Coinsquare is a large exchange that is based in Toronto Canada. They started out as Coinsquare.io as a pure retail cryptocurrency exchange but have since moved to Coinsquare.com and have expanded the business.

They have opened up a mining venture arm as well as a capital markets division that will focus on high net worth individual investors and institutions.

The company was founded in 2014 and has grown substantially since then. They have raised over $47.3m in the past few years with the most recent funding round seeing them bringing in $30m. Today, there are over 90 employees in their office and they hope to employ over 200 by the end of the year.

This has helped Coinsquare to become the dominant cryptocurrency exchange in Canada and they have grown to have over 100,000 user accounts on the exchange.

Coinsquare has also been lucky in that they were one of the exchanges that stood to gain from the collapse of QuadrigaCX. For those that do not know, Quadriga was the exchange that went under when the CEO died with the private keys.

However, there have been a number of other Canadian cryptocurrency exchanges that have expanded their operations. These include the likes of BitBuy, Coinsmart and Coinberry. This means that the market is becoming increasingly competitive.

Is Coinsquare Safe?

Security and exchange safety is one of the most important considerations for any centralised exchange.

This is especially true for Canadian cryptocurrency traders given the recent collapse of QuadrigaCX. Thousands of users lost millions of dollars because of the poor operational practices of the CEO and management team.

Luckily for Coinsquare, they have not had a single incident in their 4 year history – so that is a plus. This could probably come down to their exchange and user-side security protocols. Below are some of these systems and tools that the exchange implements. Coinsquare also gets a firm nod of confidence as they are Canada’s first IIROC-regulated cryptocurrency exchange, so users can be fairly certain that there are no shady dealings going on there as we saw with FTX.

Exchange Security

Coinsquare employs well-known security protocols when it comes to coin management and server testing. For example, they operate a system of 95% cold storage of coins in their control. Cold storage means that they store the private keys to the coins offline and air gapped away from the internet. These are some of the most secure ways of keeping hackers far away from the coins.

Another concern for an exchange is losing track of ledger management and account balances. This is something that happened at the Bitgrail exchange for example. Coinsquare manages their ledgers “about 2346” times a day so they are able to keep track of all that which is owed.

Lastly, they claim that they have stress tested their servers to make sure that they do not fall victim to DDoS (Dedicated Denial of Service Attacks). For anyone who has traded on exchanges such as Bitfinex they will know how stressful DDoS attacks can be as they bring down the exchange and restrict you from getting access to your coins.

User Security

Coinsquare also has measures in place on the user side to protect you from phishing attacks and hackers that attempt to get into your account. For example, they have two-factor authentication that will help secure your account in case someone gets hold of your password.

This is not activated by default so we would recommend that you activate it the moment that you start using Coinsquare in order to protect yourself from the get-go.

They have also implemented secure SSL communications in order to avoid the risk of any man-in-the-middle attacks that could try to intercept your internet traffic. Hence, you should always look for the secure green padlock when logging into Coinsquare to make sure that you are not on a phishing site.

Asset Coverage

Coinsquare started off as a Bitcoin exchange but has recently expanded their cryptocurrency asset coverage to include Ethereum, Litecoin, Bitcoin Cash, Dogecoin, Dash, Ripple XRP as well as Stellar Lumens (XLM).

Coinsquare is what is called a “Fiat Gateway” primarily for use by Canadian traders who want to use their CAD to buy cryptocurrencies. While many users would be comfortable with the coins that Coinsquare has on offer, there is always the option to move these coins onto another cryptocurrency exchange and pick up other altcoins.

Hence, Canadian cryptocurrency investors can buy their Bitcoin with their Canadian dollars on Coinsquare and then move them to another exchange such as Kraken or Binance in order to buy the smaller altcoins. If you wanted to get an idea how much crypto you could buy on their platform with your dollars right now you can use their currency converter.

Coinsquare Fees

Trading fees at Coinsquare are relatively simple to understand and are really attractive. In fact, compared to other Fiat exchanges, the trading fees at Coinsquare are at least half of them.

They have two types of orders being market order “Bit markets” or a Quicktrade.

Bit Markets Fees

For the BitMarkets trades, they operate a maker / taker model where those who make a market have a slightly lower fee than those who take the market price. When you are trading on the Bit Markets exchange you will pay 0.1% as a “Maker” and 0.2% as a “taker”.

So, what do we mean by a “maker” and “taker”?

