Bitcoin, the world’s largest cryptocurrency, could face more losses if this bearish pattern plays out

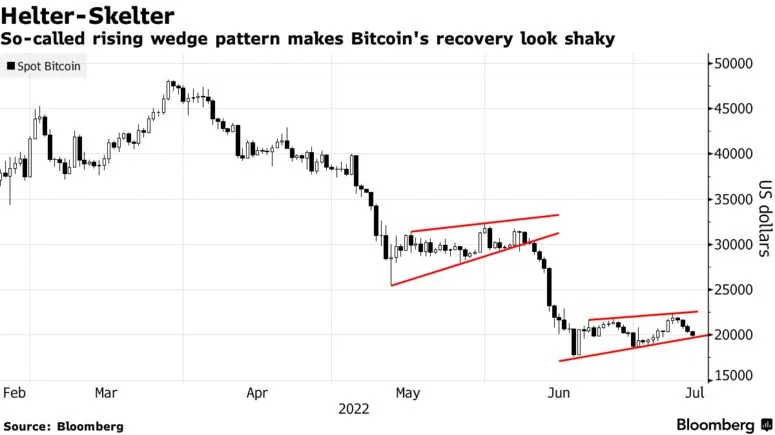

According to a recent report from Bloomberg, a bearish rising wedge pattern indicates that Bitcoin, the world’s largest cryptocurrency, may face further losses.

When the aforementioned pattern is accompanied by declining trading volume, it usually means a continuation of the bearish trend.

Notably, the exact same pattern formed earlier in the second trimester. It was the harbinger of a 40% correction that took Bitcoin down to $17,600 last month. The cryptocurrency’s performance was so atrocious that it actually recorded its worst quarter in over a decade.

After Bitcoin managed to gain some ground last week, the Sunday sell-off threw a wrench in the works for bulls who hoped for an eventual recovery. Earlier today, the flagship cryptocurrency dipped to the $19,600 level.

If the current rising wedge pattern eventually materializes, Bitcoin will likely edge closer to Scott Minerd’s ultra-bearish price target of $8,000. The best crypto would have to exceed another 59% to achieve this goal.

As reported by U.Today, the Bloomberg MLIV Pulse survey showed that Bitcoin was likely to plunge to the $10,000 level, according to the majority of retail and institutional investors. Concerns about the U.S. Federal Reserve’s monetary tightening remain the main reason behind this persistent bearish pressure.

Meanwhile, the former CEO of BitMEX doubled his too-good-to-be-true price prediction by $1 million after the euro nearly hit parity with the dollar. He previously said that the largest cryptocurrency would be able to achieve this goal by 2030.