During the last 125 days or roughly four months, the total value locked (TVL) in decentralized finance (defi) has been range bound within the $50 billion to $65 billion region. The TVL in defi has shed significant value during the past six months as it dropped from $161 billion on April 1, down more than 67% lower to today’s $51.72 billion.

TVL drops by over 67% in 6 months, DeFi market action idles for 4 months

DeFi action has decreased significantly in terms of the total value locked in during the past six months. As of Saturday, October 22, 2022, TVL in DeFi is approximately $51.72 billion, with 14.76% of the entire TVL as collateralized debt position (CDP) protocol MakerDAO Saturday morning (ET) with $7.64 billion.

In addition to Makerdao, Lido, Curve, Aave, and Uniswap make up the top five largest TVLs today. The liquid staking protocol Lido is just below Makerdao with a TVL of around $6 billion and $5,839,046,587 of Lido’s TVL is staked ethereum (ETH).

MakerDAO posted a 30-day rise in price as TVL jumped 4.82% higher last month. Sushiswap saw significant growth, rising 41.27% during the past 30 days, and yield protocol Aura jumped 38.70% over the previous month.

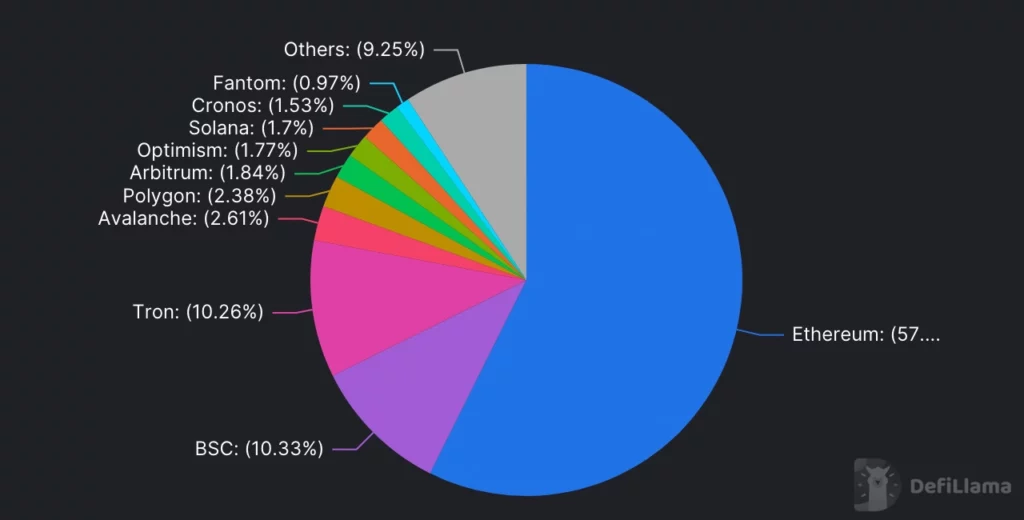

Out of all the blockchains today, Ethereum is the most dominant in terms of defi TVL with roughly 57% of the entire $51.72 billion locked in defi today. ETH has around $29.56 billion, while the second largest TVL by blockchain, Binance Smart Chain (BSC) has $5.32 billion or 10.33% of the aggregate value locked.

Apart from ETH and BSC, Tron, Avalanche, Polygon and Arbitrum are respectively behind TVL in terms of blockchain. Today, statistics show that there are 607 decentralized exchange (DX) protocols with $21.57 billion in lockouts.

There are 189 lending defi apps with $13.96 billion locked on Saturday and 57 CDP protocols command $10.37 billion. There’s also a total of 45 liquid staking applications that hold $7.91 billion in value today.

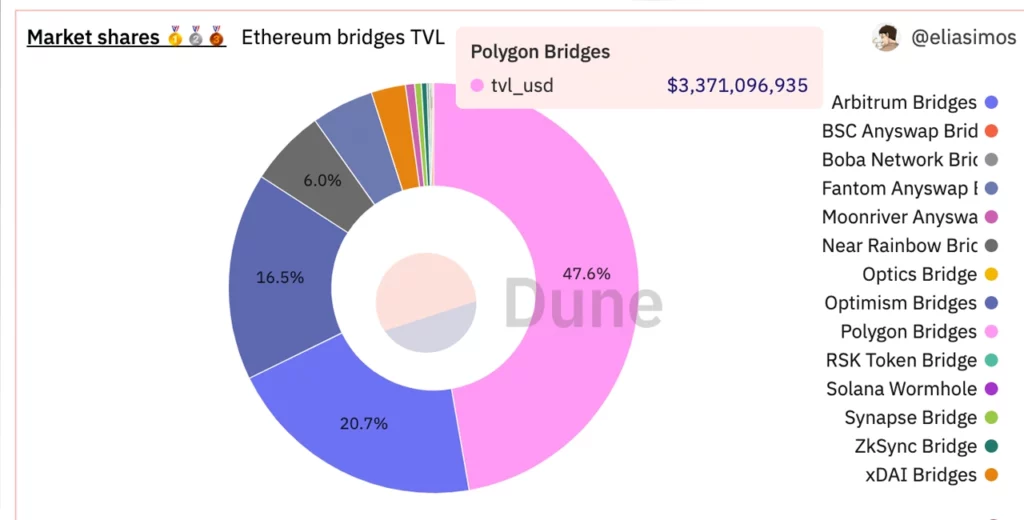

The closing price in the cross-chain bridge platform is also down 22% during the last 30 days. $7.80 billion is locked on a decentralized cross-chain bridge platform with a total of 13,178 unique depositor addresses.

Polygon is leading the bridge pack with roughly $3.37 billion TVL, but the TVL is down 6% during the past month. Arbitrum has around $1.44 billion which is down 2% lower than the month prior.

Today the top five smart contract platform tokens by market capitalization include Ethereum (ETH), bnb (BNB), Cardano (ADA), Solana (SOL) and Polkadot (DOT). ADA, SOL and DOT have seen losses between 3.4% and 6.8% during the past week. ETH and BNB have been in the green over the past seven days, ranging between 0.3% and 0.8% last week.