Ethereum [ETH], the largest altcoin, has HOLDers that have placed their faith in the upcoming Merge to aid the bleeding price. At press time, ETH declined by a staggering 16% as the price dropped to the $1,238 mark. Now, given the delay in this transition, ETH could have a different journey ahead…

Is there light at the end of this dark tunnel?

Ethereum network developers have decided to delay the difficulty bomb, a major step leading up to the highly anticipated Merge upgrade. They set the deadline at two months to “make sure we check all the numbers before selecting an exact rollout deadline and time,” according to lead developer Tim Beiko.

This so-called bomb would make mining profitability plummet to disincentivize miners ahead of the long-awaited Merge. Given this delay, many would portray bearish viewpoints concerning the largest altcoin. But, the scenario here could be a different one by looking at ETH’s network traction growth.

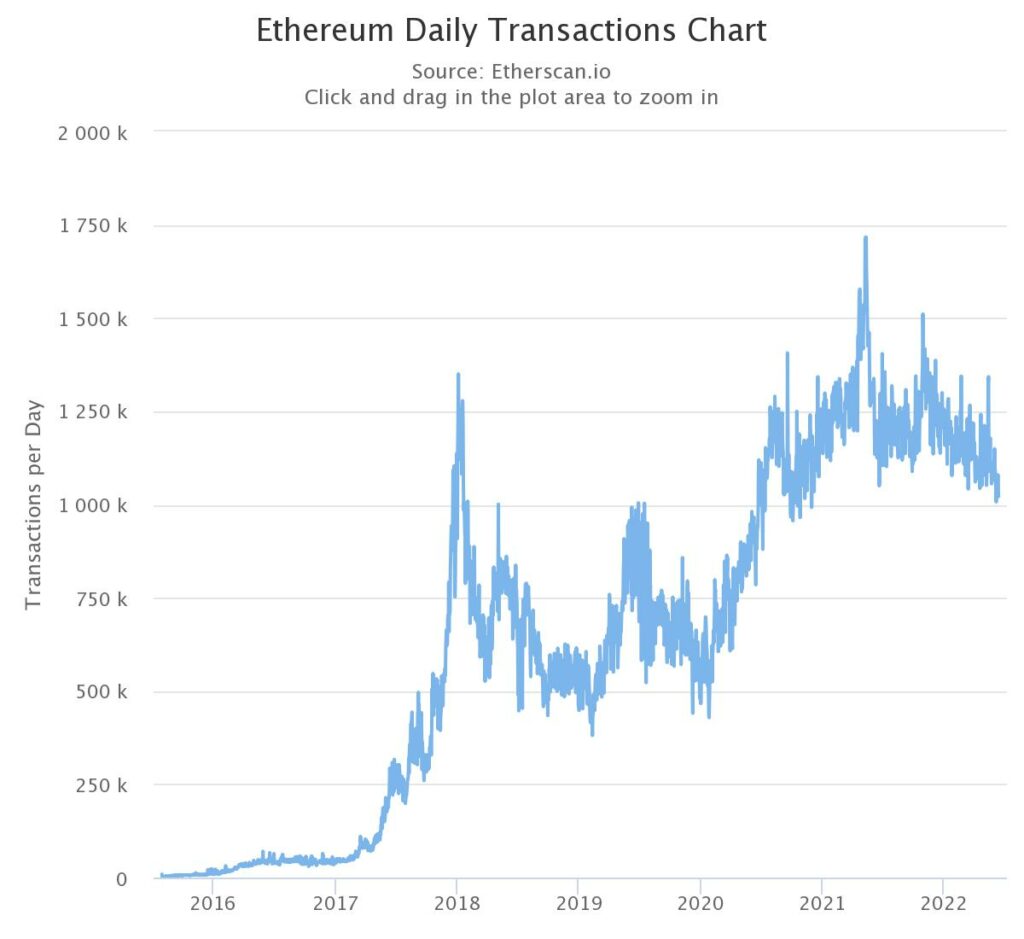

The ETH daily transaction chart, shown below, has been steadily growing in a range of one million to two million in 2022. This could mean that the network has integrated or effectively managed the transaction load.

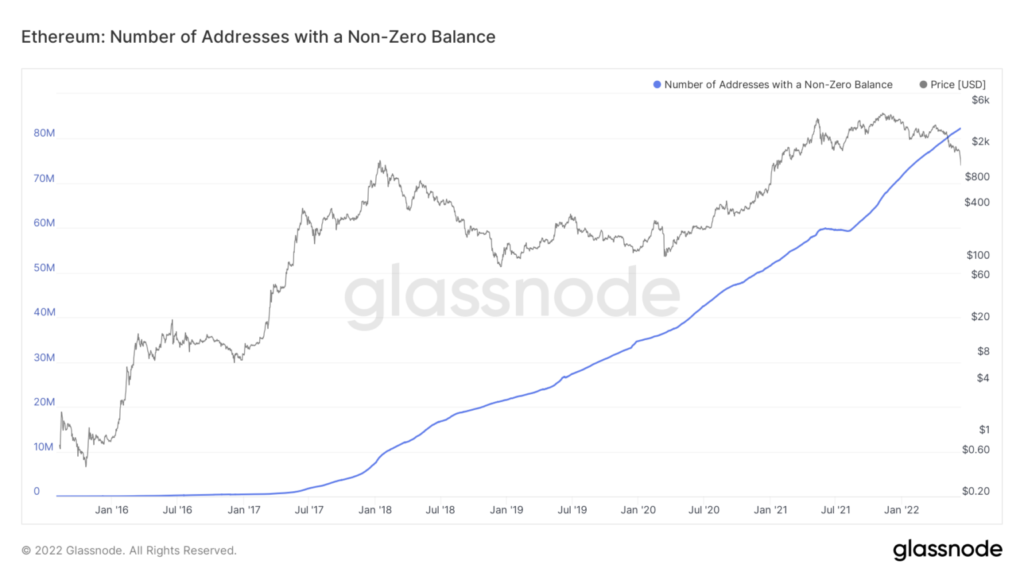

Meanwhile, the number of addresses piling on the network painted a similar picture as well. The number of Ethereum addresses with a non-zero balance has hit a new all-time high—just like it did at this time last year.

There are now 82,151,788 addresses holding some of the second-largest cryptocurrency by market cap, according to blockchain data site Glassnode. On top of that, the anticipation around Merge is still active and existing.

Despite the poor reaction of prices to the first successful merge on the Ropsten testnet, ETH 2.0 staking has been stable. Total deposits to the ETH 2.0 deposit contract rose continuously.

Indeed, indispensable support for the merger and its possible consequences.

Be AWARE!!!

While, the aforementioned developments might act a brief support for the bleeding token, but not for long. Consider this for instance:

Glassnode’s senior on-chain analyst, known as Checkmate, has highlighted a potential decentralized finance (DeFi) disaster that could send Ether’s price crashing further into 2022.

The ratio between Ethereum’s and the top three stablecoins’ market capitalization grew to 80%.

(Ethereum is the platform hosting over $100 billion in leveraged loans and DeFi positions. Most people borrow stablecoins. If the network is worth less than the stablecoins built on it, that means the debt is very high compared to collateral. The risk of cascading is high.)