As the end of the year approaches, several experts had predicted that Bitcoin (BTC) would see a “Santa rally”. Even still, the token’s price hasn’t shown any encouraging trends.

Continuing the modest uptrend, the King cryptocurrency ended December 24 with a price above $16,800. This proved to be true on 25 December as well.

The leading cryptocurrency hasn’t been making many upward trends lately. Over the course of the December 24–25 period, it increased by just 0.1%. As of this writing, one bitcoin is worth $16,866, an increase of 0.20% in the last twenty-four hours. Now, everyone’s focus is on the year 2023 and what it will bring for cryptocurrency.

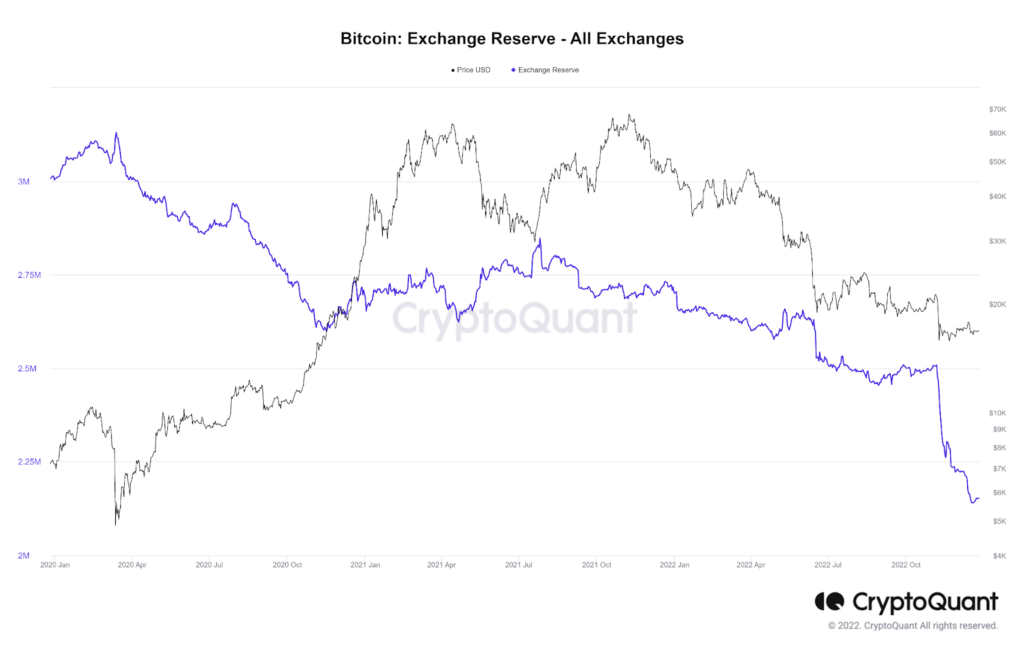

What Bitcoin’s Exchange Reserve Data Is Saying

Bitcoin Exchange Reserves for All Exchanges data shows that reserves are falling, which is also confirmed by on-chain analytics platform CryptoQuant. Usually, when the 14-day SMMA of bitcoin reserves on crypto exchanges crosses above the 30-day SMMA, there is an upward trend in the price of bitcoin. Consequently, a bullish crossing of the Exchange Reserves moving average may signal the start of a bullish trend.

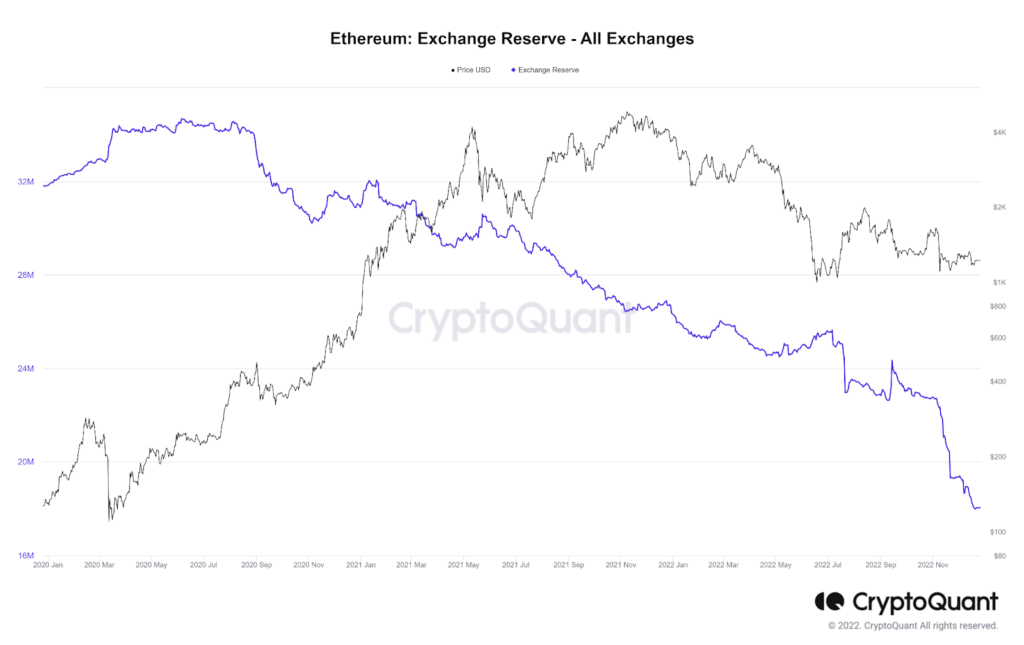

As for Ethereum, its price is hovering around $1,220 at the moment. The low for the last 24 hours is $1,205, and the high is $1,224. As a result, the price of ETH is likewise trending sideways, having increased by 0.09% in 24 hours and by over 2.7% in the last week.

According to data from CryptoQuant’s Ethereum Exchange Reserves for All Exchanges chart, centralized exchanges have found a reduction in ETH reserves by over 30%. This is the reason why there has been an increase in the number of optimistic investors buying Ethereum recently.

What 2023 Has In Store For Crypto?

Bitcoin’s historical bull runs had an average duration of four years. Beginning with Bitcoin accumulation, the cycle progresses via an upswing, cryptocurrency sales and distribution, and eventually a slump. Accumulation may begin in 2023, according to some experts.

Experts disagree on which direction the crypto economy will head next year. Mike Novogratz, CEO of Galaxy Digital, believes that this disappointing trend could last for the next two to six months.

A consensus among prominent cryptocurrency experts, including Michael van de Poppe, Rekt Capital, and CredibleCrypto, has established that a monthly Bitcoin price close above or below the $16,900 $to 17,000 range will define a bullish or negative trend in 2023.

Where the cryptocurrency industry goes from here is anyone’s guess. No one has a crystal ball, but most people are pointing fingers that the market downturn will end soon. This year has been really challenging.