The bears took control of the crypto market last week and were able to push the ETH price down 12% since reaching its weekly high above $3500.

The DXY Index rises and news from China regarding COVID19 cases has rekindled fear in the market. The big question is, are we waiting for the lower levels – below $3,000 – and is the March bull market over?

The Daily Chart

In this analysis, we examine the trend using the Volume Delta and Taker Buy/Sell Ratio index, which is related to the order book of derivatives exchange.

On the daily time frame, ETH is very close to the key support level at $2800-$3000 (marked in green), which showed an excellent zone for a potential trend reversal.

As we can see in the following chart, the recent uptrend has been accompanied by an increase in the strength of buyer takers (marked yellow line) and an increase in volume delta (yellow rectangle).

This shows that rising prices are formed when buyers are more greedy and aggressive than sellers. On the other hand, the downtrend has increased the strength of the taking sellers (marked in blue). However, it still does not show a rising sign on the charts. We have to wait and see if the eager buyers re-enter the market at the key support mentioned above.

If ETH goes below this key level, we can expect the bloodbath to expand. Until then, it is better, as we said in the previous analysis, to avoid emotional decisions and act more cautiously.

Moving average levels

MA20: $3277

MA50: $2941

MA100: $2967

MA200: $3489

The 4-Hour Chart

On the 4-hour timeframe, ETH failed to break the MA100 (marked blue) after two attempts, and the price has dropped to MA200 (marked white). Currently, the bulls are trying to hold it. The RSI 14-day indicator is also close to the oversold zone.

As mentioned in the analysis above, the most important thing now is to hold the support at $2,800-$3,000.

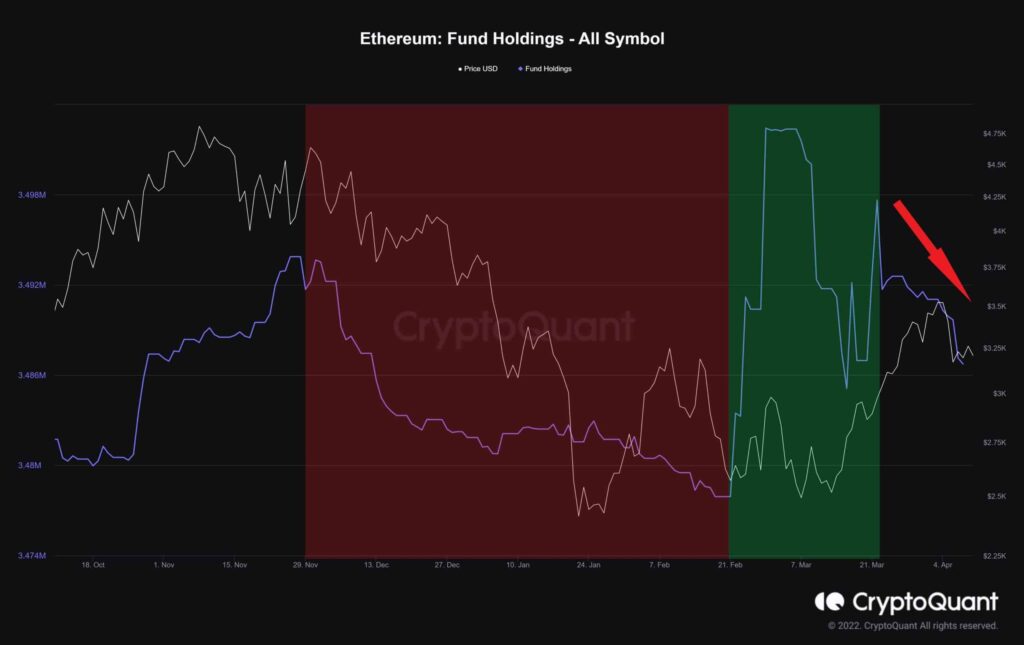

On-chain analysis: Fund Holding

Fund Holing indicates the total amount of coins held by digital assets holdings such as trusts, ETFs, and funds. The amount could increase as demand for indirect investment increases.

Demand for Ethereum from indirect investors has increased in recent months following the price. But now after the bearish news they seem to be more cautious and the demand is falling.