In recent times, cryptocurrencies that burn tokens have been very popular and a number of well known blockchain projects have destroyed large sums of digital assets. While a number of crypto projects have different burn schemes, the overall effect is usually the same, as destroying tokens reduces the circulating supply.

Blockchain projects burn tokens for specific benefits and purposes

Token burning has been a popular trend and articles often highlight specific projects like Ethereum, Terra, Shiba Inu and many others that have destroyed large amounts of native tokens.

Six days ago, Bitcoin.com News reported on the Shiba Inu (SHIB) developers launching a burn portal, which allows shiba inu holders to burn their stash of SHIB. In that particular case, SHIB burners are rewarded for destroying their tokens. SHIB currently has a burn rate of around 180.18% during the past 24 hours.

During the first week of November 2021, the Terra (LUNA) developer team burned 88.7 million LUNA and projects like Ethereum (ETH) are burning native tokens every minute of the day. For example, after the implementation of Ethereum Improvement Proposal (EIP) 1559, over 2.17 million Ether was destroyed forever.

Just like SHIB, Ethereum has a burn rate as well, as metrics show over the last 60 minutes, 135 ether was burned, and during the last 24 hours, 4,477 ETH has been destroyed. The Binance digital asset BNB has a scheduled burn process and the project has destroyed coins to reduce the overall supply.

Burning crypto simply means sending tokens to a null address

The process has been leveraged by a number of cryptocurrency network developers and the community has grown attached to the process. Burning tokens, however, does not mean that the tokens are literally engulfed in flames.

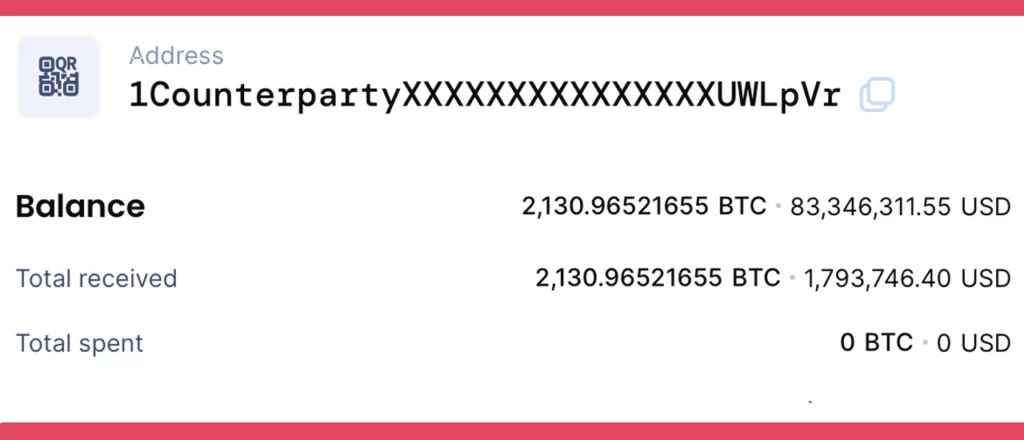

Most projects burn tokens by simply sending the digital currencies to a dead address. The address is simply a black hole of funds as no one has the private keys to the addresses used in the destruction process, which is simply sending coins to the null address.

Once the tokens are sent to the null address, the coins are unrecoverable and will never be used again. Digital currency burning systems have been around for years and the Counterparty project is one of the oldest to deploy the idea of the burning mechanism.

Counterparty’s Proof-of-Burn

In fact, Counterparty burned bitcoin (BTC) to bootstrap the project. “All XCP that will ever exist were given out proportionally to those who recognized Counterparty’s value and were ready to “burn” their bitcoins to participate in Counterparty,” the project explains in a blog post about the proof-of-burn process.

Token burning has a number of advantages, and some algorithmic stablecoin protocols leverage the burning process to distribute stablecoin assets autonomously. While Counterparty used proof of burn to start XCP, most blockchain projects burn coins to reduce the overall supply of the token.

In a way, burning tokens is similar to a share buyback in traditional equity markets. Removing coins from the circulating supply makes the crypto asset scarce and the scarcity aims to make the rest of the coins in circulation more valuable.