In its new report titled “State of Ethereum Report — Q2, 2022,” Bankless reviewed the performance of the Ethereum Network and its ecosystem in the second quarter of 2022. It touched upon the network’s performance under four broad categories – Protocol, Decentralized Finance (DeFi), Non-Fungible Tokens (NFTs), and Layer 2.

Before the Ethereum 2.0 merger, here is an overview of the main developments within the Ethereum ecosystem during the previous quarter.

Here’s what the network says

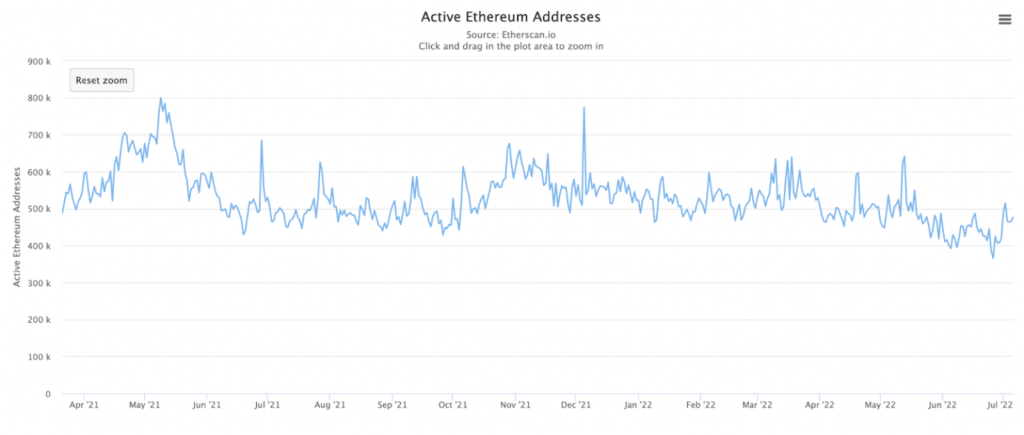

Bankless found that as a result of the downturn of the general crypto-market between April and June, transaction fees paid to use the Ethereum Network saw a 33.4% decline – From $1.91B in Q1 to $1.28B in Q2.

In addition to fueling a drop in network revenues, the bearish context of the last quarter caused the average index of daily active addresses to drop by 20.6%. In the first quarter, that was 593,404.

However, the third quarter so far has been marked by a bullish correction. Hence, an uptick in daily active addresses on the Ethereum Network might be recorded by the end of the quarter.

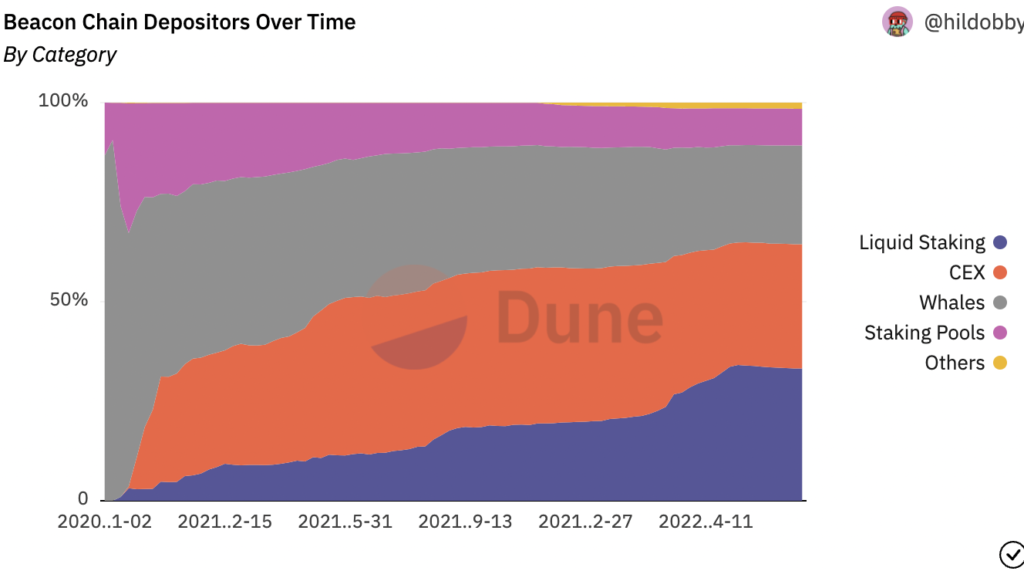

With the planned transition of the Ethereum network from Proof Of Work (PoW) to Proof Of Stake (PoS), Bankless has found that the amount of ETH staked on the Beacon string increased by 116%, from 6.01 million in the first quarter to 12.98 million in the last quarter.

About 0.86% of the total supply of ETH was staked by the end of the second quarter. On 6 July, the network successfully completed its merge on the Sepolia test net. With the merge with the Goerli Network expected in the coming weeks, the final merge with the Ethereum mainnet is expected before the end of the year.

Decentralized finance (DeFi)

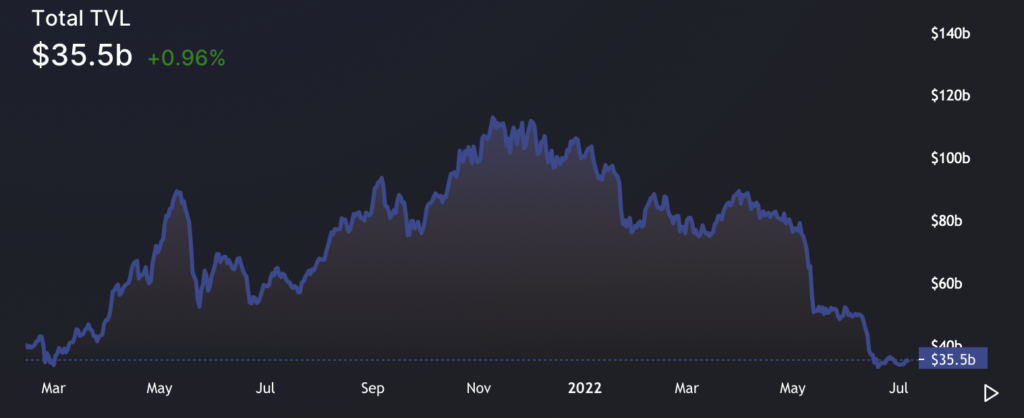

Bankless found that the second quarter of the year was marked by a decline in the total value locked (TVL) of DeFi protocols hosted on the Ethereum network.

Within that period, TVL fell from $59.42 billion in Q1 to $34.21B in Q2 – A 42.4% decline.

Total trading volume on decentralized spot exchanges built on the Ethereum network also saw a decline in the second quarter. Between April and June, this fell 9.0%, from $350.54 billion in the first quarter to $319.13 billion at the end of June.

Finally, Bankless noted that in the last quarter, there was a 177.5% increment in the share of ETH staked. These were staked with non-custodial protocols that issued liquid staking derivatives.