This morning, the leading cryptocurrencies are trading in the negative after seeing a short bullish run yesterday and the day before. Additionally, the overall cryptocurrency market is experiencing increased selling pressure. This is most likely a direct result of the Federal Reserve’s decision to boost interest rates by 50 basis points.

According to data provided by Sentiment, major players are slowly making their way into the cryptocurrency market, resulting in an overall increase in purchasing power.

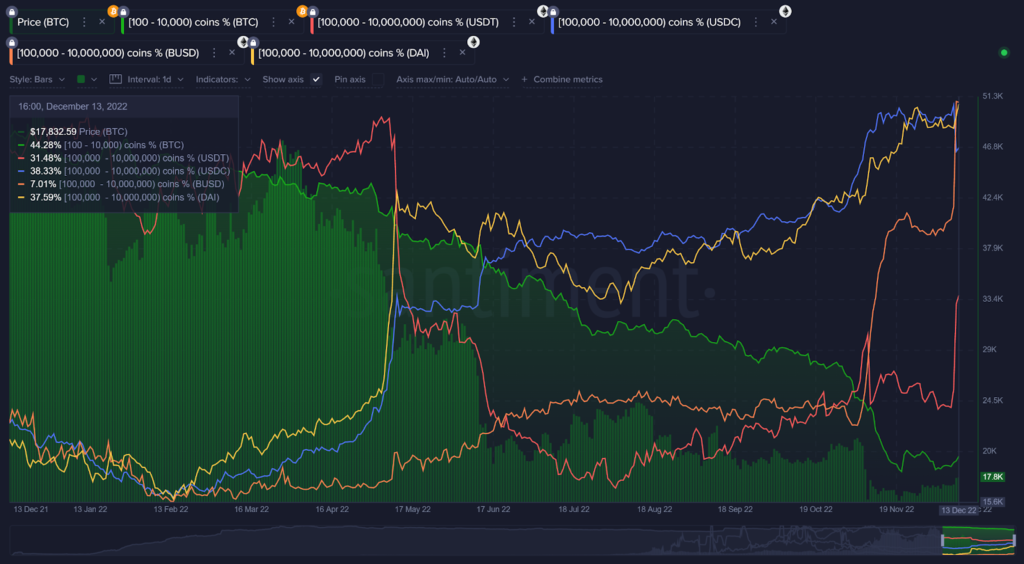

On-chain data shows whales have resumed their activities and have been amassing stablecoins such as USDT, USDC, BUSD, and DAI. These addresses are often those with a holding of one hundred thousand dollars or more, which allows them to accumulate a lot of stablecoins.

The green line shows the daily closing price of bitcoin over the past year. The green area shows the portion of the bitcoin supply owned by the most significant bitcoin addresses, those that hold 100 bitcoins or more but less than 10,000 bitcoins.

The red line indicates the supply of Tether (USDT) owned by addresses with $100,000 to $10,000,000. The orange line represents the supply of Binance USD (BUSD) owned by addresses with values ranging from $100,000 to $10,000,000.

The blue line represents the supply of USD Coin (USDC) owned by addresses ranging in value from $100,000 to $10,000,000. The yellow line represents the supply of Dai owned by addresses ranging in value from $100,000 to $10,000,000.

Investors now understand, as a result of the rate rise, that the Federal Reserve may still maintain its aggressive monetary policy in 2023, despite the fact that the rate hike was less significant than in previous years. And despite the fact that we had anticipated it would get less severe as the new year began, the decision made by the Fed demonstrates that it most likely won’t.

According to data provided by CoinGecko at the time of writing this article, bitcoin, the most valuable cryptocurrency as measured by market cap, was exchanging hands for $17,673, down 0.7% during the past twenty-four hours. . The price of one Ether has fallen by 2.6% in the past day and is now at $1,288.

Are Whales Selling More Crypto?

It’s abundantly clear that investor mood has a major impact in driving up or driving down the price of cryptocurrencies. And given the recent events involving FTX and the Federal Reserve’s decision to raise interest rates, it’s possible that they are not feeling very bullish right now.

Data from Sentiment indicates that bitcoin whales have been steadily offloading their holdings over the past 14 months, following the cryptocurrency’s spectacular gains in value in 2020 and 2021. With these sales, the prices keep coming down.

However, a change may be on the horizon today. Though maybe not with pricing just yet, whales are finally stockpiling rather than selling. The above chart shows that there are, nonetheless, enormous upswings.