Ethereum funds had an underwhelming week, according to data provided by CoinShares

Ethereum funds saw $11.6 million in outflows last week, according to data provided by cryptocurrency asset manager CoinShares. Its outflows now exceed a quarter of a billion dollars since the start of 2022.

Algorand funds, for comparison, saw a record-breaking $20 million worth of inflows.

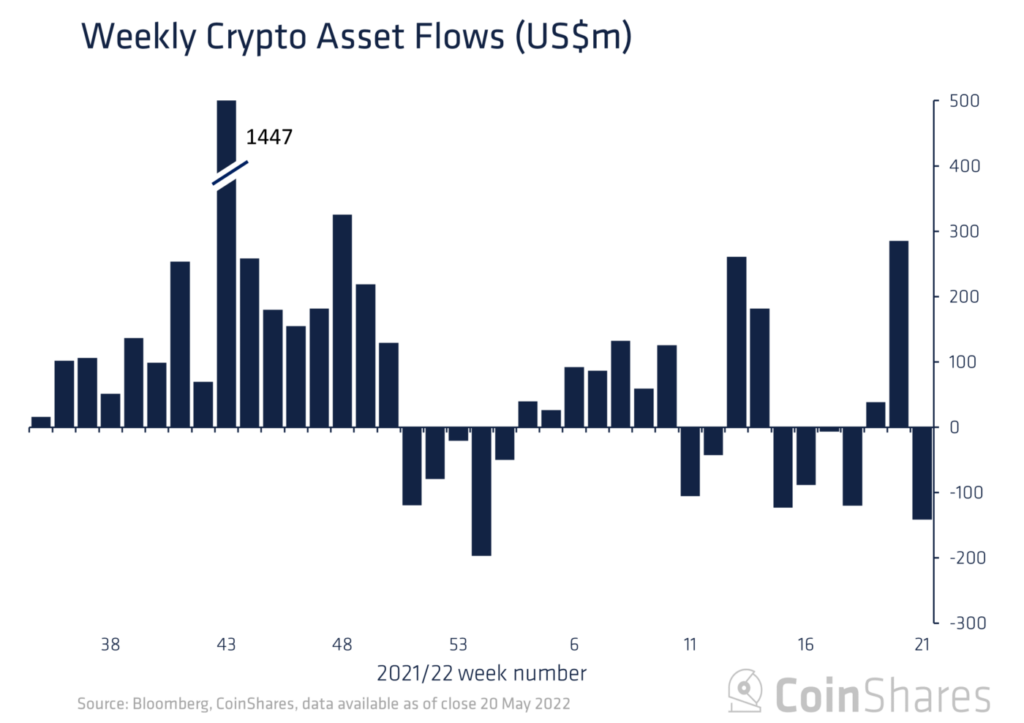

Overall, digital asset investment products attracted $87 million, with bitcoin-centric funds accounting for the vast majority of the sum ($69 million). Last week, cryptocurrency funds saw $141 million in outflows.

North America was far ahead of Europe in terms of total inflows last week ($72 million and $15.5 million, respectively).

Solana comes in third place with $1.8 million thereafter. It is followed by funds that follow Tron and Polkadot ($400,000 and $300,000), respectively.

Due to the recent market correction, total assets under management have now shrunk to the lowest point in almost a year.

Grayscale, the largest cryptocurrency asset manager, has an AUM of $24.5 billion.

Overall, cryptocurrency funds have already attracted $520 billion worth of inflows since the start of this tumultuous year.

Cryptocurrency prices have rebounded significantly this week after a two-month selloff.

The price of Bitcoin is currently sitting just above the $32,000, adding nearly 7% within the last week.

Ether is still in the red last week, but is now on the verge of regaining the psychologically important level of $2,000.

The cryptocurrency market is currently valued at $1.31 trillion, according to CoinMarketCap data.

Considering that Short Bitcoin saw almost $2 million in inflows, the market remains bearish, according to CoinShares.