June is important for two reasons for the crypto market. Firstly it marks the end of the second quarter, and secondly, the end of June will also mark the arrival of the Merge. The highly anticipated event is expected to be a turning point for Ethereum [ETH] and maybe for the ones investing in the token as well.

Let’s go for ETH

Probably not, but the transition to proof-of-stake (PoS) should certainly help Ethereum recover from its recent losses. Apart from what ETH witnessed during the May 9 crash, the king of the altcoin has been on a steep decline since, having lost almost 7.6%.

But, the losses aren’t just limited to the price action. Investors’ behavior has been a contributing factor as well.

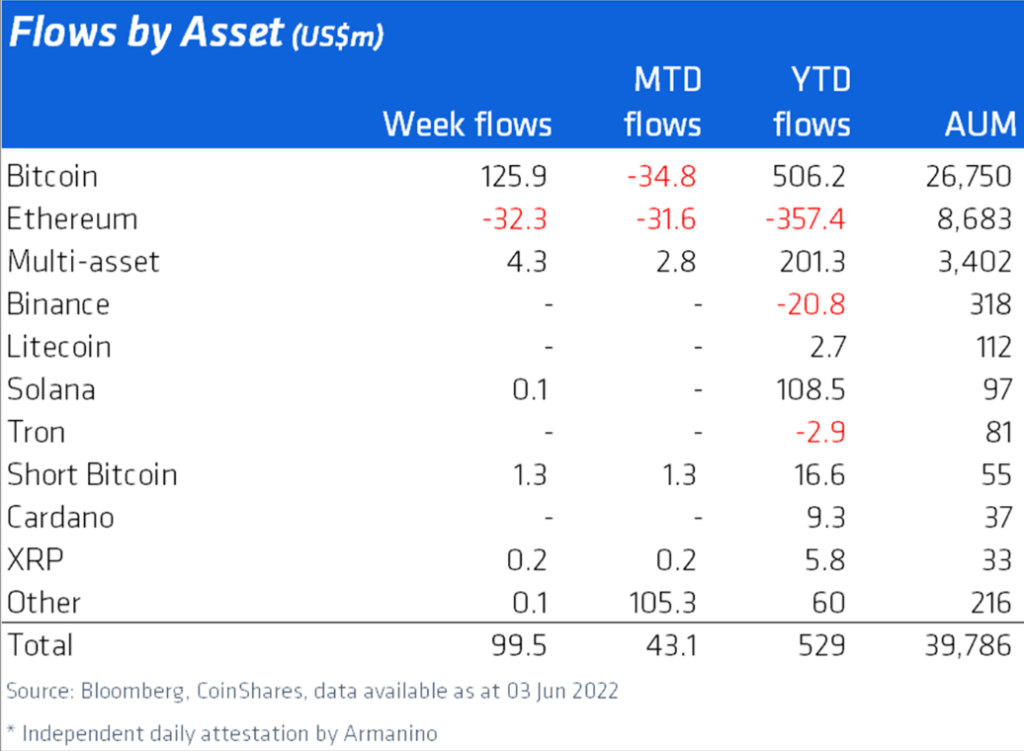

According to institutional feeds, Ethereum has been the worst performing asset, seeing year-to-date outflows worth $357 million. For the week ending June 3, Ethereum again noted that institutions were withdrawing money from the asset to the tune of $32 million.

This is despite the fact that the overall netflows have been positive, exceeding $100 million, led by Bitcoin. A part of the reason behind these consistent outflows is the delays Ethereum experiences pertaining to the aforementioned Merge.

However, now that Ethereum is on the verge of becoming cheaper, faster and more economical, institutions should also invest heavily in the asset. It might also help recover outputs.

Institutions’ investment could act as a morale boost for the long-term holders that have been in a bind for more than a month now.

