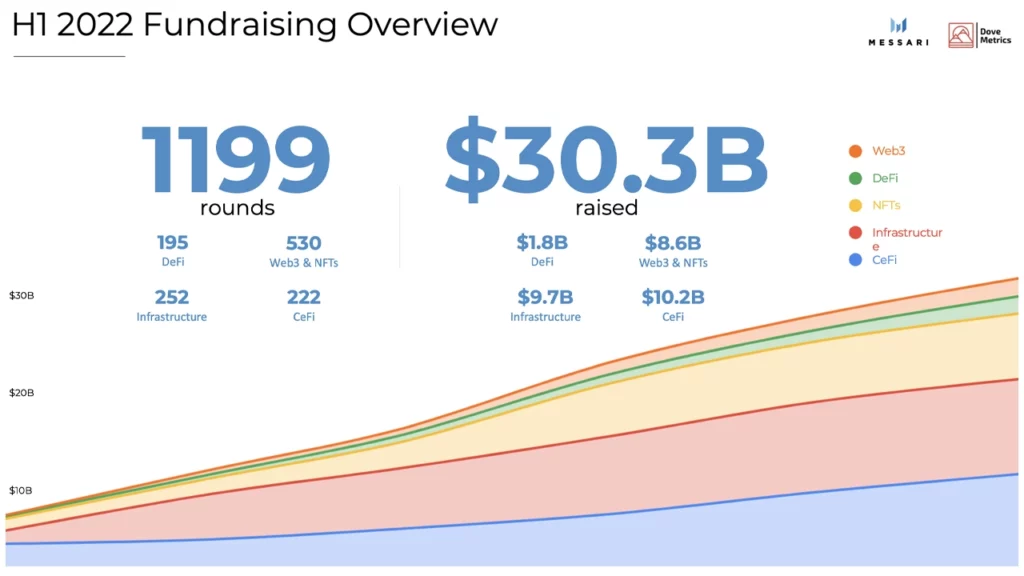

While cryptocurrency markets have seen poor performances during the first two quarters of 2022, a recently published fundraising report authored by Messari researchers notes that $30.3 billion was raised by crypto projects and startups during the first half of 2022. The $30.3 billion raised across 1,199 fundraising rounds surpasses all the funding blockchain startups and projects obtained last year.

H1 Crypto Ecosystem Funding Report Reveals Capital Inflows Continue Despite Crypto Winter

According to the “H1 2022 Fundraising Report” published by Messari and Dove Metrics, a subsidiary of Messari Holding Inc., a significant amount has been injected into specific blockchain projects and startups within the crypto industry. According to the report, centralized finance (cefi) overtook decentralized finance (defi), as cefi captured more than $10.2 billion in H1.

Defi managed to gather $1.8 billion, while Web3 and non-fungible token (NFT) projects and related companies raised $8.6 billion in the first six months of the year. $9.7 billion was injected into blockchain and crypto infrastructure sector and while Web3 and NFTs saw the third largest capital raised, the Web3-NFT sector saw the most fundraising rounds with 530 rounds during the first two quarters.

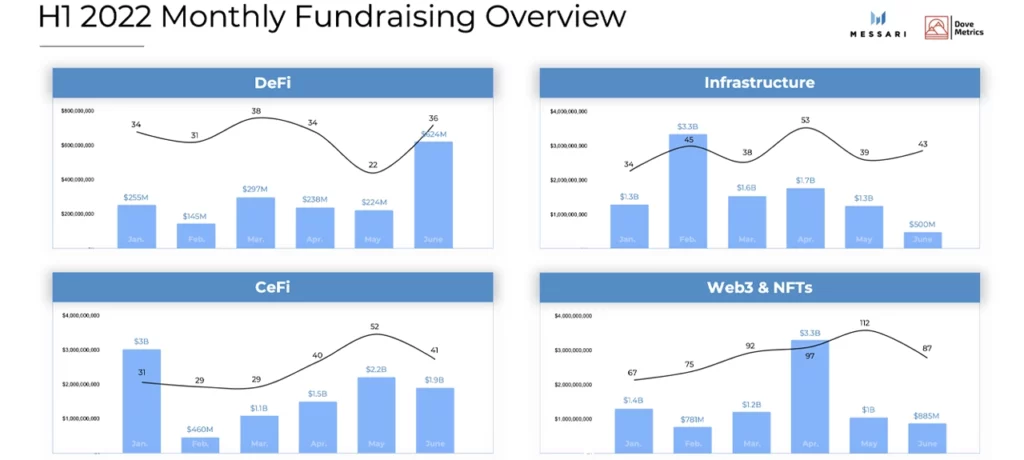

June was DeFi’s biggest month, as several DeFi projects and businesses raised $624 million. “Despite the maturity of the DeFi, the seed round dominates,” the Messari researchers explain in the report. The highest fund during a month for infrastructure was February, the top month for CEFI was January, and the best month for the Web3-NFT sector was April.

Ethereum-based defi projects and startups have received the most rounds and the highest dollar amounts, in comparison to alternative smart contract blockchains like Solana, Avalanche, and Polkadot when it comes to fundraising. Ethereum-based defi projects saw 54 deals in Q1 and 61 deals in Q2. In Q1, Ethereum-based defi projects raised $387 million while projects from alternative blockchains raised $309 million during the first quarter of 2022.

In the second quarter, ETH-based DeFi raised $890 million, while alternative chain-based projects raised about $193 million. The Messari researchers noted that in the Web3-NFT space, early-stage funding eclipsed most NFT funding for roast and gaming. Once again, Ethereum also dominates the Web3-NFT industry in comparison to the alternative smart contract platform network.

Cefi, Infrastructure, Web3 Sectors Mature

As far as centralized finance is concerned, cefi “continues to mature,” Messari’s report says as it highlights that $10 million+ funding rounds “make up 50% of activity.” Messari’s latest H1 fundraising report follows the recently published “4th Annual Global Crypto Hedge Fund Report 2022,” authored by the international professional services firm Pricewaterhousecoopers (PWC).

Insights from PwC’s recent crypto study show that hedge funds investing in cryptocurrency and blockchain projects have increased over the past year. Researchers at PwC estimate that 21% of hedge funds participated in financing rounds involving crypto, while this year’s participation rate is up to 38%.

Messari’s fundraising report details that many sectors are “maturing” as Series A financing rounds or later made up 40%+ of H1’s crypto infrastructure dedicated rounds. Web3’s Series A rounds or later equated to around 30%+ of the fundraising rounds in H1 2022. Investors mentioned in Messari’s fundraising report include companies like FTX, Mechanism Capital, Pantera Capital, Sequoia Capital, Gumi Cryptos, Dragonfly Capital, Slow Ventures, Seven Seven Six, and around a dozen and a half others.