Ethereum seems to be running low on gas as it edges towards capitulation. Recent weeks have been nothing but a stain on the vision endorsed by Buterin and his team. The altcoin king dropped to a 14-month low over the weekend as it continues to struggle.

“Far from home”

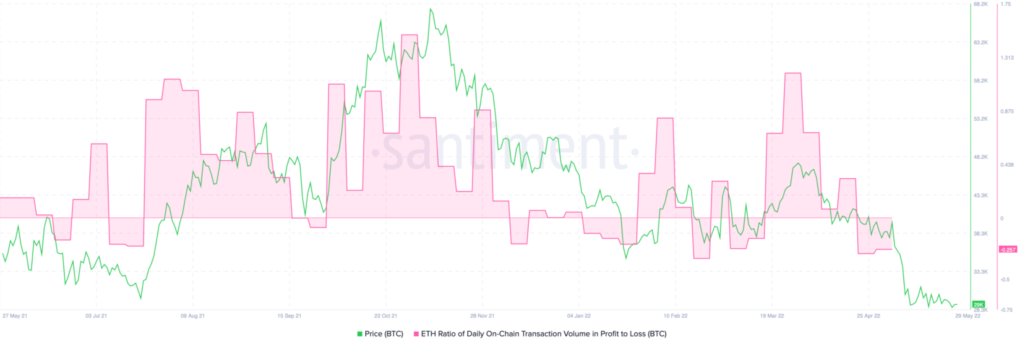

The Ethereum community was puzzled after learning that ETH dropped to $1,724 over the weekend. This is its lowest value in the last 14 months, which only adds to the decline seen in recent months. A Heart Tweeter recently discussed that Ethereum is showing a “significantly low” profit-to-loss ratio over the weekend. The new 14-month low can be attributed to these low returns on ETH transactions.

But this is how it’s been for Ethereum recently. It has been down 10% this week alone as it has fluctuated between the $1700 to $1850 range. The metrics are also suggestive of the downfalls of the network.

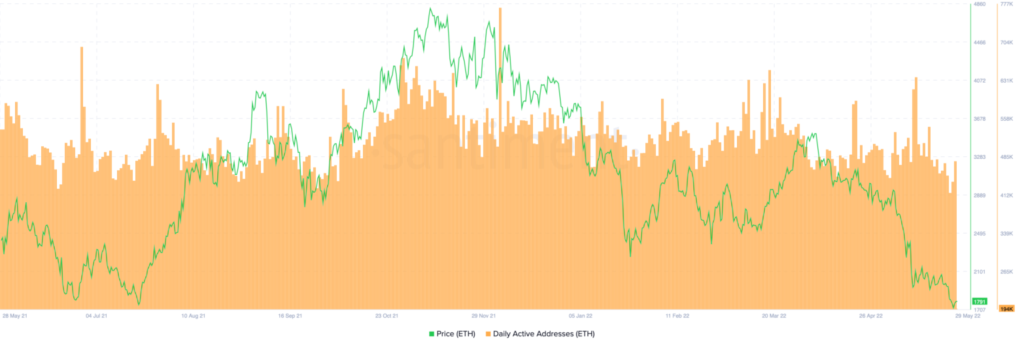

Daily active address data shows worrying signs for the Ethereum community. This metric reached a monthly high of around 650,000 active addresses at the height of Terra’s collapse. The sudden surge is attributed to depressed ETH prices and market volatility causing panic among investors. Daily active addresses are currently averaging 450,000 this week.

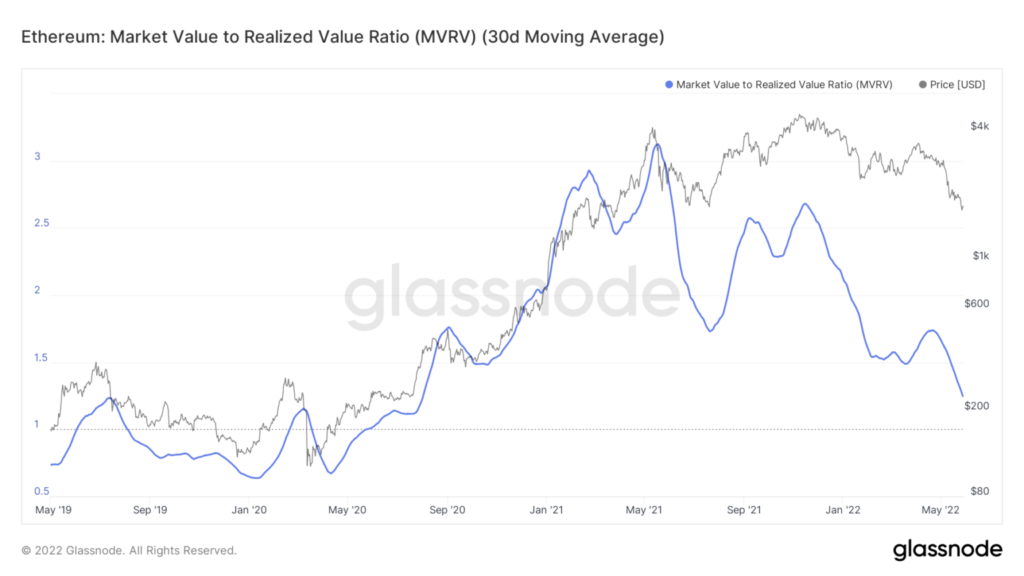

Another metric is signaling a bearish patch for Ethereum. The MVRV Ratio (30 days) is currently stuck at 1.24 after poor performance in recent months. This is the lowest value for the index since early- August 2020. This often means that investors are holding large unrealized losses which is the case here as briefed above.

We can now move on to the whaling business which turns out to be the last straw for investors. As shown in the table below by Saniment, the whales had been actively accumulating during previous price falls and were emptying accordingly. Despite recent downturns, there has been limited accumulation among major ETH “stakeholders”.

HODLers continue to double down

In a weekly update by Lucas Outumuro, he shed light on the ETH HODLer addresses during recent selloffs. According to Outumuro, IntoTheBlock’s Head of research, addresses holding Ethereum for more than a year have managed to acquire more than 50% of ETH in circulation.

The HODLers balances moved inversely to the price action. They had been decreasing their balances since September 2021, but started accumulating in January 2022. Since then, the balance of HODLers has increased after each big crash, reaching over 50% of the entire circulating supply for the first time since 2020.

Most of their recent accumulation came during Ethereum’s price struggles as it continues to struggle below $1,800. But the HODLers are keeping a long term perspective on their assets despite the recent market struggles.