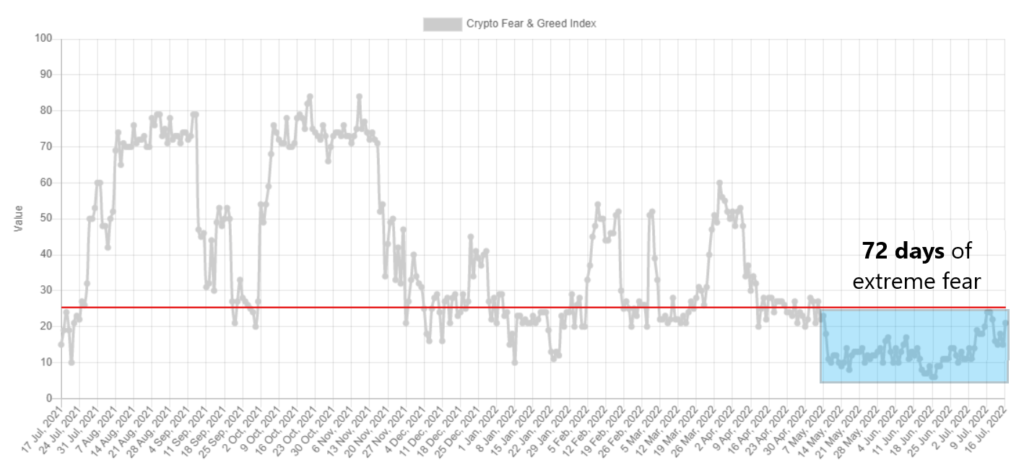

While the Bitcoin market is trying to generate the bottom of the current bear market, the Fear and Greed Index consistently remains in extreme fear. The index has been in a range of extremely negative sentiment for a record 72 days.

The sharp crash in cryptocurrency market sentiment occurred on May 5th. At that time, Bitcoin lost its support at the $38,000 level and broke below the ascending support line (blue). On May 12, it recorded a low of $25,228 and started a consolidation above the next support line.

However, it too failed to hold, leading to an accelerated decline in mid-June. The current low at $17,567 was generated on June 18. The consolidation, which has continued since then, is again following the rising support line.

Fear and Greed Index Breaks Fear Record

The day after the break of the original support line, i.e. on May 6, the fear and greed index fell to a level of 22. This value belongs to the extreme fear in the range 0-25 (zone blue). Since that day, the fear and greed index has been continuously in extreme fear for 72 days.

This situation was noted yesterday by analyst @PositiveCrypto, who published a long-term chart of Bitcoin color-coded according to Fear and Greed Index readings. In the past, based on the data he presented, the index has twice been continuously in a negative fear sentiment.

The first time a similar situation occurred was in the absolute bottom area of the 2018-2019 bear market and lasted for 32 days. The second time this happened was during the March-April 2020 COVID-19 crash, and this time the fear and greed index stayed in the 0-25 range for 50 days. .

In the analyst’s opinion, such a long-lasting extreme fear in the cryptocurrency market may be a signal for a potential trend reversal in the near future. On the one hand, the classic investor maxim seems to favor this opinion: “Be fearful when others are greedy. Be greedy when others are fearful.” But on the other hand, the current macroeconomic situation, rising inflation and interest rates, the specter of recession, and the war in Ukraine continue to generate an environment that is not favorable to high-risk assets such as cryptocurrencies.