Though June was not in favor of the crypto market, the month of July has pushed the market into a recovery phase. The world’s first cryptocurrency, Bitcoin price which is selling at $23,362 has seen a surge of 20% in the last thirty days.

However, what needs to be taken into account now is the future performance of the bitcoin price and the role of August.

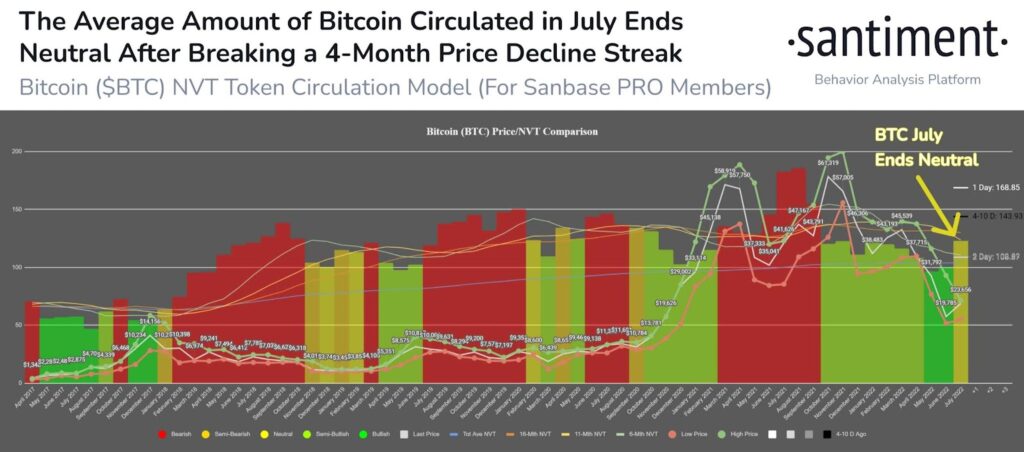

The analytic firm, data reveals that for the month of May & June, the firm’s NVT model bullish approach witnessed a price surge. However, now the indicator is signaling neutral with an increase in price while token’s circulation is seeing a decline. Hence, August could see a move in either direction.

Meanwhile, Mike McGlone, a senior commodity strategist at Bloomberg, claims that the month of July saw a sharp decline in bitcoin’s 100-200 weekly moving average, with signs of recovery. Mike further adds that the risk versus reward is indicating massive bullishness.

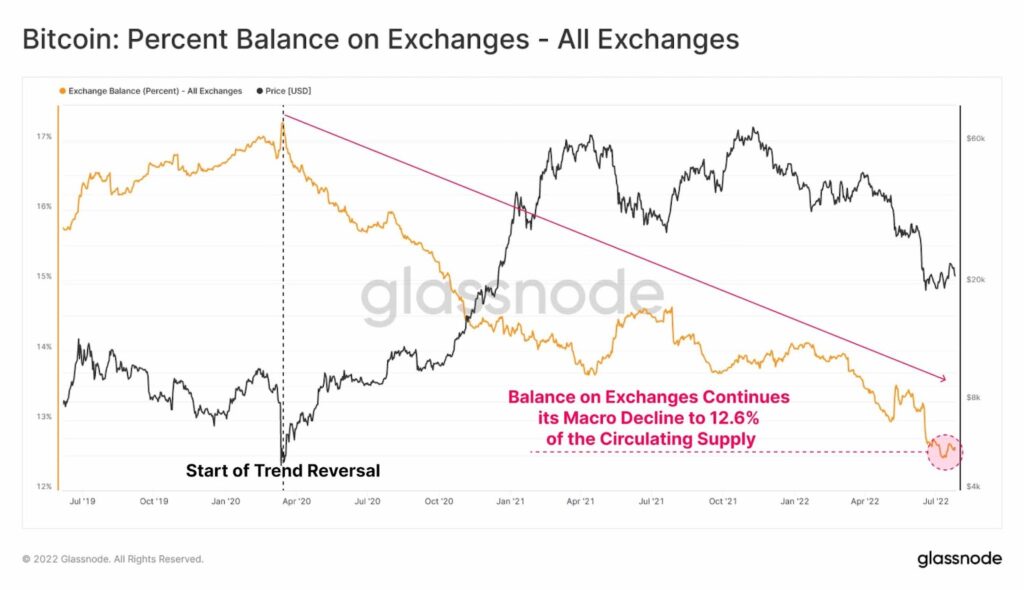

Next, the Glassnode report suggests that on exchanges, the Bitcoin balances are seeing a downfall. The BTC balance has now hit 12.6% of total circulating supply.

Crypto Market to Follow US Equity Market

On the other hand, when looking at the performance of the US equity market, it has done well even during the rate hike by the Federal Reserve. Hence, some well-known market analysts are leaning towards a bullish trend, as the crypto market is expected to follow the US equity market.

Ethereum, on the other hand, has grabbed its $1,500 range and is currently trading at $1,690 with a drop of 0.17% over the last 24hrs. In the last month the currency saw a decline of 60%.

Other altcoins that are trading on a positive trend are XRP, Polygon (MATIC), Solana (SOL) among others.