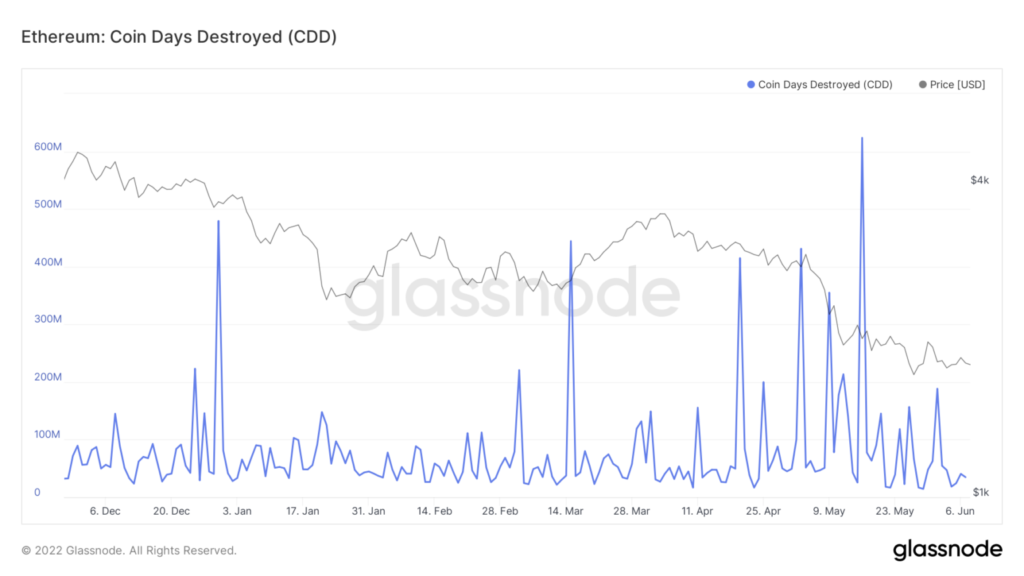

According to the liveliness of Ethereum, investors have been clinging to the idea of accumulation since December 2021, regardless of the price drop. But since April, they have considerably liquidated their positions.

This is also verified by the bouts of selling noted at their end, which on multiple occasions has destroyed as much as 650 million days.

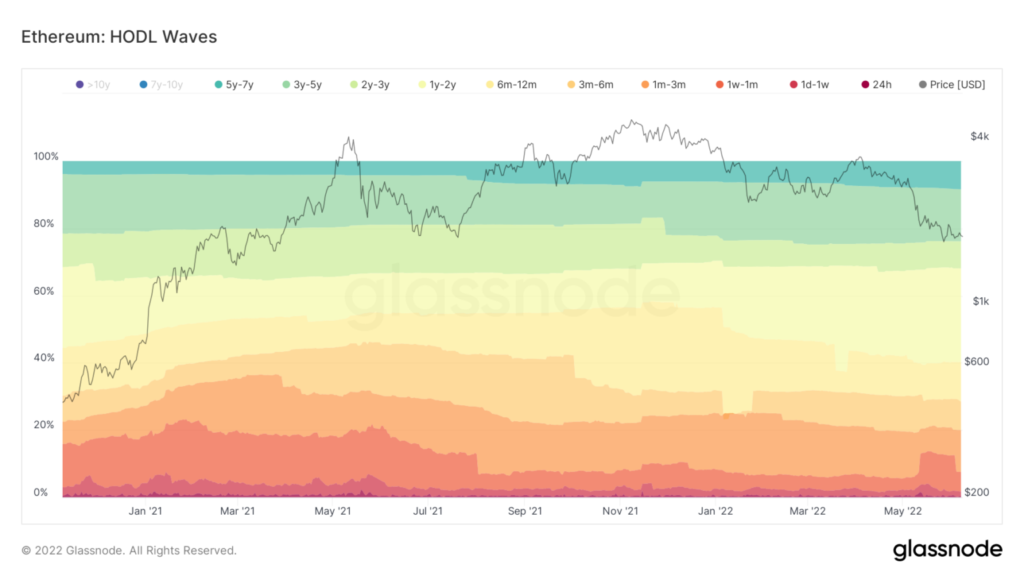

It is critical that LTHs refrain from selling their holdings as those holding ETH, six months to seven years, control around 69% of the supply.

The cohort that bought their holdings approximately one to two years ago has the most domination with 28% supply in their possession. Should they begin selling, Ethereum could be in trouble.

So, going forward, ETH 2.0 is expected to bring changes to encourage LTHs to hold and institutions to invest in Ethereum.