Over the last five days, Ethereum (ETH) fell toward its long-term Point of Control (POC) and found support near its 200 EMA in the $3,100 zone.

Now, the alt king could face a slight setback before continuing its gradual rally. Any drop below the POC would be detrimental to the bulls as the sellers attempt to push the price below the 55 EMA. At press time, ETH was trading at $3,246.3.

ETH Daily Chart

Since losing its long-term POC at the $3,100-mark, the king alt saw major sell-offs on high volumes. Thus, ETH poked its six-month low on 24 January.

After conforming to its historical trends, ETH recovered from the support of the 13-month trendline. (yellow, dotted). After testing this level several times, the bulls finally powered a strong rally that broke the POC. While the $3,500 mark remained strong, the rising wedge saw an expected break that led to a 9.1% five-day retracement.

From here on, while the EMA ribbons still depict a bullish edge, the buyers needed to ensure the $3,100 support for a continued recovery. Further pullbacks could reverse from its POC while ADA witnesses a clash between the buyers and sellers in that area.

Reasoning

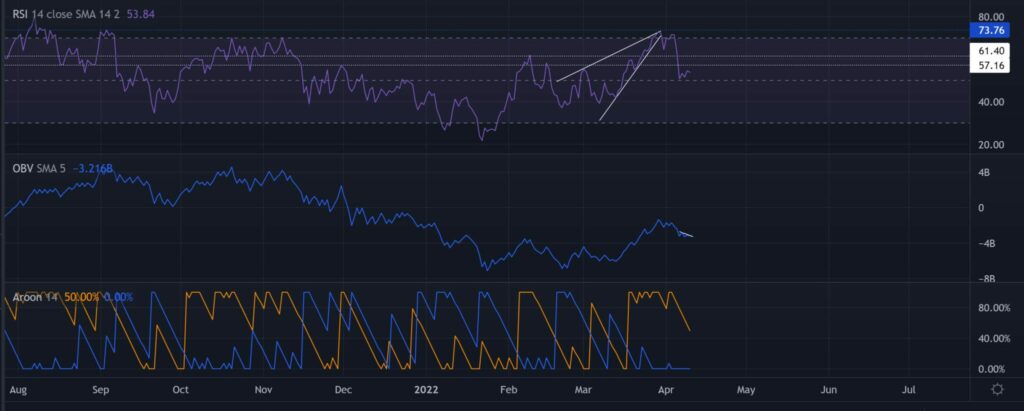

The RSI matched the price and saw a similar breakdown from the rising wedge. Its midline support is strong as the bulls refrain from giving carte blanche to the sellers.

The OBV marked lower peaks in the last three days while the price saw a slight resurgence. This hinted at a slightly weak bearish divergence between them. Thus, a potential restest of the 55-EMA should not be discarded by the investors.

Finally, the Aroon down (blue) has been flat for the past few days. Thus, its likely recovery in the coming days would favor sellers.

Conclusion

Considering the readings on its technical indicators, near-term retracements seemed plausible. Should the POC stand strong, the bulls would continue their gradual recovery.

Additionally, investors/traders should keep a close eye on Bitcoin’s movement, as ETH shares an astonishing 96% 30-day correlation with the King’s Coin.