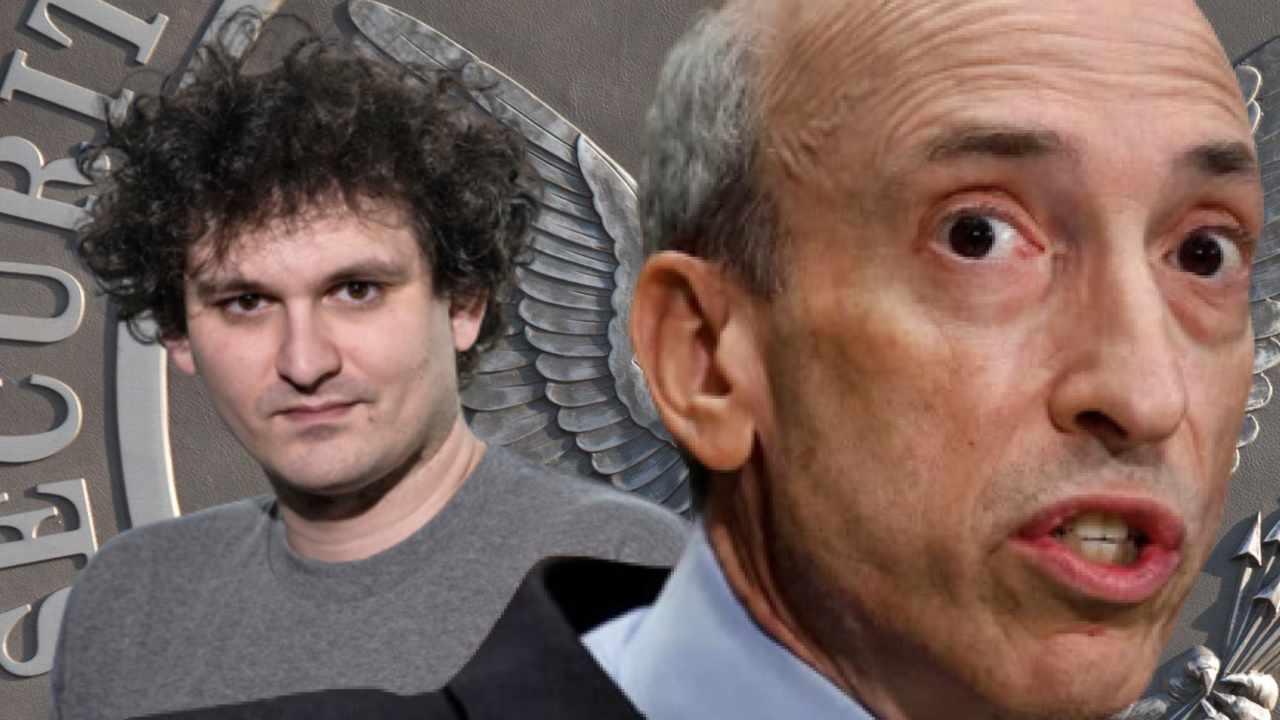

The U.S. Securities and Exchange Commission (SEC) reportedly met with crypto exchange FTX and former CEO Sam Bankman-Fried several times before the crypto firm filed for bankruptcy. SEC Chairman Gary Gensler was rumored to be helping FTX with legal loopholes. However, a new report indicates a contradicting viewpoint.

Gensler Meets with Sam Bankman-Fried and FTX

Following the bankruptcy filing of cryptocurrency exchange FTX, US Securities and Exchange Commission (SEC) chairman Gary Gensler is accusing former FTX CEO Sam Bankman-Fried and his bankrupt exchange of helping it “achieve a regulatory monopoly with legal loopholes”. Rumors have surfaced.” Some even speculated that the SEC boss was about to issue a no-action letter to FTX.

Gensler’s own calendar shows that he did meet with Bankman-Fried in March. According to an SEC meeting note, “members of the staff of Chair Gensler met with staff of IEX and FTX to discuss custody of digital asset securities by special purpose broker-dealers, including the unique risks associated with custody of digital asset securities and the conditional no-action relief discussed in the statement.”

However, Fox Business’ Charles Gasparino Explained on Twitter on Saturday that “contrary to speculation” about Gensler looking to give former FTX CEO Sam Bankman-Fried a regulatory monopoly on the crypto exchange:

March meeting between the two sides was described by a person attending as ’45 minute lecture by Gensler’ on what he wants from a crypto exchange.

The SEC chairman not only made no commitments to Bankman-Fried, FTX and IEX, but he also “ordered them to provide more in the way of disclosures etc. to the SEC about their model,” the journalist said.

“Follow-up meetings with the SEC continued up to nearly the time FTX imploded but no SEC approval was signaled,” he continued. “House GOP likely to hold hearings on FTX given Bankman-Fried’s Dem political leanings by calling Gensler as a witness might have to think twice. Sources say Gensler told Brad Katsuyama & Bankman-Fried he wanted strict oversight, standards & there was no guarantee of approval.”

Nonetheless, several people have expressed their belief on social media that either Gensler or other SEC staff members were helping FTX. Some suspected that this was because Bankman-Fried is a major donor to the Democratic Party. According to Open Secret political donor data, the former FTX chief was the second biggest donor to Democrats in 2021-22, donating $39.8 million – second only to George Soros.

Referring to the sanctioning of Ethereum crypto mixing service Tornado Cash, privacy activist and whistleblower Edward Snowden tweeted:

The White House bans and arrests kids for the ‘crime’ of building privacy tools to protect you, while ‘regulators’ were quietly toying with thieves who just robbed 5 million people. gap? Thieves were big political donors.

Congressman Tom Emmer (R-MN) tweeted Thursday: “Reports to my office allege he was helping SBF and FTX work on legal loopholes to obtain a regulatory monopoly. We’re looking into this.”

Last week, Gensler confirmed during an interview on CNBC that he had met with Bankman-Fried. The SEC chairman said: “I think we’ve been clear in these meetings… noncompliance is not going to work, the public is going to get hurt.”

The SEC chairman has often been criticized for his enforcement-centric approach to regulating the crypto industry. Gensler has repeatedly said that crypto trading and lending platforms should “come in,” talk to the SEC, and get registered. However, Ripple CEO Brad Garlinghouse said in September last year that instead of working with the crypto industry, “the SEC is using their meetings with companies as lead generation for their enforcement actions.” His company is currently engaged in an ongoing lawsuit with the SEC over the sale of XRP.

In addition, multiple news outlets have reported that the SEC and the Commodity Futures Trading Commission (CFTC) are investigating FTX for alleged misappropriation of customer funds. In May, Gensler warned that crypto exchanges often trade against their customers.