The crypto market capitalization has been on a constant decline as the Bitcoin price has not been able to break above the sceptical conditions. While a spike attracts significant liquidity, at the same time, the take profit on the longs has also been dramatically reduced. As a result, any small spike compels the market participants, regardless of the fact that the incurred profits may be extremely small.

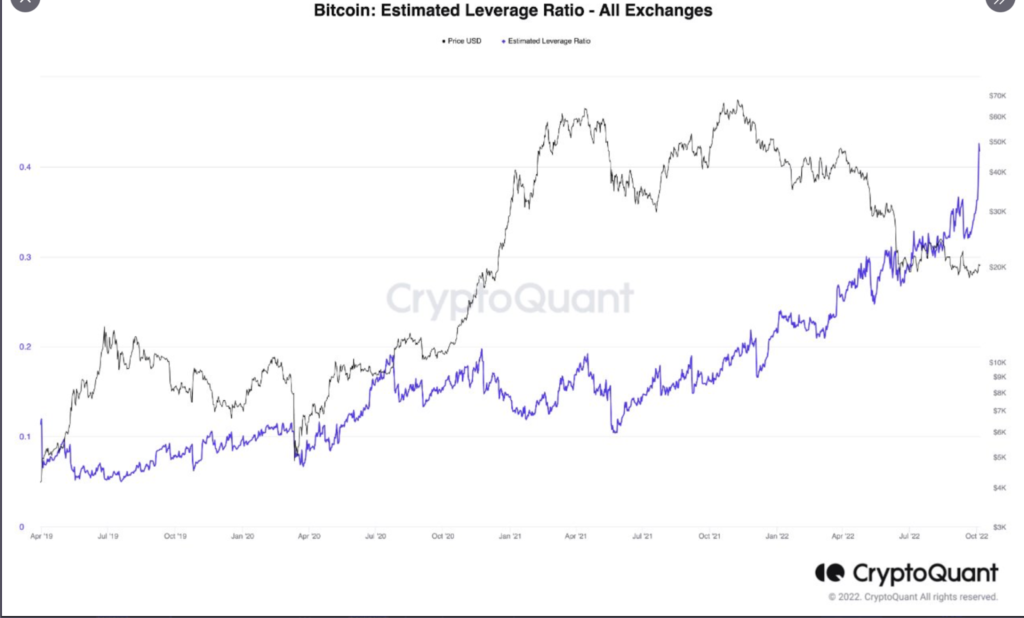

BTC price continues to trade in the same area as volumes and volatility declined significantly. However, the price is currently trading below $18,844 just above the crucial demand zone. A slight increase in volatility could push prices up. In a recent update, the projected leverage ratio, which highlights cash flows relative to interest outstanding on long-term liabilities, has risen.

As the ratio is rising, it may induce volatility in the asset. However, the Bitcoin mining difficulty has been rising for a long time regardless of the price movements. As the miners are increasing their activity and presence, it may also impact volatility in the coming days. Additionally, the Bollinger bands in the daily chart have been squeezing since the beginning of October, which may further result in a massive outbreak soon.

While the fractals are pointing to a significant uptrend, BTC price is close to sparking a huge ‘buy signal’.

As per the analyst, the Bitcoin (BTC) price has been trading below the 1000 DAILY MA levels, and each time it managed to rise above these levels, it has resulted in a major upswing. Hence, he believes that the present time is a good time to accumulate more Bitcoin.