Solana still dominates this specific market despite SOL price falling

After the drama of crypto exchange FTX and Alameda Research, there seemed to be no future for Solana. Both exchanges and trading companies have billions of dollars in SOL liquidated, and the association of blockchain with these entities further boosts token sales.

Nevertheless, Solana, though it has slipped to the top of the largest projects by the market capitalization of its tokens, and even given way to Shiba Inu (SHIB), still holds a large chunk in one of the most specific sectors of the crypto market. This is not least because of the enthusiasm of this group of crypto fanatics.

We are talking, of course, about the NFT segment, where Solana is second only to Ethereum in terms of sales of digital collectibles and other non-replaceable items. According to CryptoSlam, in the last 24 hours, the total sale of Solana-made items was almost $2.15 million, and even more, up 10.54%.

With cautious step

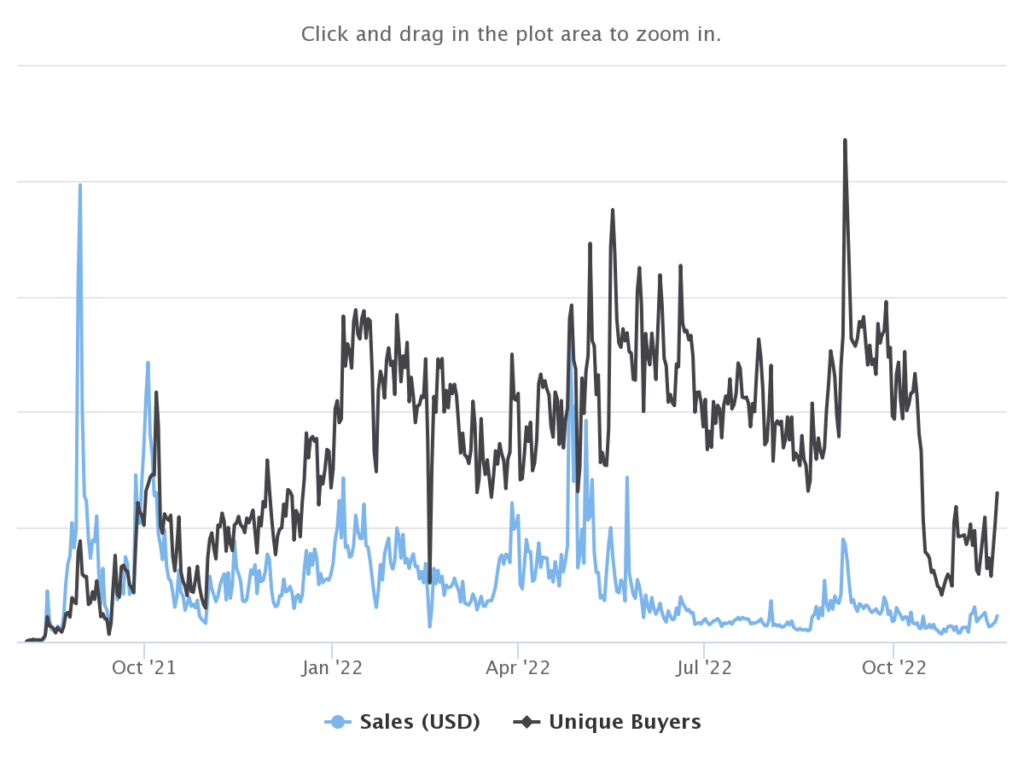

In addition, the number of unique Solana NFT buyers has started to grow again, which in a way indicates a return of buyers and their trust in blockchain. Accompanying such pleasing figures for SOL enthusiasts was an increase in trading volume for the most prime NFT collections on Solana, such as DeGods.

However, it is important to note that crypto market sentiment was and is in a fragile state, and the FTX crash and its aftermath only exacerbated this situation. NFTs are the riskiest segment of the riskiest market right now.