Ethereum’s drop below $2,000 sets it up for massive plunge, according to John Roque

According to the latest Bloomberg article, John Roque of 22V Research estimates that Ethereum could drop to $420, which would represent an 80% loss from the current price, and here’s why.

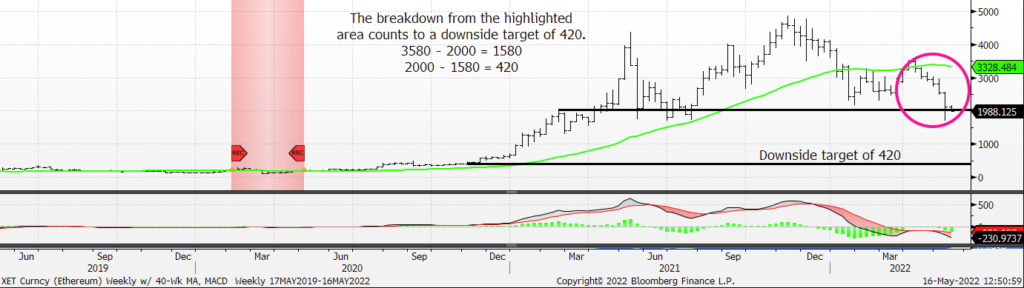

The trader believes that Ethereum, which is currently trading at around $2,000, is in the process of a breakdown from the support zone and will most likely plunge to $420. Roque highlighted a range in which $3,580 is considered the height of the range and $2,000 is the bottom.

With Ether falling below $2,000, it no longer remains within the range mentioned above; hence, will start falling to the next major chart support at around $420.

As the second biggest cryptocurrency is losing a major portion of its value so rapidly, it obviously falls below all moving averages, including the 50-,100- and 200-day lines. The downward movement of the above-mentioned indicators is a considerably bearish factor for any type of asset.

Roque also adds that Ethereum is oversold on both weekly and daily charts, which is why it cannot rally in the near future.

How bad is that really?

While the analyst suggests it’s pretty much “over” for Ethereum, we can still see major support points for the second largest cryptocurrency in the market. The weekly chart, for example, offers 200-week average support, which traders have yet to test.

On the monthly chart, which also looks bearish according to Roque’s analysis, ETH has not even touched the 50-month average, which will act as a strong support in case of Ether’s plunge to $420.

While bold predictions appeal to a certain type of trader, volatility in the cryptocurrency market can sometimes interfere with any type of long-term prediction.