Quite simply, a taker is an individual who is taking liquidity away from the exchange by meeting another order that is already on the books. You are charged a slightly higher fee because you are “thinning” the Coinsquare order books.

On the other hand, if you are a maker then you are placing an order that is away from the current price and hence you are adding liquidity to the markets. This is why you will receive a slightly lower fee.

Quick Trade Fees

If, on the other hand, you would like to buy cryptocurrencies quickly without having to place your orders on the book then you can purchase using a Quicktrade. Here, your counterparty to the trade is Coinsquare and you will pay a flat fee for the trade.

If you are swapping Bitcoin for some other coin then you will be charged the single rate fee of 0.2%. Alternatively, if you trade one altcoin for another altcoin (no Bitcoin at all) then you will pay a double fee of 0.4%.

Just as a comparison, if you were to get charged the highest fee for the trade at 0.4% this is still quite small compared to the 1.49% fee that is applied at Coinbase for example.

Coinsquare Payment Methods

There are a number of ways for you to fund / withdraw from your account at Coinsquare. They have relationships with quite a few Canadian banks which means that CAD funding options are relatively straightforward. Below are the funding options together with fees and processing times.

It is important to note before you decide to fund your account that you should be verified and have completed their required KYC steps. We will cover all of this below.

Withdrawal Options

If you wanted to withdraw your funds in Canadian dollars then the following are your options to do so.

| Payment Method | Min | Max | Fee | Processing Time |

| Direct Bank Deposit | $100 | $10,000 | 2% | 1-9 Days |

| Wire transfer | $10,000 | $100,000 | 2% | 1-9 Days |

| Wealth Wire | $10,000 | $100,000 | 1% | 1-9 Days |

| Rushed Wire | $50,000 | Unlimited | 2% | 1 Day |

The “wealth wire” is the payment option for those traders who run Coinsquare wealth accounts (more below). Rushed wire is the same as a simple wire except you will pay a premium in order for Coinsquare to process your payment with haste.

Similarly, you can always withdraw just the coins off of the exchange. Coinsquare will not charge a fee for this but they will have to charge the going rate for the network (mining) fee.

Trading Platform

Depending on what sort of cryptocurrency buyer you are, the trading platform can make / break your experience. Some people would like to merely buy and “hodl”. Others would like to trade the crypto markets more regularly as a day trader. The latter will therefore be really interested in the type of trading technology an exchange has.

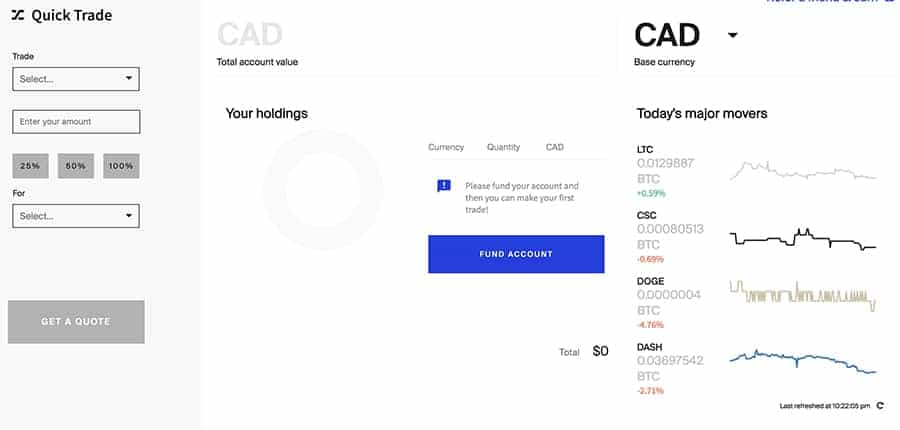

For those who are interested in merely buying a cryptocurrency quickly with a simple buy order, they will use the “Quick Trade” option that is available right on the dashboard. Here, you can get a simple quote for the cryptocurrency that you want to buy and then place your order. It will be executed immediately and added to your wallet.

Your holdings to the left of the order form will then be updated to reflect the coins that you have just bought. You also have a basic overview of the price movements over the past 24 hours for the coins that have moved the most.

Below that you will also have a summary of the live markets with the updated prices of all the coins available for purchase on the Coinsquare platform.

