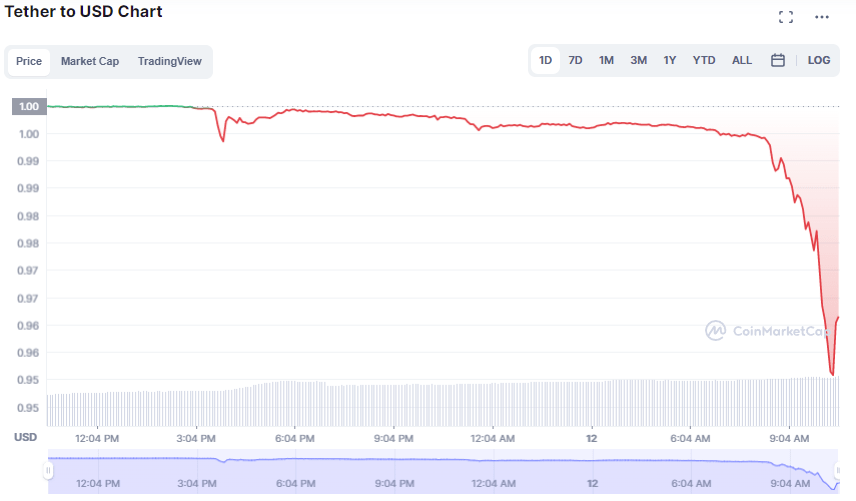

Tether is being pushed down heavily as the panic on the crypto market aggravates

Following the turmoil in the cryptocurrency market and the de-peg of the UST stablecoin – which caused most digital assets to drop – Tether also had problems with the USD peg as its price fell below 0 $.97.

Is Tether mimicking UST’s faith?

Following the news of the price drop of USDT, users started manically moving their funds away from the stablecoin and sending them to more centralized solutions like USDC. According to orderbooks on various exchanges, investors are ready to sell their USDT with an 8% discount.

But the panic around the largest stablecoin in the cryptocurrency market is purely speculative and psychological as Tether’s reserves are at a significantly higher level compared to UST, which was backed by two extremely volatile assets like Bitcoin and Luna.

According to Tether’s official website, its stablecoins are backed with actual cash or its equivalents and short-term deposits. Only 6.3% of Tether’s backing are digital assets marked as “other investments.”

But despite the stable’s diverse support, industry experts still had plenty of questions about “trade papers” which could essentially be anything, including loans to foreign developers, which is illegal in some jurisdictions.

Not the first run for Tether

Despite remaining the biggest stable asset on the cryptocurrency market, USDT had issues during high volatility periods on the cryptocurrency market. According to CoinMarketCap, on April 23, 2017, USDT had a brief drop to $0.97 and then failed to recover immediately.

It took more than a week for Tether to rally above $1, which will most likely be during this selloff. At press time, Tether remains at $0.96, while the UST peg had been completely lost as it trades at $0.5.