Billions worth of cryptocurrencies are leaving market as trust between exchanges and traders suffers

Mass exodus of cryptocurrencies out of exchanges continues: Investors increasingly liquidate most of their positions on trading platforms and move their funds to cold storage or hot wallets due to an emerging trust crisis between exchanges and their users. Huh.

Cryptocurrency exchanges have been facing a real crisis after the implosion of FTX: unprecedented volumes of Bitcoin, Ethereum and other top-tier cryptocurrencies are leaving centralized trading platforms as investors are looking for ways to safeguard their holdings. The trend might persist on the market up until the end of the year.

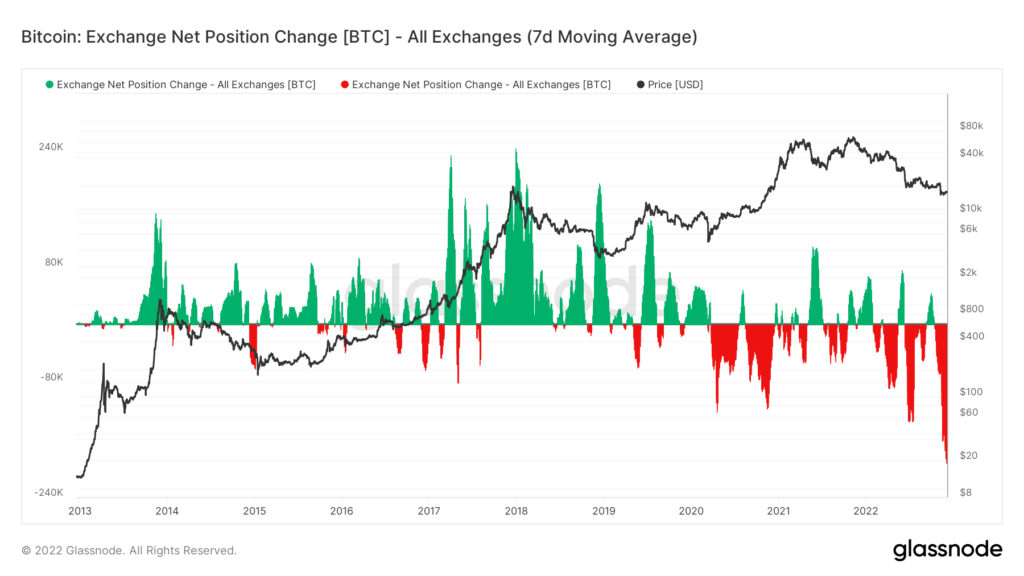

According to on-chain data, nearly 200,000 BTC worth $3.4 billion and over 1 million ETH left various centralized cryptocurrency trading platforms, making it the largest migration of funds from CEX since 2021. Such a trend is indicative of many things. ,

First, the decreasing amount of assets on exchanges quite often correlates with a descending trend in open interest and overall selling pressure on the market. Once traders move their funds away from the open market, they tend to hold them longer in comparison to those investors who store their funds on exchanges’ wallets.

How does it affect the market?

If the trend continues, the selling pressure we saw in November will subside along with the volatility. The outflow of money from exchanges typically initiates an accumulation phase, which comes just before an overall market recovery.

Despite the depression in the macroeconomic sector, the recovery of the cryptocurrency market is still possible, even without the rally on tradfi markets. However, making predictions and setting time frames is a complicated task to perform, especially by the end of the year.