These numbers prove that Ethereum had terrible month (together with rest of crypto market)

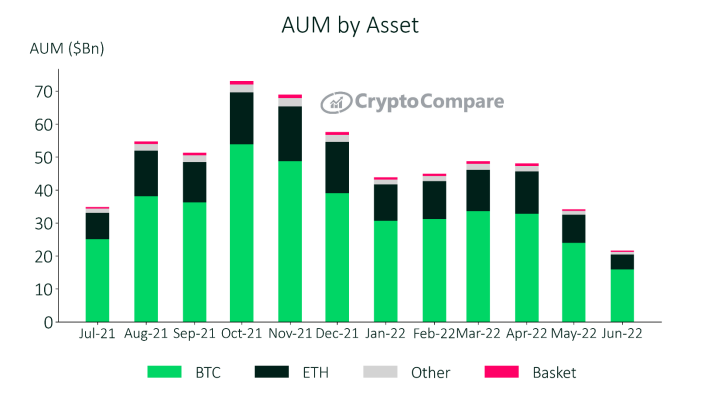

According to a recently published report by cryptocurrency analytics firm CryptoCompare, assets under management for Ethereum investment products plummeted 46.7% in June to $4.54 billion.

For comparison, Bitcoin’s AUM shrunk by roughly 33.6% over the same period of time.

Ethereum recently had its worst quarter ever, plunging 67% since April. On June 18, the price of the second largest cryptocurrency crashed to $881. Meanwhile, Bitcoin recorded its worst quarter since 2011, with its value falling by more than 68%.

Grayscale, the world’s largest crypto asset manager, accounts for more than 77% of the total AUM.

Overall, weekly net outflows recorded a new all-time high average of $188 million, showing that institutional investors have soured on crypto due to rapidly falling prices.

ETF-linked AUM plunged by more than 52% last month due to worsening market conditions.

Meanwhile, Bitcoin shorts profited from the crypto carnage, adding $33.2 million on average per week.

Trading volumes remain relatively steady

In the meantime, trading volume across cryptocurrency investment products fell by 7.16% last month. Grayscale Bitcoin Trust (GBTC) was, as expected, the most traded one, recording $125 million in average daily volume. In fact, GBTC’s trading activity grew more than 18% last month. On the other hand, Grayscale’s Ethereum trust logged a 25% drop in trading volume, failing to buck the trend.

Although the overall decline was relatively modest, digital investment products still saw their lowest trading volume since November 2020.