk, BYDFI is not like other leveraged exchanges in that they do not have an insurance fund. Instead, they have real time risk auditing and risk management tools that monitor market positions and exposure.

Communication Security

As you will have noticed, BYDFI has full SSL encryption which means that whenever you are sending documents or communicating with them – it is a secure communication.

Asset Coverage & Instruments

When it comes to the instruments traded on BYDFI, these are not futures. They are leveraged contracts that work very much like a Contract for Difference (CFD).

As such, there are no order books at BYDFI. When you trade you are placing a trade that is matched by the exchange themselves. The benefit of this is that you won’t get any order slippage on your trades.

When you are trading with BYDFI, you are doing so on the margin. This means that the margin that you are putting down is a fraction of the full trade amount and implies a leveraged position. At BYDFI, the leverage goes all the way up to 100x.

This brings us onto an important point though: You do not need to use the 100x leverage. Indeed, this is perhaps too risky. You can always start out at lower levels like 10-20x leverage.

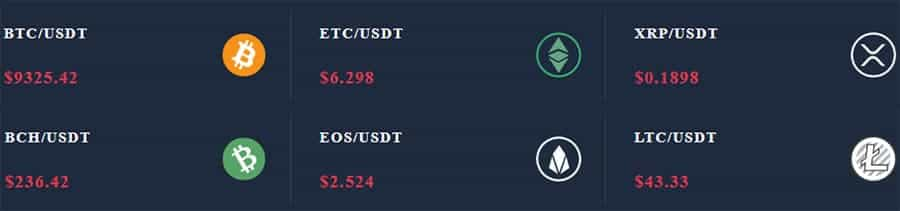

When it comes to the asset coverage, you have a pretty decent selection to trade at BYDFI. They offer the following: Bitcoin Cash, Bitcoin, DASH, EOS, Ethereum Classic, Ethereum, LINK, Litecoin, Tron & XRP. This is pretty extensive and is more than other exchanges such as Bybit et al.

Margin

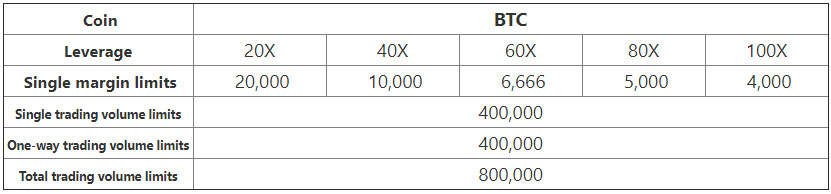

The exact margin and consequently leverage, that you can take on will depend on the size of the trade. The margin may be adjusted down for some of those larger trades just to manage the risk at the exchange.

We encourage you to take a look at the individual margin limits over at the exchange but to give you an idea of what these are, below is the margin limits for Bitcoin.

It is also important to point out that at BYDFI, you will not get liquidated. This is because they have a system of isolated margin. This means that the margin that you have set aside for your trade is kept separate from the rest of your trading positions.

This is opposed to those other exchanges that have “cross margin”. In this case, the margin can be adjusted across the various other positions.

K-Line Weighted Average

Given that BYDFI does not have their own order books, they will have to pull in external Bitcoin pricing data. In order to make sure that this has been done in a transparent way they will use a “K line” weighted average approach.

What this means is that the price that they reference for their contracts on the exchange is an average of the price on a number of different exchanges. In this case the exchanges referenced are Binance, OKEx and Huobi. The weights are 30%, 40% and 30% respectively.

BYDFI Fees

Fees are no doubt one of those things that could come back to bite in the long term. They do, after all, directly impact on your long term profitability.

Something that you can appreciate at BYDFI is just how simple their trading fees are. You will be charged a 0.05% commission on entry and exit of the position. So, in other words, the fee that you will be charged is:

Opening Fee = Margin*leverage*0.05% Closing Fee = Margin*leverage*0.05%

Unlike with those exchanges that have order books, unfortunately there are no examples of “maker” or “taker” fees. This is because there is no need for liquidity as it is met by BYDFI themselves.

In terms of the other fees that you are likely to incur, you also have what is termed the “overnight fee”. This is basically the fee that you will have to pay in order to keep your order on overnight. This is calculated as:

