Renowned crypto analyst and Bitcoiner (BTC) Willy Woo unveils why BTC might be undervalued

Today, April 20, 2022, the price of Bitcoin (BTC) managed to bounce above $42,000. At the same time, digital gold still has room for growth, according to Willy Woo’s Highly Liquid Supply Shock indicator.

What supply shocks can say about Bitcoin (BTC) price

Top-tier Bitcoin (BTC) researcher and analyst Willy Woo has taken to Twitter to share bullish forecast on mid-term price dynamics for digital gold.

Such a statement was made based on the Highly Liquid Supply Shock indicator, which is a version of Mr. Woo’s Supply Shock metric. The supply shock is the ratio between the unavailable supply and the available supply of a particular asset.

Regarding Bitcoin (BTC), Mr. Woo describes the Highly Liquid Supply Shock indicator as the ratio between the number of coins held by long-term holders and short-term speculators.

Historically, the price of Bitcoin (BTC) shows a strong correlation with the momentum of the Supply Shock indicator, Woo adds:

At first glance you can see the Supply Shock model tracks price quite closely. A closer look shows Supply Shock leads price.

Psychologically, Bitcoin (BTC) supply shock indicators demonstrate investor sentiment: once coins are bought/sold, they migrate from “illiquid supply” to “liquid supply”.

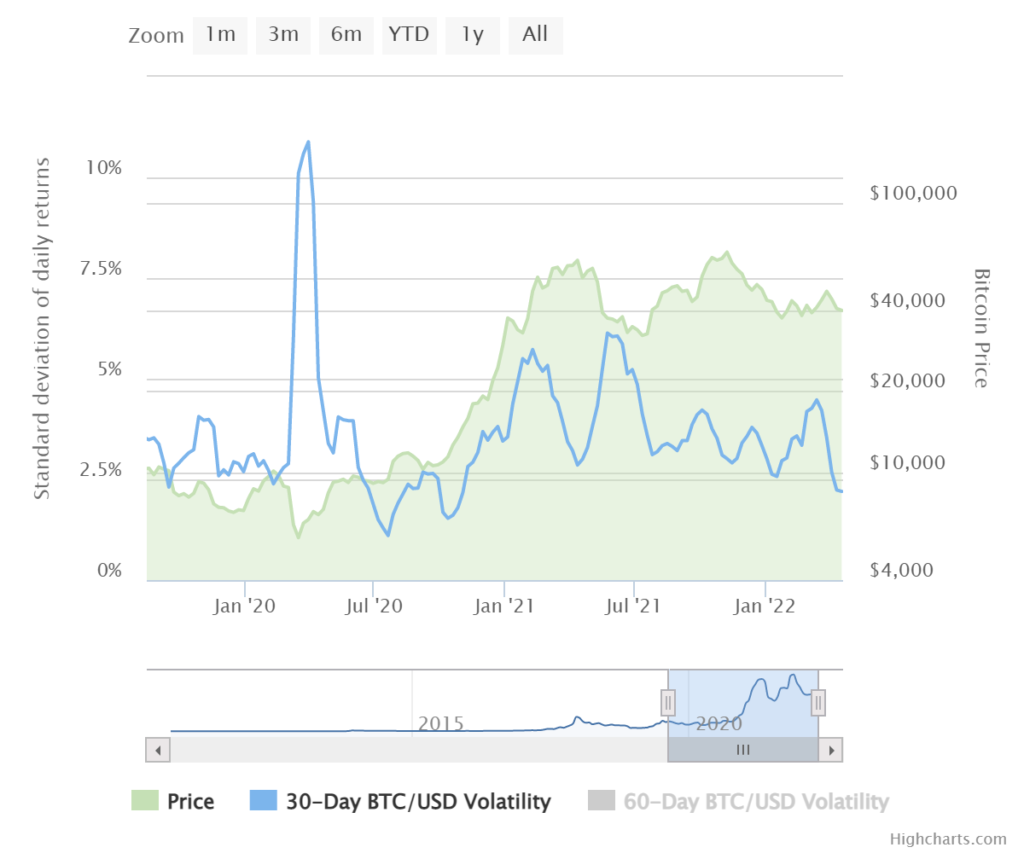

Bitcoin (BTC) volatility targets 17-month lows

Such a promising price action is accompanied with the record-breaking dropdown of Bitcoin (BTC) volatility.

The standard deviation of daily returns (i.e. the amount of Bitcoin added or lost in 24 hours) fell below 2.5% on the 30-day average chart for the first time since mid- November 2020.

The last time that Bitcoin 30-day price volatility was at today’s lows, the orange coin was worth $11,000.