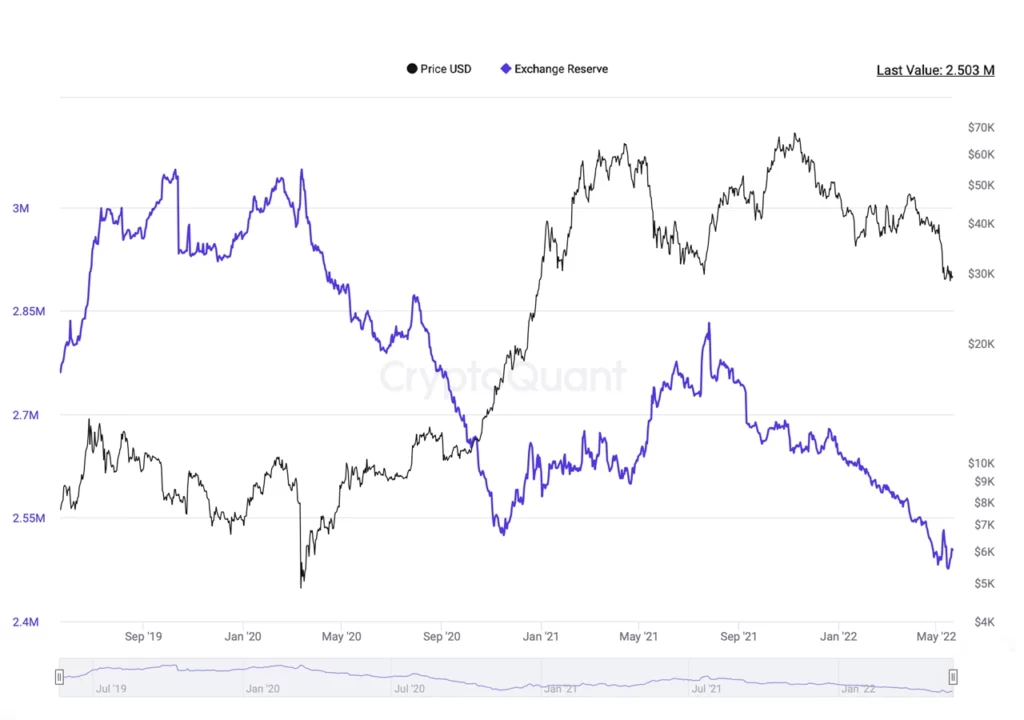

Amid the market carnage tied to Terra’s recent fallout, bitcoin sent to exchanges saw a brief spike on May 7, jumping more than 2% higher from 2.481 million to 2.532 million bitcoin. Despite the recent increase of bitcoin sent to trading platforms, the number of bitcoins on exchanges today remains lower than ever before.

Bitcoin continues to be removed from exchanges

Bitcoin (BTC) continues to be pulled from centralized cryptocurrency exchanges as the number is well below lows seen on November 15, 2020. 248 days earlier, March 12, 2020, the day after the infamous “Black Thursday,” there were just over 3 million bitcoins held on centralized digital currency trading platforms.

During the course of that time frame, the number of BTC held on exchanges dropped 15.86% on March 12 from 3 million BTC to 2.524 BTC on November 15, 2020. In more recent times, the number of BTC held on exchanges has been lower and in May the metric hit two significant lows.

On May 2, 2022, data from cryptoquant.com shows that there were 2.481 million BTC held on exchanges. The 2.481 million bitcoin was 1.70% lower than the number of BTC held on November 15, 2020. However, amid the fallout from the Terra blockchain and the terrausd (UST) unpeg event, there was a brief spike in BTC deposits sent to exchanges.

After the low on May 2, there was a 2% increase in BTC deposits sent to centralized crypto exchanges. But that metric changed real quick as the 2.532 million bitcoin high on May 7, dropped over the course of the following week down 2.21% lower to 2.476 million BTC.

Of the $73 billion in bitcoins held on trading platforms, 5 exchanges hold over $50 billion

At the time of writing, 2.503 million bitcoins worth $73.7 billion are held on digital currency trading platforms. Data provided by Bituniverse’s Exchange Transparent Balance Rank (ETBR) indicates that Coinbase owns approximately 34% of bitcoin held on the exchanges. The ETBR listing shows that Coinbase holds 853,530 bitcoins on the trading platform, which is valued at around $25.14 billion using current BTC exchange rates.

13.58% of the 2.503 million bitcoin kept on exchanges is held by Binance. Binance is the second-largest exchange, in terms of BTC holdings, as it currently controls a stash of 340,410 BTC worth roughly $10 billion.

Okex ranks third in terms of BTC holdings, as the company currently holds 266,530 BTC, or 10.62% of the aggregated total. Huobi Global now ranks fourth in size, with 160,950 bitcoins held on the platform. Huobi’s BTC reserve is equivalent to 6.39% of all 2.503 million bitcoins held by the exchanges.

The crypto exchange Kraken is the fifth largest BTC holder with 102,900 bitcoin held or 4.07%. Between the top five exchanges, as far as BTC reserves held is concerned, the group of trading platforms holds 68.66% of the 2.503 million bitcoin.

The five exchanges order 1.724 million BTC worth $50.7 billion out of a total of 2.503 million worth $73.7 billion. Although there is far less BTC held on exchanges, the number of bitcoins held by these trading platforms is largely concentrated in Coinbase, Binance, Okex, Huobi, and Kraken.