The trading session on 8 August was an interesting one for ETH HODLers as the price of the leading altcoin jumped above $1,800 for the first time in two months, data from Santiment revealed.

Over the past 30 days, the ETH network has seen over 546,000 active addresses trade the token daily. Sentiment featured it as the highest rate in the registered daily active address index so far this year.

Fortune has smiled on the leading altcoin

At the beginning of the bull market in July, Ether traded at $1,059. Sharing a close correlation with Bitcoin, the price of ETH surged as the price of the king coin rallied.

During the intraday trading session on August 8, ETH traded above the $1,800 price mark, jumping over 40% over the past month.

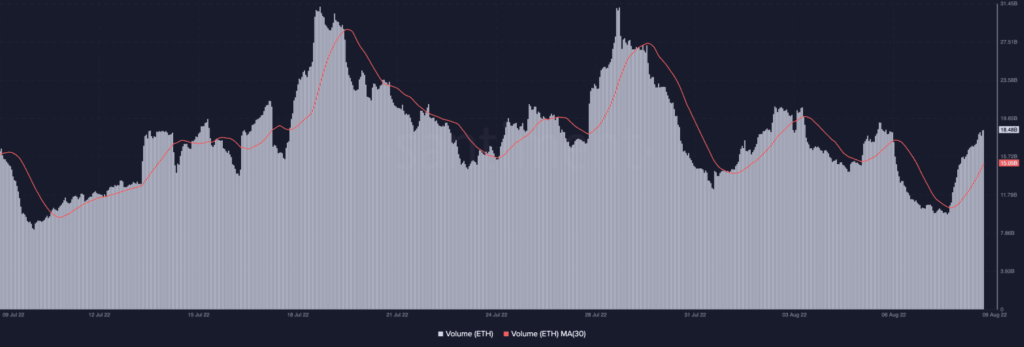

Further, the Ethereum Network has seen over 15 billion in daily trading volume over the last 30 days.

At the time of writing, ETH is trading at $1,771.66 and has registered a 2.39% increase in price over the past 24 hours. According to data from CoinMarketCap, trading volume increased by 69% over the same period.

On a 4-hour chart, a gradual accumulation of ETH coins was underway at press time. The coin’s Relative Strength Index and Money Flow Index were spotted at 63 and 74, respectively.

on-chain analysis

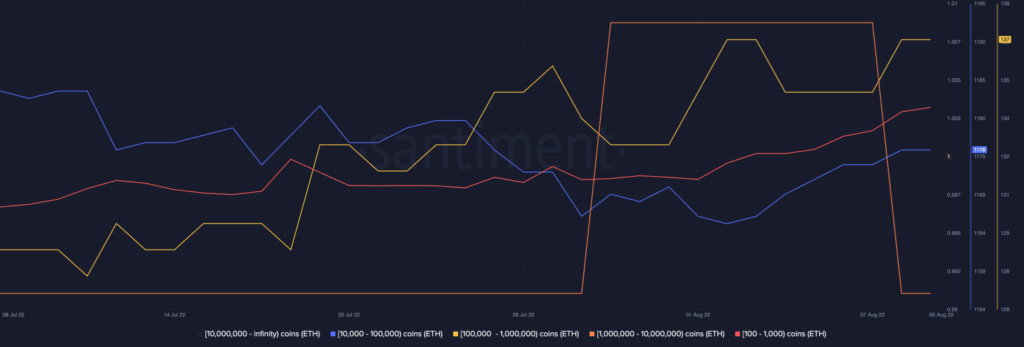

Over the past 30 days, wallet addresses holding between 100 and 1,000 ETH coins have seen a 1% increase in their ETH holdings.

According to data from Glassnode, addresses on the ETH network holding 1k+ ETH coins just clocked a seven-month high of 6,333.

In addition, large whales increased their holdings by 6% between 100,000 and 1,000,000 ETH coins. However, since July 29, holders of 1,000,000 to 10,000,000 ETH coins have reduced their holdings by 14%.

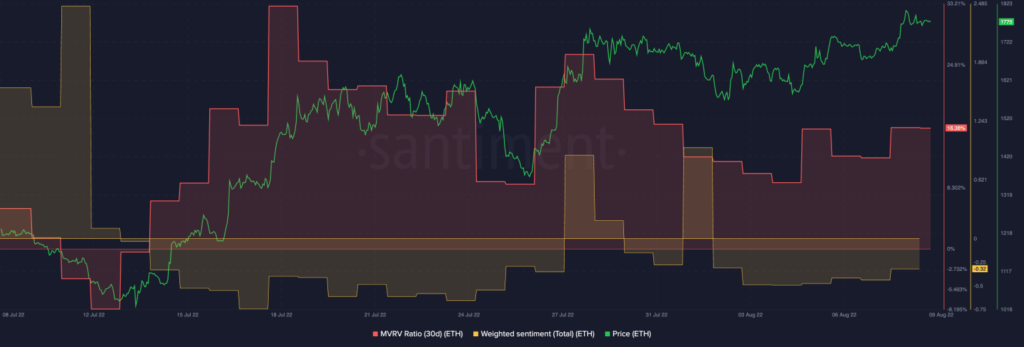

With the last 30 days marked by a jump in the price of the leading altcoin, the 30-day MVRV revealed that many investors have been in profit.

At press time, it stood at +16.36%. Interestingly, the weighted sentiment was negative 0.32 as of this writing.

This showed that some investors still entertained fear even as the general market remained bullish.

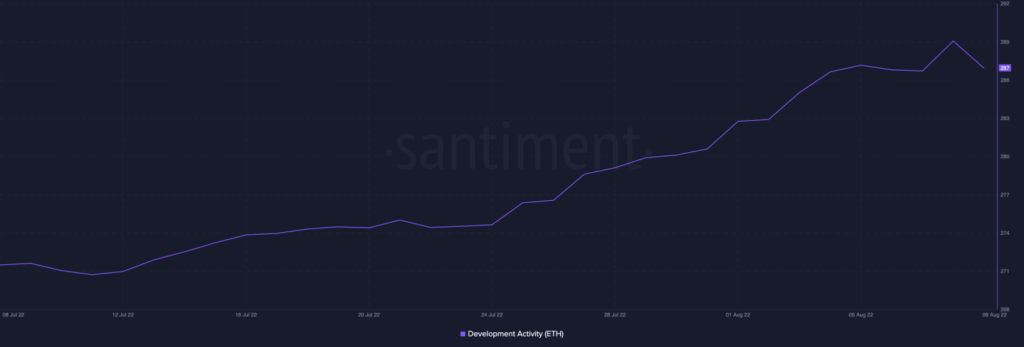

Notably, the development activity of the Ethereum network has seen an increase over the past 30 days, with the Proof of Stake merge taking place in a few weeks.