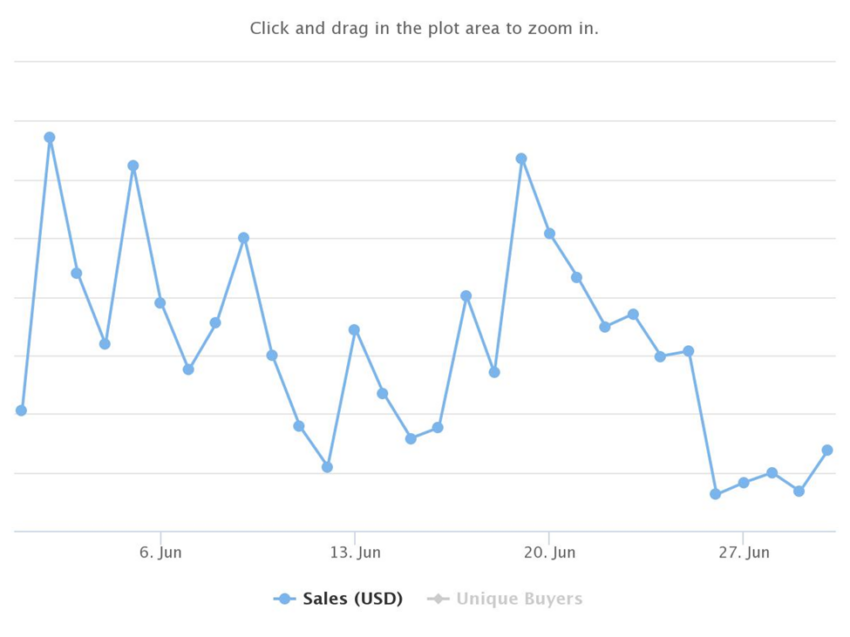

Solana non-fungible token (NFT) sales plummeted during June due to the bearish trends in the digital collectibles market.

Solana is the third best performing blockchain, with a combined NFT sales volume of around $2.48 billion. According Be[In]Crypto research, the channel’s sales volume was around $91.52 million in June.

Despite the plunge, the project had higher monthly sales than WAX, Immutable X, Polygon, Binance Smart Chain, Avalanche, Waves, and Ronin. With that said, it still trailed Ethereum in volume.

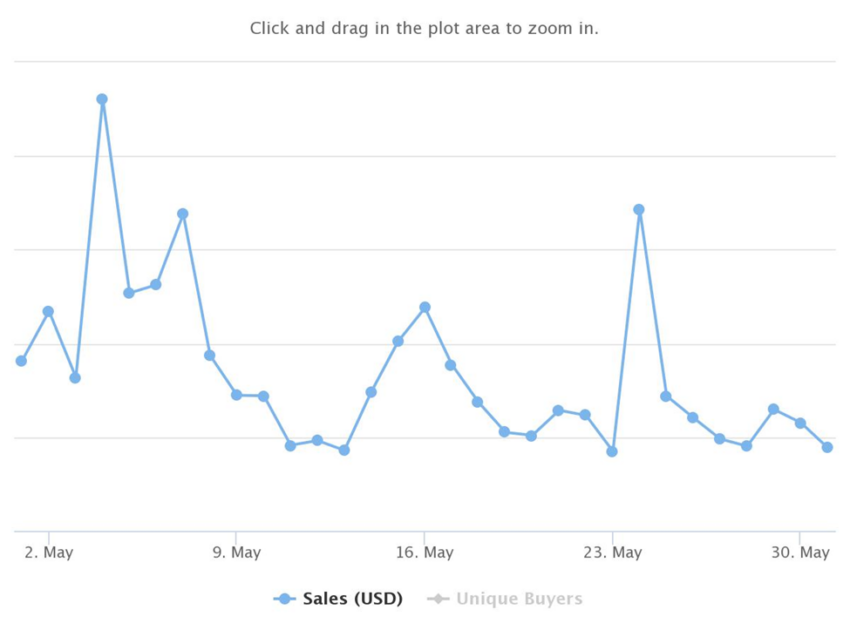

However, the June figure was a 64% drop in sales from May. In May, the volume on the blockchain was $261.07 million.

New to Solana NFTs?

Launched in March 2020, Solana Labs and the Solana Foundation oversee the development of the ecosystem. The blockchain processes at least 3,000 transactions, which come at an average cost of $0.00025 per transaction.

Some of the popular NFTs on the platform include Chainers, Thug Birdz, Meerkat Millionaire Country Club, Frakt, Portals, Solsteads, Cosmic Condos, SolPunks, Blockstars, Akuma no Neko, Family Sol, Transdimensional Fox Federation, Aurory, Degenerate Ape Academy, Rogue Sharks, Infinity Labs, Galactic Geckos Space Garage, Solana Monkey Business, Boryoku Dragonz, and Pesky Penguins.

Why the waning sales?

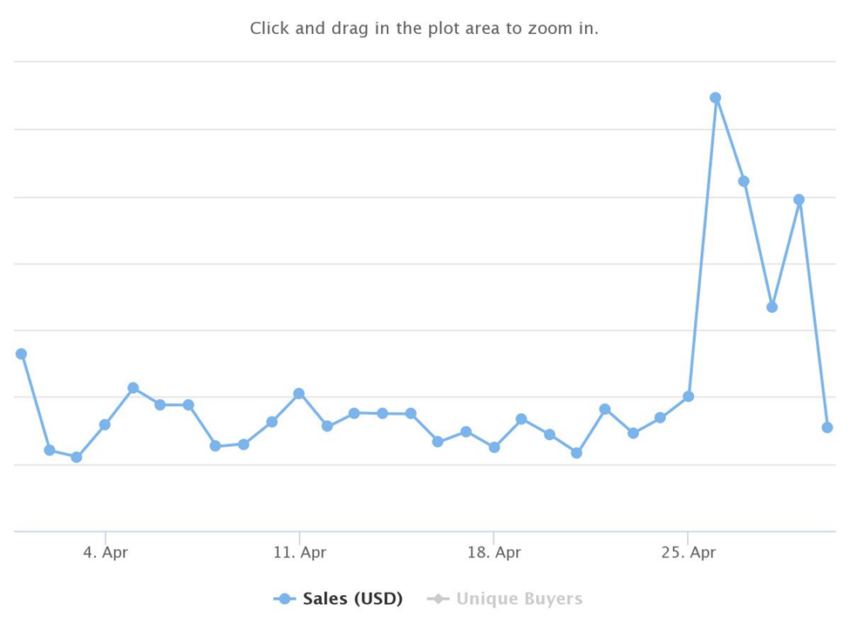

The fall in average sale value was the reason for the sinking NFT sales. Despite reaching an all-time high in monthly sales volume during April, the average sale value in June was much lower.

In June, the average sale value of an NFT was $58.50, down 79% from $387.43 in April.

Volume for April was approximately $311.55 million.

SOL price reaction

SOL opened on June 1, with a trading price of $45.77, reached a monthly high of $45.95, tested a monthly low of $26.06 and closed the month at $33.59. Overall, this equates to a 26% decline between the opening and closing price of SOL in June.