According to a recently published report, the decentralized exchange (dex) Uniswap has blocked roughly 253 cryptocurrency addresses allegedly tied to crimes or government sanctions. The information was discovered by the software developer Banteg who analyzed and saved the shared logs from Uniswap’s server.

30 out of 253 blocked addresses are ENS domain names, Uniswap labels 7 types of risk factor categories

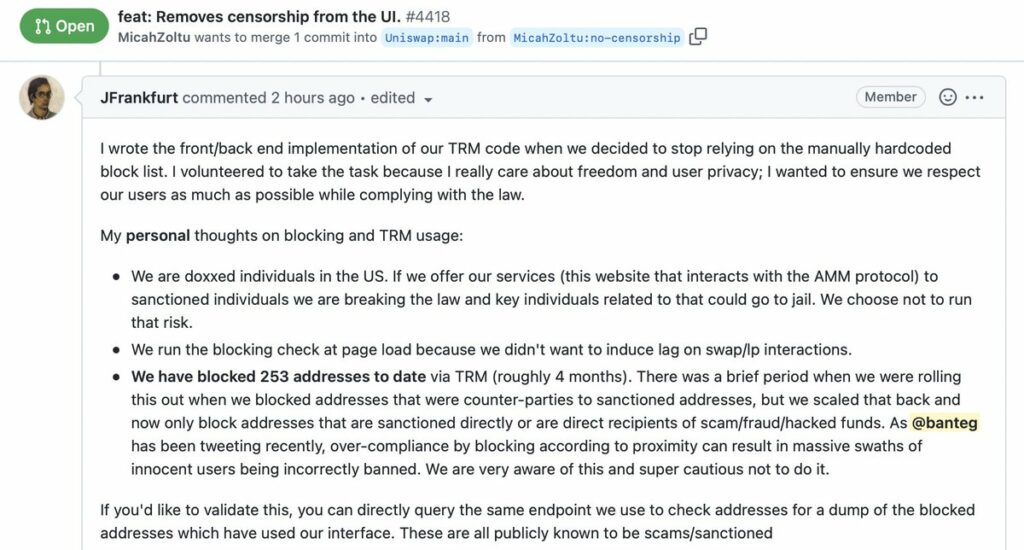

On August 19, software developer and Year Finance contributor Bantag published a twitter thread Which claims that Dex Uniswap blocks 253 crypto addresses. “UnisWap provides an unusual level of transparency,” Bunteig said in regards to “frontend censoring through TRM Labs.” In mid-April Uniswap partnered with TRM Labs and the firm blacklists crypto addresses that may be linked to sanctions and crypto crimes.

The same month, reports appeared that indicated a few innocent Uniswap users were affected by the TRM Labs-gated front end. At the time, no one was sure about exactly how many crypto addresses were blacklisted by Uniswap’s TRM Labs-gated front end. Banteg says there are 253 addresses and 30 addresses are ENS domain names. The developer also noted that there are seven different types of risk factor categories and two risk levels.

“Both the ownership and the counterparty to the ‘bad’ address are checked and may contribute to the blocking,” Banteague wrote, According to Banteague, the data “wasn’t meant to be public” but the developer noted that people could still “view the first one exclusively”. [TRM Labs] Leaks, courtesy of Uniswap.”

Smart Contracts and Code Are Defi, Not the Web Platforms That Host Them

The news follows the recent U.S. government ban of Tornado Cash, the ethereum mixing protocol that leverages Coinjoin and ZKsnark technology. After Tornado Cash was banned an open source developer was arrested, Github code was erased, Tornado Cash Github codebase contributors were suspended, and the project’s Discord server was deleted.

However, the nonprofit that focuses on policy issues facing crypto assets, Coin Center, believes that the US Treasury Department’s Office of Foreign Asset Control (OFAC) has “exceeded its legal authority. ” The Coin Center is researching the validity of the Whirlwind Cash ban and plans to “engage” with OFAC to discuss the matter.

While Uniswap has been updating its TRM Labs-gated front end, there’s likely a whole lot more crypto companies and decentralized finance (defi) protocols following the same measures. For instance, on August 8, Banteg revealed that the Centre Consortium, the stablecoin issuer operated by Circle Financial and Coinbase Global, blacklisted 75,000 USDC that belonged to Tornado Cash users.

“I think this is the first time a pool has been frozen, not an individual account,” Bunteig said at the time.

The issues surrounding Tornado Cash and the precautions taken by defi teams like Uniswap, expose the underlying weakness in so-called ‘decentralized finance’ protocols and whether or not they truly are decentralized.

Even before the US government banned Tornado Cash, Tornado Cash developers blacklisted OFAC-listed Ethereum addresses using the Chainalysis oracle contract. Furthermore, in July 2021, users criticized Uniswap for blocking more than 100 tokens from the main interface.

During both these instances, crypto users discussed how they could simply leverage Tornado Cash code or Uniswap’s smart contracts and mirror sites to bypass these types of restrictions. The fact is that Uniswap is a company registered in the U.S. and the frontend, or website, is owned by the U.S. entity. In time, people may want to clarify that defi web portals are not decentralized, and the only things that could be classified as such would be the smart contracts and code.