Advanced Trade

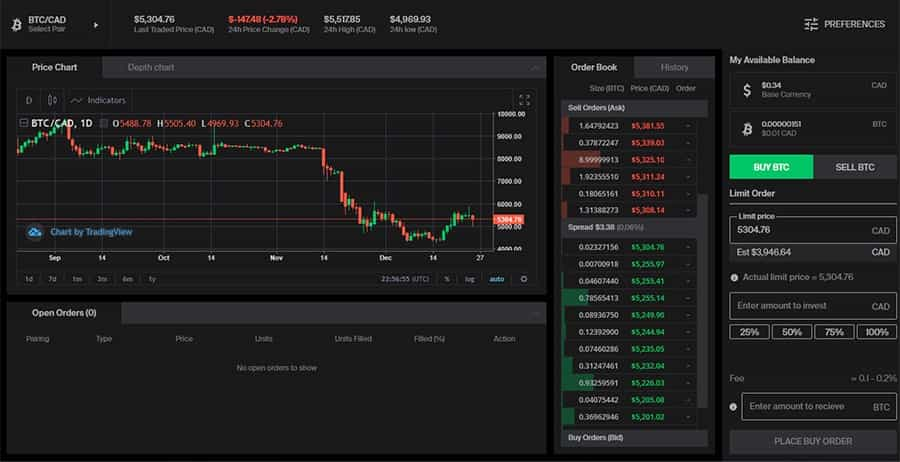

For those day traders among you that would like to have a few more tools at your disposal, you can head on over to the Advanced Trade tab on the platform. This will give the trader greater functionality when it comes order types and of course slightly lower fees (maker / taker).

It will also give you more information on the order books, current pricing as well as the most recent orders. Below is a screenshot of the advanced trading platform with the order form to the left of that.

The first thing to point out is that Coinsquare allows you to change the theme of the advanced trading platform. This is ideal for those traders who love that space grey dark theme. This is also a relatively new feature on the platform and it is a welcome change.

If you take a look at the chart on the left, it will be quite familiar to most traders. This is because the chart is a Tradingview chart. Coinsquare is using the software from this well-known charting package provider. It is also used by a number of other exchanges as their charting software of choice.

Tradingview charts give you a whole range of tools that you can run technical analysis with. Not only can you chart out the patterns and trend lines but it also has a compendium of indicators that can serve the chartist well.

Coinsquare App

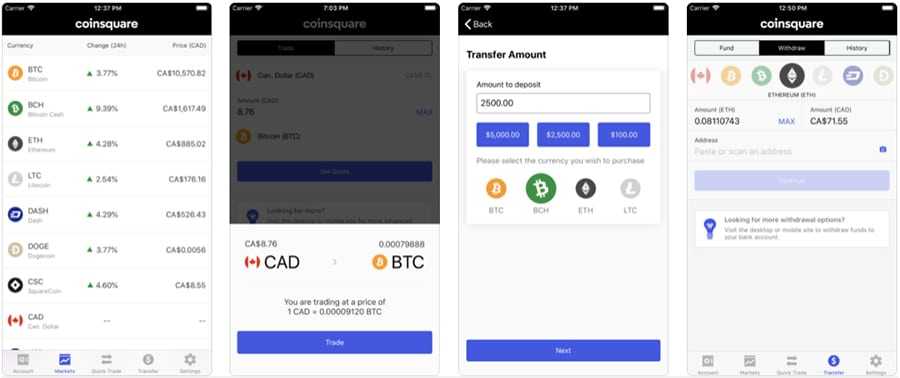

For those traders and cryptocurrency users who cannot be in front of their PCs the whole day, then the Coinsquare mobile application will no doubt come in handy. This was developed for both Android and iOS and has some of the same functionality of the online trading platform.

We downloaded the app and started using it just to test the functionality. It is relatively well laid out and you can easily toggle between the different functions from trading to funding and withdrawals. It does, however, lack the advanced trade option so you cannot use the more advanced order types.

We also took a look into the reviews that people were leaving on the App store and Google play store. It seems as if the Android app had quite a few technical issues that some users mentioned. There were quite a few complaints about the latest release of the app that it was not properly tested before being rolled out.

Bottom Line

Our Coinsquare review was relatively easy to complete. It’s a pretty large exchange that has been offering Canadians with an attractive trading alternative for a couple of years now.

Moreover, they are trying to expand vertically in the cryptocurrency industry as they are also investing in crypto mining ventures as well as a larger capital markets business.

However, despite this there are a number of concerns that surround the exchange. They have to take concrete steps to address their data breach and wash trading allegations. This is especially true given the competition they now face in Canada.