On-chain signals are showing bullish indications for the largest meme cryptocurrency

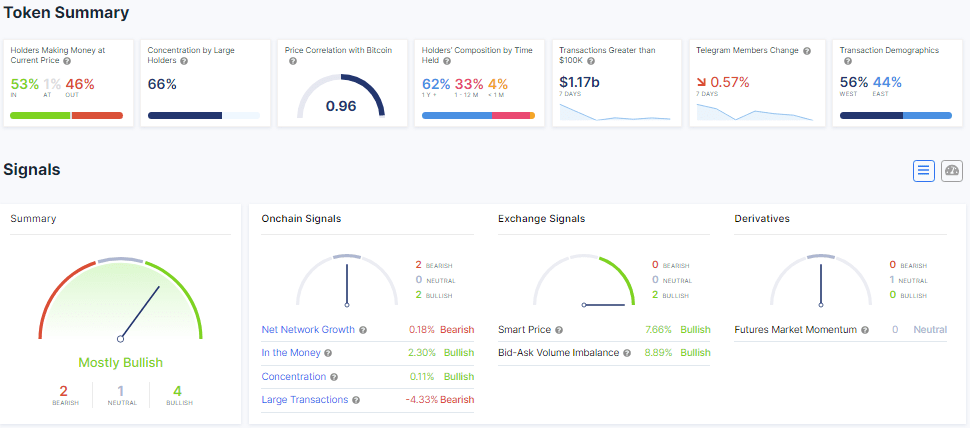

According to data from IntoTheBlock, the profitability of the biggest meme cryptocurrency, Dogecoin (DOGE), increased slightly to 53%, after falling below 50% following the price decline at the beginning of the month. may. Additionally, on-chain signals show bullish indications for the largest cryptocurrency even following the latest surge in profitability and holder concentration.

Per IntoTheBlock’s holders’ composition by time held, Dogecoin “hodlers,” referring to addresses that have held Dogecoin for more than a year, is presently 62%. Presently, 33% of addresses have held the asset for a year, while 4% have held onto their assets for barely less than a month.

With the bulk of Dogecoin holders being medium to long-term holders, this might suggest that Dogecoin may have come under buying pressure from this class.

Dogecoin recent developments

TAG Heuer, a Swiss luxury watchmaker, has announced that it is now accepting cryptocurrencies, “Dogecoin inclusive,” as payment through a partnership with BitPay, according to a press release. TAG allows customers up to $10,000 per transaction, with no minimum spending requirements for cryptocurrencies.

Earlier in the week, stock trading platform Robinhood said its new “Robinhood 3” non-custodial wallet would allow users to hold the keys to their crypto, earn yield, and trade or trade coins. crypto, including non-fungible tokens, without paying network fees. .

This might mean Dogecoin owners on Robinhood will soon be able to trade or swap Dogecoin with no network costs.

Dogecoin remains one of the top 10 holdings for the first 4,000 BSC Whales who are currently “hoarding” $28,396,426 of DOGE.

At the time of publication, Dogecoin was trading down 1.83% at $0.084.