Overnight Fee = Margin * Leverage * 0.045% * Days

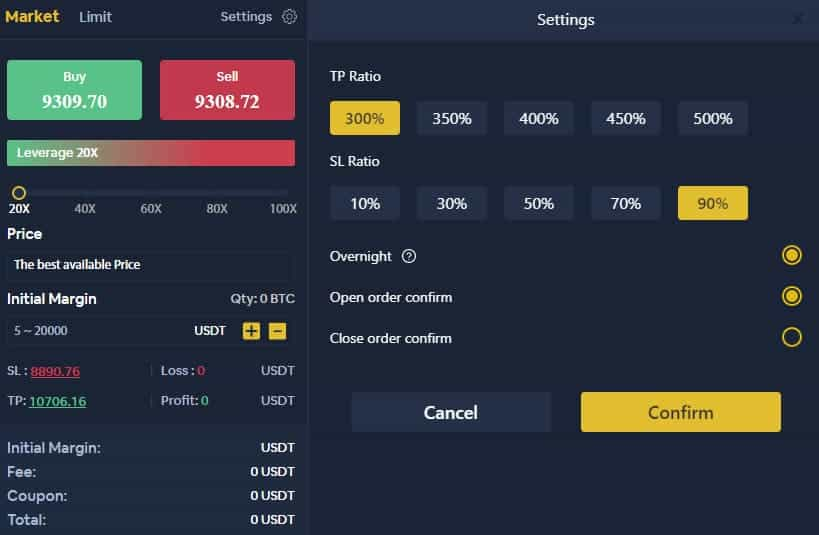

You should note though that positions are not automatically kept open overnight. This is something that you have to select when you are making your trades on the platform (we will cover in a bit). The Overnight Fee will be charged at 05:55:00 (GMT+8, Singapore time).

Finally, when it comes to deposit and withdrawal fees, you won’t be charged any fees on a deposit. However, when making a withdrawal you will have to pay 2 USDT.

BYDFI Trading Platform

It’s time to take a look into the belly of the beast – the trading platform.

The first thing that you will notice when you land on the BYDFI platform is just how simplistic it is. Firstly, you should note that the layout is adjustable. You can also increase the size of the chart in order to do your analysis.

However, with the standard layout you have all of your markets on the left where you can select which one you want to trade. Then in the center you have your charts, to the right your order forms and then below that you have all of your previous and live orders.

When it comes to the charts itself, they are not the most advanced that we have seen. You can’t really use any sort of technical indicators and tools. However, you can map some trendlines and patterns with some of the drawing tools that they have provided.

There are two types of orders that you can place at BYDFI:

- Market Order: This is an order that you place at the exact market rate. It will be the latest traded price that has gone through on the BYDFI platform

- Limit Order: This is an order that is placed away from the market rate and which will be executed once it reaches that. This can be above for a sell order or below for a buy order.

Once you have chosen the order that you would like to place you will have to select the leverage you are willing to trade with. Don’t forget that this exact number will depend on how large the total trade size is.

Customer Support

Often, one of the most frustrating things that we see with traders is when they have to deal with shoddy customer support at exchanges. Days waiting on end for those tickets to be answered. Hence, this is why it is such an important criterion that we test at the exchanges.

At BYDFI, the quickest and easiest way to get hold of them is through the use of their live chat function. When we tried this on a number of occasions we were helped almost instantly.

They connected us to an agent who was incredibly helpful every time we reached out. This was despite the time of day. This is great to see and should be a standard that other exchanges should try to set.

If, however, you are a bit more old school then you can always reach out to them on their email address and they will try to get back to you.

Promotion

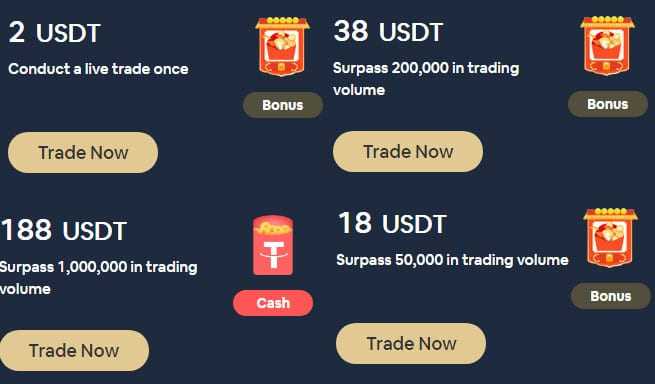

Something pretty neat about BYDFI is that they have a number of promotions and bonuses that allow you to earn free cryptocurrency. This could be a great way for you to augment your trading.

This crypto is earned from just doing a number of elementary things on the platform. These include things like setting up a username, binding an email or a phone number, conducting a simple live or demo trade, surpassing certain volumes of trades. You can see the full list on their rewards page.

When you create an account, you also have the opportunity to earn their proprietary BYD token. This is a platform token that is issued by BYDFI with a total supply of 210 million. You will get 6 BYD after your activation.

Something else that we found quite exciting about BYDFI is their daily mining. Every day they give away some free crypto which you can mine over on their mining page. All you need to do to claim them is to click on them.

Bottom Line

In summary, this is a great leveraged exchange that is making complicated instruments simple to use for traders of all skill levels. A trading experience with no slippage and liquidations.

It’s also pretty secure given that they have licences from 4 different regulators. Add to that their advanced coin management protocols and risk management policies and you have a pretty secure exchange to trade with.

We also found their customer support to be among the best with agents who knew what they were talking about. They answered us in under 1 minute irrespective of the time of day.

Of course, there are some areas of improvement that we highlighted. However, if they were receptive to this review then they could implement changes which could take the trading experience to the next level.